IMARC Group has recently released a new research study titled “United States Luxury Goods Market Report by Product Type (Watches and Jewellery, Perfumes and Cosmetics, Clothing, Bags/Purse, and Others), Distribution Channel (Offline, Online), End User (Women, Men), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Luxury Goods Market Overview

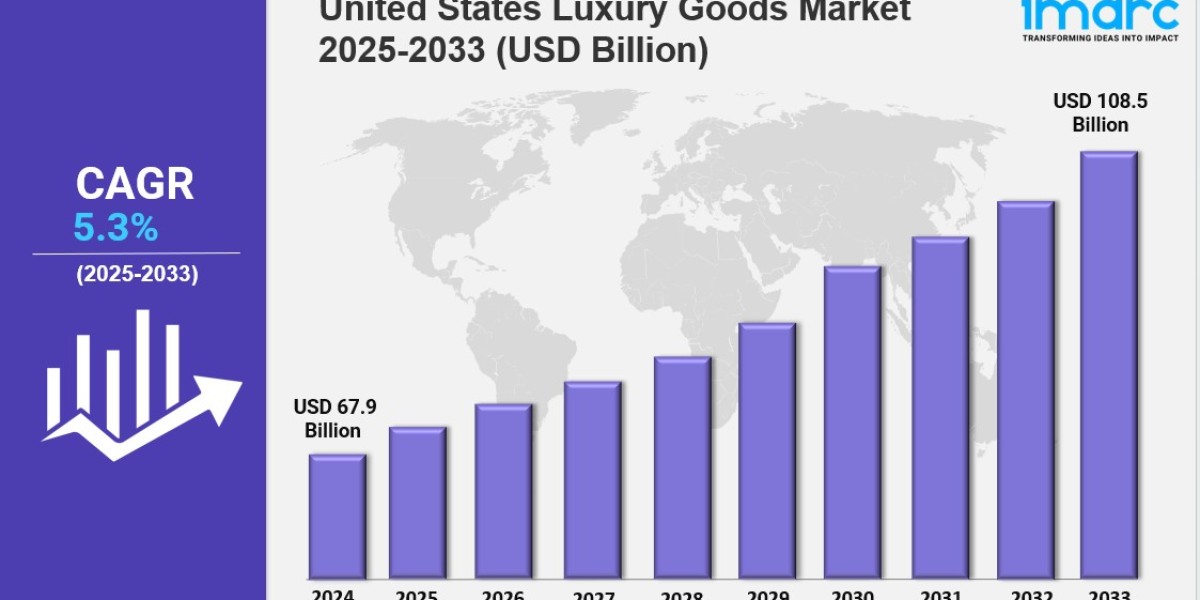

United States luxury goods market size reached USD 67.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 108.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 67.9 Billion

Market Forecast in 2033: USD 108.5 Billion

Market Growth Rate 2025-2033: 5.3%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-luxury-goods-market/requestsample

Key Market Highlights:

✔️ Strong market growth driven by rising disposable income and aspirational consumer spending

✔️ Increasing demand for premium fashion, accessories, and lifestyle products among younger demographics

✔️ Expanding digital presence and personalized experiences enhancing luxury brand engagement and global reach

United States Luxury Goods Market Trends

The United States luxury goods market is going through big changes, and sustainability is no longer just a buzzword—it's shaping how people shop. More luxury buyers, especially younger ones, are paying attention to where their products come from, how they’re made, and whether the brands behind them are truly committed to doing better for the planet. In fact, a 2024 McKinsey report found that nearly 7 out of 10 affluent U.S. consumers under 40 consider environmental impact a major factor when making luxury purchases. This has pushed brands like Gucci and Stella McCartney to launch resale programs, use biodegradable packaging, and even track materials with blockchain to show transparency.

Still, going green in the world of luxury isn’t always simple. The craftsmanship that defines high-end fashion often clashes with eco-friendly material swaps, and there’s growing skepticism about brands that talk the talk but don’t walk the walk. To stay credible, major players are turning to outside certifications and partnerships in areas like regenerative agriculture. LVMH, for instance, is putting $600 million into biodiversity projects over the next few years. As a result, product development timelines are changing, with sustainability checkpoints added throughout the process—something we’ve never seen before in this space.

Luxury Goes Digital—and Personal

Luxury shopping has also evolved beyond boutique visits. While in-store shopping has made a strong comeback—foot traffic rose 22% in early 2024—digital innovation is now part of the experience. From AR try-ons to exclusive NFT-backed rewards programs, brands are finding new ways to connect with customers. According to Bain & Company, 41% of luxury purchases in the U.S. now involve some kind of digital interaction. Younger shoppers are especially drawn to immersive, high-tech experiences. A great example: Tiffany & Co.'s virtual gala in the metaverse brought in 1.2 million guests, with many buying digital wearables that cost as much as $450 apiece.

At the same time, these technologies are helping fight counterfeits. Prada’s CryptoTags, for example, have cut down on fake product reports by more than a third. Still, there’s an ongoing debate in the united states luxury goods market about how to balance exclusivity with accessibility in the digital space—Hermès’ legal battle over MetaBirkin NFTs shows just how tricky it can get.

Luxury is no longer just about New York or Los Angeles. The united states luxury goods market size is expanding as more money flows into cities like Phoenix, Austin, and Miami. These Sun Belt hubs saw luxury retail sales jump 31% in 2024, compared to New York’s 9%. With remote work changing where wealth is concentrated, brands are adjusting. Nordstrom now uses AI to tailor inventory by location—like offering exclusive Bottega Veneta colors in Scottsdale based on local trends.

Meanwhile, Gen Z is making a serious mark. Despite inflation and economic uncertainty, their luxury spending rose nearly 50% last year. They’re looking for gender-inclusive styles, limited-edition drops, and brands that reflect their values. Saks Fifth Avenue in Dallas now devotes nearly a third of its store to TikTok-favorite "quiet luxury" brands like The Row. Also worth noting: aspirational shoppers—those earning $150k to $300k—now make up more than half of the united states luxury goods market size, pushing brands to offer flexible payment plans and entry-level items like $390 Gucci lipsticks.

What’s Fueling United States Luxury Goods Market Growth

The united states luxury goods market growth isn’t just about higher prices—it’s about a mindset shift. More consumers are treating luxury as an investment in personal well-being, not just a status symbol. That’s why items like Loro Piana’s $2,800 cashmere yoga mats and Louis Vuitton’s designer dog carriers are seeing impressive sales. Luxury wellness and pet lifestyle products are becoming key categories.

Cultural and political shifts are also affecting buying habits. On the East Coast, a growing number of shoppers are embracing "stealth wealth" styles—quiet, logo-free luxury—to avoid drawing attention in a time of rising income inequality. At the same time, the resale space is heating up. Rolex, for example, now sets aside a portion of its inventory for certified pre-owned items, sometimes selling them at a premium.

Fashion trends are shifting too. With more people working from home, daytime luxury—think tailored Chanel jackets—is back in style, while formal eveningwear isn’t moving as fast. And what really sets brands apart now? Personalization. Made-to-order services are in high demand. Brunello Cucinelli, for instance, saw a 73% spike in bespoke orders—even with a wait time of up to five months.

All of these changes reflect a deeper truth: luxury in the U.S. is no longer just about owning something expensive. It’s about owning something meaningful. As expectations evolve, the united states luxury goods market continues to grow by offering more than just products—it’s offering experiences that feel rare, personal, and worth every dollar.

United States Luxury Goods Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Product Type:

- Watches and Jewellery

- Perfumes and Cosmetics

- Clothing

- Bags/Purse

- Others

Breakup by Distribution Channel:

- Offline

- Online

Breakup by End User:

- Women

- Men

Breakup by Region:

- Northeast

- Midwest

- South

- West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20366&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302