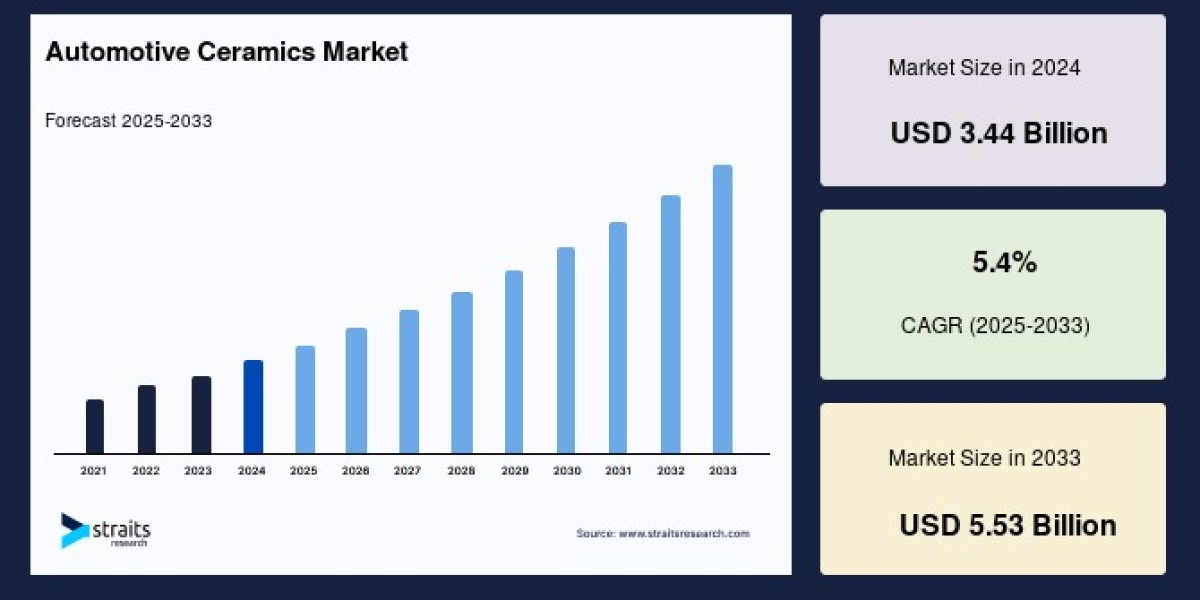

The global Automotive Ceramics Market Size was valued at USD 3.44 billion in 2024 and is projected to reach from USD 3.63 billion in 2025 to USD 5.53 billion by 2033, growing at a CAGR of 5.4% during the forecast period (2025-2033).

Role of Advanced Ceramics in Automotive Technology

Ceramic materials offer a unique combination of favorable thermal, mechanical, and electrical properties that position them as superior choices over traditional metals and plastics in automotive components. Their high strength, thermal stability, wear resistance, and electrical insulation abilities make them ideal for diverse applications such as sensors, mechanical seals, bearings, valves, ignition parts, and exhaust systems.

The use of ceramics improves several vehicle attributes including fuel efficiency, emissions control, durability, and comfort. For example, ceramic components like silicon nitride engine parts, oxygen sensors, exhaust gas catalysts, and knock sensors contribute to reducing engine wear and enhancing combustion efficiency. Additionally, ceramic diesel particulate filters (DPFs) effectively trap soot and fine particulates from exhaust gases, helping automotive manufacturers meet increasingly stringent emission standards worldwide.

Market Segmentation by Component and Application

The automotive ceramics market is broadly segmented by components such as engine parts, exhaust systems, and automotive electronics. Among these, engine parts represent the largest segment, with advanced ceramics being used in spark plug insulators, piston rings, and coatings that reduce friction and wear, thereby boosting engine life and performance.

The passenger vehicle segment dominates the automotive ceramics market by application, driven by rising per capita income and consumer preference for fuel-efficient and environmentally friendly cars. Growth in both electric and hybrid vehicle manufacturing further accelerates the demand for ceramics due to their role in battery systems, electronic circuitry, and lightweight mechanical parts.

Regional Insights and Growth Drivers

Asia-Pacific stands as the largest market for automotive ceramics, accounting for the highest revenue share largely due to the mass production of automotive components and escalating electric vehicle sales in countries such as China, India, Japan, and South Korea. Factors such as abundant raw material availability, cost-efficient manufacturing, and government initiatives support this regional dominance.

Europe is the fastest-growing market, propelled by stringent emission regulations and aggressive adoption of electric vehicles. Germany, with significant automotive manufacturing capabilities, exemplifies this growth through investments in electric vehicle production and emissions control measures.

North America follows closely, with advancements led by firms like Tesla and high disposable incomes fostering demand for fuel-efficient and electric vehicles. Moreover, LAMEA markets are emerging due to increased adoption of eco-friendly vehicles and governmental policies aimed at carbon emission reductions, notably in the Gulf Cooperation Council (GCC) countries and South America.

Trends and Opportunities

The push toward vehicle electrification is a significant trend shaping the automotive ceramics market. Ceramics contribute to increased electric vehicle range, safety, and efficiency by enabling high-performance batteries, thermal shielding, and precision components with superior durability and lower weight. As manufacturers compete to meet enhanced fuel efficiency and emissions targets, ceramics become indispensable materials for future vehicle architectures.

Additionally, technological advancements in ceramic materials and manufacturing processes are opening new opportunities for developing customized automotive components with enhanced performance. Collaboration between automotive and ceramic manufacturing companies is fostering innovation for components that contribute to noise reduction, vibration control, and improved driving dynamics.

Challenges and Market Restraints

Despite the advantages, the automotive ceramics market faces challenges including high material and manufacturing costs relative to traditional metals and plastics. Difficulty in recycling ceramics and the capital-intensive nature of R&D for new ceramic automotive components are also critical barriers. These factors can limit widespread adoption, particularly in cost-sensitive vehicle segments.

Nevertheless, ongoing investments in research to reduce production costs and improve recyclability are expected to ease these restraints over time, allowing broader application of ceramics in automotive manufacturing.

Conclusion

The automotive ceramics market is positioned for robust growth through 2033, fueled by automotive industry evolution toward sustainability, electrification, and performance enhancements. With their superior thermal, mechanical, and electrical properties, ceramics offer compelling benefits that address critical industry challenges such as emissions reduction, fuel efficiency, and durability. While cost remains a constraint, technological progress and expanding applications in passenger and commercial vehicles create promising opportunities for market expansion. The Asia-Pacific region will continue to lead market size, while Europe offers rapid growth prospects, supported by policy frameworks and increasing electric vehicle penetration.