IMARC Group, a leading market research company, has recently releases a report titled “Bioprocess Technology Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033.” The study provides a detailed analysis of the industry, including the global bioprocess technology market share, size, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Bioprocess Technology Market Highlights:

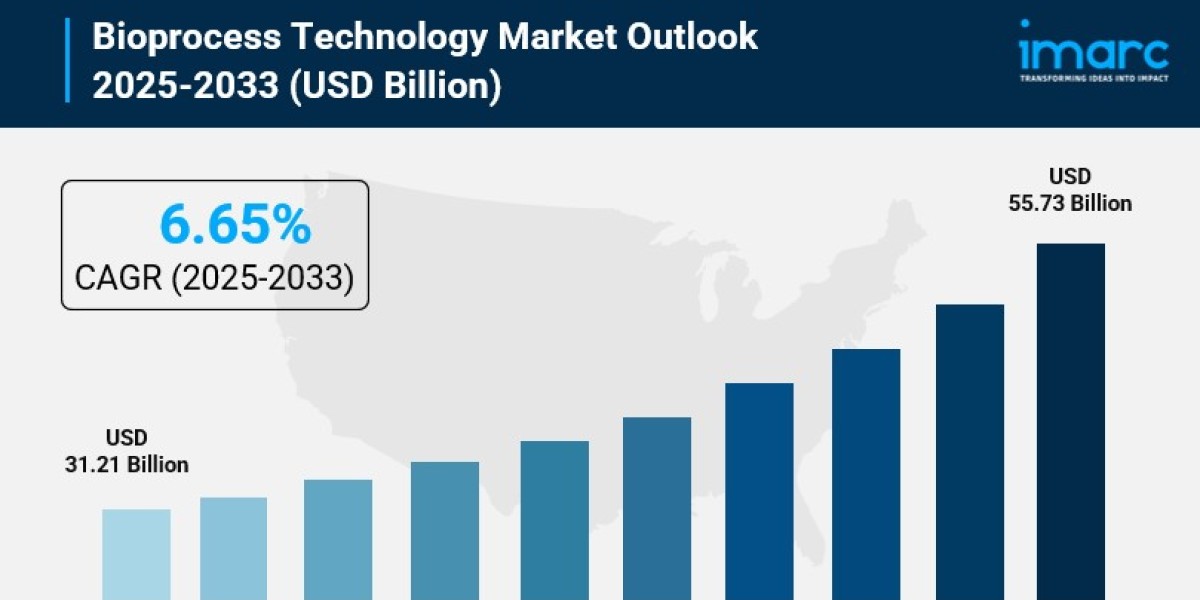

- Bioprocess Technology Market Size: Valued at USD 31.21 Billion in 2024.

- Bioprocess Technology Market Forecast: The market is expected to reach USD 55.73 billion by 2033, growing at an impressive rate of 6.65% annually.

- Market Growth: The bioprocess technology market is experiencing robust growth driven by expanding demand for biologics, increasing adoption of single-use technologies, and rapid advancements in cell and gene therapy manufacturing.

- Technology Integration: Advanced technologies like single-use bioreactors, continuous bioprocessing systems, and automation are revolutionizing biopharmaceutical production processes.

- Regional Leadership: North America commands the largest market share at 44.5%, fueled by advanced healthcare infrastructure, strong R&D investments, and leadership in biologics production.

- Manufacturing Innovation: Rising adoption of continuous bioprocessing and process intensification strategies are enabling higher productivity and cost-efficiency in biologics manufacturing.

- Key Players: Industry leaders include Thermo Fisher Scientific Inc., Danaher Corporation, Lonza Group AG, Sartorius AG, and Hoffmann-La Roche AG, which dominate the market with cutting-edge solutions.

- Market Challenges: Supply chain complexities and the need for seamless integration of advanced technologies with existing manufacturing infrastructure present ongoing challenges.

Request for a sample copy of the report: https://www.imarcgroup.com/bioprocess-technology-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Surging Demand for Biopharmaceuticals and Advanced Therapies:

The global healthcare landscape is witnessing unprecedented demand for biologics, with pharmaceutical production reaching new milestones. India's pharmaceutical industry, recognized as the "Pharmacy of the World," witnessed an export rise of 8.36% from $2.13 Billion in July 2023 to $2.31 Billion in July 2024, according to the Press Information Bureau. The sector is expected to reach $100 billion by 2025, boosted by a 10-12% growth rate and PLI schemes worth INR 15,000 Crore. This explosive growth in pharmaceutical manufacturing is creating massive demand for sophisticated bioprocess technologies that can handle the production of complex biologics including monoclonal antibodies, vaccines, and biosimilars. Modern manufacturers need scalable, efficient systems that can maintain the highest quality standards while meeting growing global healthcare requirements.

- Revolutionary Single-Use Technologies Transforming Production:

Single-use technologies are fundamentally reshaping biopharmaceutical manufacturing by offering economical and flexible solutions. In October 2023, Getinge announced the launch of the AppliFlex ST GMP, a single-use bioreactor system aimed at enhancing clinical cell and gene therapy production. This innovative solution bridges research and clinical applications ensuring GMP compliance. With customizable sizes and integrated software, it supports manufacturers in translating laboratory processes to clinical trials efficiently. Single-use bioreactors, mixers, and tubing significantly reduce cleaning and sterilization costs and time. These systems reduce contamination risks due to pre-sterilized disposable components, ensuring product safety and quality. They're ideal for small-scale production and clinical trials due to their scalability and ease of implementation, facilitating quick changeovers and increasing productivity in multiproduct facilities.

- Breakthrough Advances in Continuous Bioprocessing:

Continuous bioprocessing is emerging as a transformative approach in biomanufacturing, enabling seamless production of biologics through uninterrupted processes. In November 2023, WuXi Biologics successfully implemented a fully integrated continuous bioprocess achieving an average productivity of approximately 6 g/L/day at pilot scale. Utilizing its proprietary WuXiUP platform, the process enhances biologics manufacturing efficiency, allowing more than 60 kg of monoclonal antibodies per batch with plans to scale up for GMP production globally. Continuous methods integrate upstream and downstream operations, significantly shortening processing times and increasing efficiency. This approach maintains steady-state production to meet increasing demands for biologics such as monoclonal antibodies and vaccines. Continuous bioprocessing achieves lower resource consumption, cost reduction, and higher product quality due to continuous monitoring and control, driven by automation, process intensification, and real-time analytics.

- Rapid Expansion of Cell and Gene Therapy Manufacturing

The cell and gene therapy sector is experiencing explosive growth, creating substantial demand for specialized bioprocessing solutions. In December 2024, the Governor of New York announced the opening of New York's first cell and gene therapy hub at Roswell Park Comprehensive Cancer Center in Buffalo. The $98 million facility intends to enhance research, generate employment, and focus on treating solid tumors. Additionally, in October 2024, NewBiologix announced the launch of the Xcell Portfolio, a suite of advanced technologies aimed at enhancing gene and cell therapy production. The portfolio addresses challenges like low yields and high costs, offering innovative tools and insights for rAAV quality. This initiative aims to accelerate the development of effective gene therapies for patients. Manufacturing these advanced therapies requires highly controlled processes to ensure safety, efficacy, and scalability. Innovations in bioprocessing, including closed systems and automated platforms, are critical in meeting regulatory and quality standards while enabling cost-effective production.

Bioprocess Technology Market Report Segmentation:

Breakup by Product:

- Bioprocess Technology Instruments

- Bioprocess Analyzers

- Osmometers

- Bioreactors

- Incubators

- Consumables and Access

- Culture Media

- Reagents

The bioprocess technology instruments segment dominates the market, as these tools are crucial for precise monitoring, control, and optimization of biological processes, with bioreactors being central to scaling up production while maintaining quality standards.

Breakup by Application:

- Recombinant Proteins

- Monoclonal Antibodies

- Antibiotics

- Others

Recombinant proteins lead the application segment, driven by their critical role in producing biopharmaceuticals such as monoclonal antibodies, hormones, and vaccines for treating healthcare issues like cancer and diabetes, with demand further fueled by increasing chronic diseases and personalized medicine.

Breakup by End User:

- Biotechnology and Biopharmaceutical Companies

- Research and Academic Institutes

- Others

Biotechnology and biopharmaceutical companies account for the largest share, as their focus on developing biologics, biosimilars, and advanced therapies drives significant demand for efficient, scalable, high-quality manufacturing processes, spurred by expanding R&D investments and a growing pipeline of biologics.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market, driven by advanced healthcare infrastructure, strong presence of biopharmaceutical companies, significant R&D investments, regulatory support, growing adoption of single-use technologies, advancements in automation, and a strong pipeline of cell and gene therapies along with high prevalence of chronic diseases.

Who are the key players operating in the industry?

The report covers the major market players including:

- Advanced Instruments LLC

- Biopharma Dynamics Ltd.

- Danaher Corporation

- Hoffmann-La Roche AG

- Lonza Group AG

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Univercells Technologies

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=12992&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302