ADX Indicator: The Secret Strength Behind Smart Trading

Have you ever wished for a trustworthy map in the world of trading, one that guides you safely through choppy market waters? Meet the ADX indicator—your compass for market trend strength. In this article, we’ll walk together through everything you need to know about the ADX indicator, its full form, and even take a peek into algorithmic trading software price—all in easy, everyday language.

Discover the ADX indicator, ADX indicator full form, benefits, and algorithmic trading software price. Simple tips, strategies, and FAQs for the general public.

Introduction to the ADX Indicator

Imagine setting sail on the vast ocean of financial markets. The wind feels promising, but will it last, or is a storm brewing beyond the horizon? This is where traders turn to the ADX indicator, short for Average Directional Index. Simply put, the ADX tells you how strong the market’s waves (trends) are—helping you decide if it’s a good time to jump in or stay ashore.

What Does ADX Stand For? (ADX Indicator Full Form)

You may be wondering, “What’s the ADX indicator full form?”

It stands for Average Directional Index. Created by technical analyst J. Welles Wilder in 1978, the ADX was built to give traders an unbiased sense of trend strength—no guessing, just clear signals.

Why Do Traders Rely on the ADX Indicator?

Trading without direction is like driving in dense fog. The ADX indicator works like headlights, illuminating whether the market is trending strongly or just drifting sideways. Knowing this can make the difference between a winning and a losing trade. Think of the ADX as your “market thermometer”—it doesn’t tell you if the weather is hot or cold, just how strong the climate shift is.

Breaking Down How the ADX Works

Let’s peel back the curtain. The ADX indicator doesn’t act alone; it’s part of a family of calculations:

- +DI (Plus Directional Indicator): Measures upward movement.

- -DI (Minus Directional Indicator): Measures downward movement.

- ADX: The main value, expressing trend strength, regardless of direction.

The calculations behind ADX may sound like chef’s secret sauce, but the recipe is simple to follow with trading platforms. You won’t have to crunch numbers—just know what you’re looking at.

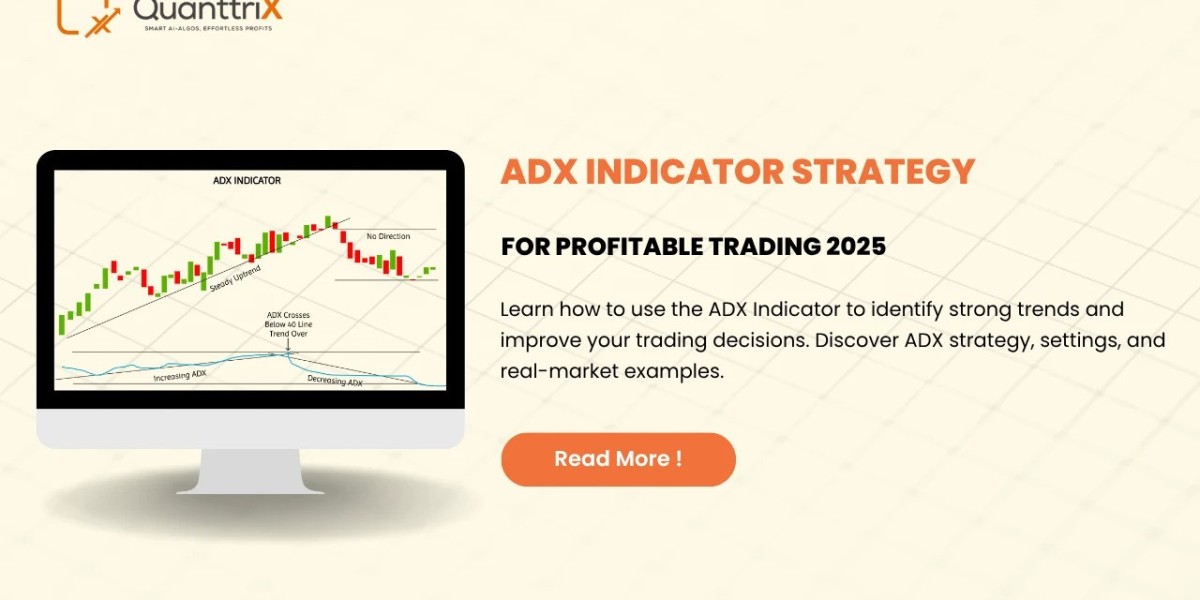

Understanding Trend Strength vs. Trend Direction

Here’s an eye-opener: The ADX indicator tells you how strong the trend is, not if it’s bullish (up) or bearish (down).

- High ADX (above 25): Strong trend, but direction needs checking (+DI or -DI will help).

- Low ADX (below 20): Weak or no trend—markets may be moving sideways.

Think of it like a speedometer in your car: it shows how fast you’re going but not which way you’re steering.

Key Components: +DI, -DI, and ADX

- +DI Line: When above the -DI line, the bulls have the upper hand.

- -DI Line: When above the +DI line, the bears are leading.

- ADX Line: The higher this goes, the stronger the trend, period.

The interplay between the +DI and -DI lines tells you if the wind is blowing north or south, while the ADX tells you if it’s a breeze or a gale.

How to Read the ADX Indicator Chart

Reading the ADX chart isn’t rocket science. Here’s a straightforward approach:

- Locate the ADX line (usually black or bold).

- Check the +DI (often green) and -DI (often red).

- If ADX shoots above 25, it’s “game on”—the trend has muscle.

- If +DI is above -DI, bulls are in control; if the opposite, bears rule.

- ADX below 20? Take it easy. The market is napping.

Practical Example: Using ADX in Real Trading

Suppose you’re eyeing a stock, and you see the ADX climbing sharply above 25, with +DI comfortably above -DI. This signals a strong uptrend. You could consider entering a long position. Conversely, if -DI dominates and ADX rises, a downtrend is likely at play.

Analogy:

Think about surfers waiting for the right wave. They don't jump at every ripple. The ADX helps traders spot those “big waves” worth riding.

ADX Settings: What’s the Best Period?

You’ll spot debates on the “best” ADX settings everywhere. By default, most charts use a 14-period ADX (meaning ADX looks at 14 bars—could be days, hours, etc.).

- Shorter periods (5-10): Quicker signals, but more false alarms.

- Longer periods (20-30): Smoother, but slower to react.

Unless you’re experienced, sticking with the classic 14-period setting is a safe bet.

ADX and Algorithmic Trading Software

Algorithmic trading has swept across financial markets, with computers now reading signals like ADX to make split-second decisions. The ADX indicator is a favorite “input” for algorithmic strategies. Why? Because a machine can instantly spot when trend strength appears, acting on it before most humans even blink.

If you’re curious about letting software handle some of the heavy lifting, you’ll come across trading algorithms that rely on the ADX, among other indicators.

Algorithmic Trading Software Price: What to Expect

Wondering about algorithmic trading software price? It ranges wildly, depending on features and support:

- Basic scripts or bots: Free or from $10-$100/month.

- Professional platforms (with ADX and more): $100-$1,000+/month.

- Custom-built solutions: Can cost thousands per month, plus setup fees.

Remember, a higher price tag doesn’t always mean better results—just like with cars, some features might go unused. Try demos and start with what matches your trading needs and budget.

Pros and Cons of the ADX Indicator

Let’s get real—a tool is only as good as how you use it.

Pros:

- Highlights if a trend is strong enough to trade.

- Works on any market: stocks, forex, crypto, you name it.

- Helps avoid “chasing shadows” in weak markets.

Cons:

- Doesn’t show trend direction directly.

- Can lag at turning points, leading to late signals.

- Needs pairing with other indicators for best results.

Common Mistakes and How to Avoid Them

Even skilled captains hit rough waters. Here’s how to steer clear:

- Relying only on ADX: Combine with price patterns or other indicators.

- Ignoring market context: ADX is just one piece of the puzzle.

- Overtrading in low-ADX markets: Be patient; wait for strong trends.

Tips for Getting the Most out of ADX

- Use with trend-following indicators: Moving averages or RSI work well.

- Mind the period: Test different settings based on your trading timeframe.

- Stay flexible: Markets change—review and adapt.

Conclusion: Should You Use the ADX Indicator?

If you want a fair chance at deciphering the market’s true strength, the ADX indicator is a valuable companion. It doesn’t have all the answers but acts as a trusty barometer. Use it wisely, pair it with sound judgment, and don’t forget—the best sailor is part navigator, part listener to the winds.

Frequently Asked Questions (FAQs)

- What is the ADX indicator full form?

The full form of ADX is Average Directional Index. - Is the ADX indicator good for beginners?

Yes! Since ADX is easy to read and interpret, it’s beginner-friendly. - Can I use the ADX indicator with algorithmic trading?

Absolutely. Many algorithmic trading systems use ADX as part of their strategies. - What algorithmic trading software price should I expect to pay?

Expect anything from free basic bots to $100 or more per month for pro platforms, and much higher for custom solutions. - Does the ADX indicator work for all financial markets?

Yes, ADX is versatile and can be used for stocks, forex, commodities, and cryptocurrencies.