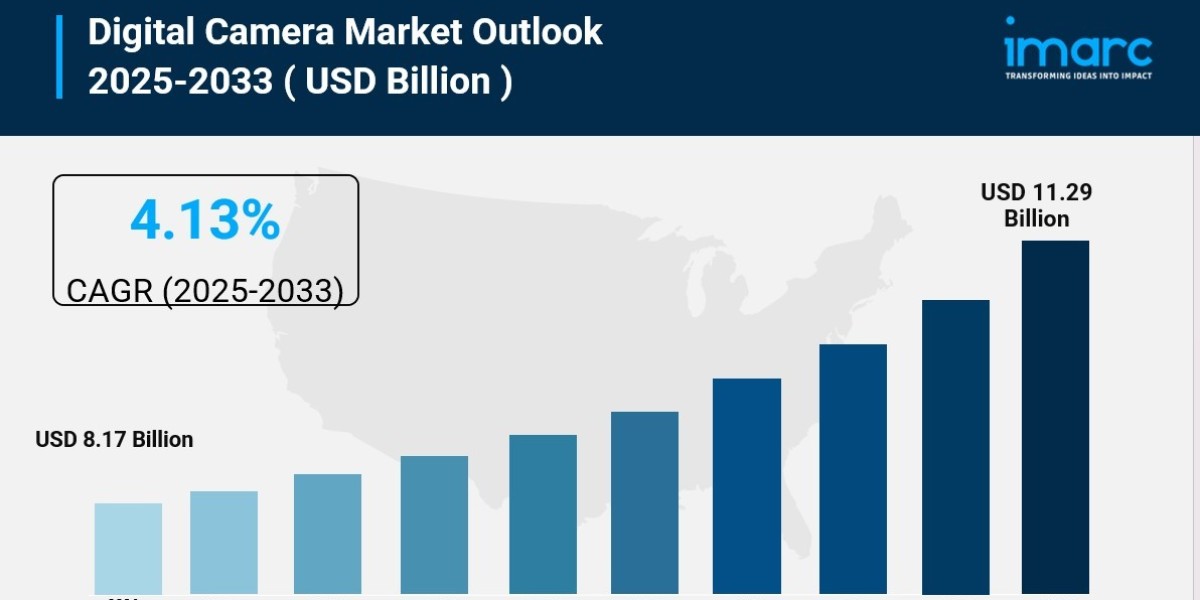

The global digital camera market size was valued at USD 8.17 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.29 Billion by 2033, exhibiting a CAGR of 4.13% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of around 39.8% in 2024. The market is experiencing steady growth driven by increasing consumer demand for high-quality images, advancements in image processing and sensor technologies, the rise of social media and content creation culture, and technological innovations in mirrorless systems, AI-assisted functionality, and more compact, user-friendly designs.

Key Stats for Digital Camera Market:

- Digital Camera Market Value (2024): USD 8.17 Billion

- Digital Camera Market Value (2033): USD 11.29 Billion

- Digital Camera Market Forecast CAGR: 4.13%

- Leading Segment in Digital Camera Market in 2024: Interchangeable Lens Cameras (89.2%)

- Key Regions in Digital Camera Market: Asia Pacific, North America, Europe, Latin America, Middle East and Africa

- Top Companies in Digital Camera Market: Canon Inc., Nikon Corporation, Sony Corporation, Panasonic Corporation, Olympus Corporation, etc.

Request Customization: https://www.imarcgroup.com/request?type=report&id=877&flag=E

Why is the Digital Camera Market Growing?

The digital camera market is experiencing a resurgence that might surprise those who thought smartphones would completely dominate photography. What's happening is more nuanced—consumers and professionals alike are recognizing that dedicated cameras offer capabilities and quality that even the best smartphone cameras can't match. This realization is driving renewed interest across multiple user segments.

Technology advancements are at the heart of this growth. Today's digital cameras feature higher megapixel counts, significantly improved sensors, and enhanced low-light performance that collectively deliver image quality that's leagues beyond what was possible just a few years ago. These aren't incremental improvements—they represent transformative changes in what photographers can capture, especially in challenging lighting conditions or when shooting fast-moving subjects.

The content creation boom deserves special attention as a growth driver. The creator economy comprises approximately 207 million creators globally and is projected to grow at a substantial annual rate to reach USD 528.39 Billion by 2030. This explosion of content creators—from YouTubers and TikTokers to Instagram influencers and professional vloggers—has generated massive demand for high-quality, portable cameras that excel at both photo and video capture. These creators need tools that deliver professional results without requiring film school expertise, and modern digital cameras with features like 4K video recording, fast autofocus, image stabilization, and wireless connectivity fit the bill perfectly.

Travel and tourism play a surprisingly significant role in market dynamics. The global surge in travel has accelerated demand for digital cameras as people prioritize capturing memorable moments during vacations and excursions. France alone recorded 100 million international travelers in 2024, highlighting the enormous scale of travel-related photography. Travelers want portable yet powerful cameras that can capture everything from sweeping landscapes to intimate portraits, driving sales of compact mirrorless systems and advanced point-and-shoot models.

AI Impact on the Digital Camera Market:

Artificial intelligence is fundamentally reshaping what digital cameras can do, making professional-quality photography accessible to users of all skill levels while pushing the boundaries of what's possible even for experts.

On May 26, 2025, Fujifilm released the GFX100RF, its first fixed-lens medium-format digital camera featuring a 102MP CMOS II sensor, X-Processor 5 processor, and AI-driven subject detection autofocus, capable of recording 4K/30P 10-bit video with F-Log2. This launch exemplifies how AI is becoming standard in high-end cameras, not as a gimmick but as a core capability that dramatically improves performance.

AI capabilities like subject detection, scene adjustment, real-time tracking, and enhanced autofocus accuracy are transforming the shooting experience. These systems can identify and track subjects—whether people, animals, vehicles, or other objects—with remarkable precision, maintaining focus even when subjects move erratically or when the photographer is shooting in challenging conditions. For sports photographers capturing fast action or wildlife photographers shooting unpredictable animal behavior, these AI enhancements mean more keeper shots and fewer missed moments.

Computational photography techniques powered by AI are delivering results that were impossible with traditional optical systems alone. HDR processing combines multiple exposures to capture scenes with extreme brightness variations, from sunlit highlights to deep shadows, preserving detail throughout. Advanced noise reduction algorithms clean up images shot in low light without sacrificing sharpness or detail. Depth mapping enables sophisticated background blur effects and allows for focus adjustments after the shot is taken. These technologies enable users to capture properly exposed, sharp images with minimal manual effort, democratizing advanced photography techniques that once required years of experience to master.

Canon, Sony, and Nikon have joined forces to develop new camera technology featuring digital signatures that constitute proof that specific imagery is real and not AI-generated, with the technology set to be implemented on flagship mirrorless cameras and including video capabilities. This collaborative effort addresses growing concerns about image authenticity in an AI-saturated world. As AI-generated images become increasingly sophisticated, the ability to verify that a photograph is genuine becomes valuable for journalists, legal professionals, and anyone who needs to prove authenticity.

Segmental Analysis:

Analysis by Product Type:

- Interchangeable Lens Cameras

- Built-In Lens Cameras

Interchangeable lens cameras (ILCs) dominate the market with approximately 89.2% share in 2024, reflecting their overwhelming popularity among both professionals and serious enthusiasts. This dominance stems from ILCs' remarkable versatility—the ability to swap lenses transforms a single camera body into an entire imaging system capable of handling vastly different shooting scenarios.

Both DSLR and mirrorless systems qualify as ILCs, though mirrorless models are increasingly capturing market share due to their more compact designs, advanced features, and cutting-edge technology. The beauty of interchangeable lens systems is adaptability: a photographer can use ultra-wide lenses for expansive landscapes, telephoto lenses for distant wildlife or sports action, fast prime lenses for low-light portraits, and specialized macro lenses for extreme close-ups—all with the same camera body.

ILCs offer superior image quality thanks to larger sensors compared to built-in lens cameras, along with extensive manual controls that give photographers precise command over exposure, focus, and other technical parameters. Their compatibility with vast accessory ecosystems—from external flashes and wireless triggers to tripod systems and specialty filters—makes them incredibly capable tools for professional work.

High-resolution video recording capabilities in modern ILCs respond to the surging popularity of video content creation. Many current models can shoot 4K or even 8K video with professional-grade color science, making them attractive to vloggers, YouTubers, and hybrid content creators who need one device for both photography and videography.

As digital storytelling and social media continue evolving, ILCs' ability to deliver both technical precision and creative freedom ensures their continued market leadership. Ongoing innovation in mirrorless technology—including improved autofocus, better image stabilization, longer battery life, and more compact designs—is expanding the ILC market by attracting users who might have previously considered these cameras too bulky or complex.

Analysis of Digital Camera Market by Regions:

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East and Africa

Asia Pacific commands the largest market share at approximately 39.8% in 2024, driven by its massive consumer base, rapid urbanization, and growing enthusiasm for photography and content creation. China, Japan, South Korea, and India are key contributors to both camera production and consumption, with the region hosting numerous major manufacturing centers supported by robust technology infrastructure and innovation capacity.

Japan deserves special mention as home to most of the world's leading camera manufacturers—Canon, Nikon, Sony, Olympus, Panasonic, and Fujifilm all have Japanese roots. This concentration of expertise creates a vibrant ecosystem for camera innovation and manufacturing excellence that benefits the entire region and global market.

Rising disposable incomes and expanding middle classes across Asia Pacific are enabling more consumers to purchase premium imaging equipment. The popularity of social media platforms—particularly those emphasizing visual content—has contributed significantly to demand for high-quality imaging devices. The growing population of professional photographers, vloggers, and influencers within the region further supports advanced camera segments, particularly mirrorless and interchangeable lens models.

Cultural factors also play a role. In many Asian markets, photography and videography are highly valued skills, with strong traditions of visual storytelling and documentation. This cultural appreciation translates into consumer willingness to invest in quality imaging equipment.

North America represents a substantial market, with the United States holding approximately 77.90% of the regional share in 2024. The market is thriving due to increased interest in content creation, vlogging, and professional photography. Consumers seek high-resolution, mirrorless, and full-frame cameras for superior image quality and portability. AI-powered features and enhanced low-light capabilities are particularly attractive to North American buyers who value cutting-edge technology.

Short-form video platforms have created armies of content creators who invest in advanced digital imaging tools to produce engaging content. The strong photography culture among both hobbyists and professionals supports consistent sales across all camera segments. Educational institutions and online learning platforms contribute to demand by promoting digital photography courses. The number of photographer jobs is expected to increase by 4% between 2023 and 2033, with around 13,700 job openings annually throughout the decade, reflecting photography's enduring career appeal.

The expanding application of digital cameras in scientific research, law enforcement, and other professional fields has created niche opportunities beyond traditional consumer photography. Retailers and e-commerce platforms enhance product visibility through online campaigns and tech-focused user reviews, fostering greater consumer engagement. Seasonal promotions and accessory bundling further stimulate purchases.

Europe's market benefits from a strong photography culture and growing creator economy. Demand is driven by diverse applications including digital archiving, wildlife documentation, and architectural photography. Eco-conscious European consumers show interest in modular camera systems that allow component upgrades rather than complete replacements, aligning with sustainability values. The filmmaking and visual arts industries provide substantial demand for professional-grade equipment.

Travel and tourism throughout Europe drive interest in high-performance cameras capable of capturing the continent's diverse landscapes and cultural treasures. Emerging trends include smart home ecosystem integration and AR/VR compatibility as photographers explore new ways to create and share immersive visual experiences. Youth adoption of visual storytelling and vlogging continues expanding the market's demographic reach.

The number of films starting principal photography during the first quarter of 2025 in the UK alone reached 37 films, marking an increase of 15 compared to the first quarter of 2024, with total expenditure of £632 Million (approximately USD 850.8 Million). This production activity directly translates into demand for professional camera equipment. Enhanced durability and weatherproof designs see increased traction in Northern and Central Europe, where harsh weather conditions demand robust equipment. With a balanced blend of innovation and traditional photography values, Europe's market is positioned for sustained long-term growth.

Asia Pacific's rapid urbanization and rising disposable incomes are accelerating market expansion. Consumers increasingly embrace photography as a lifestyle activity and form of personal expression. Visual-based social platforms and e-commerce photography needs drive investment in upgraded devices. Technological convergence, including real-time image processing and smart device integration, enhances user experiences and expands usage occasions.

Request Sample Report URL: https://www.imarcgroup.com/digital-camera-market/requestsample

What are the Drivers, Restraints, and Key Trends of the Digital Camera Market?

Market Drivers:

The digital camera market benefits from multiple converging trends that reinforce each other and create sustained growth momentum. Superior image quality remains the fundamental driver—dedicated cameras deliver results that smartphones simply cannot match, particularly in challenging conditions, when shooting distant subjects, or when maximum resolution and dynamic range are essential. As consumers become more sophisticated about image quality differences, they increasingly recognize the value of dedicated cameras for important photography.

The creator economy explosion has fundamentally changed market dynamics. With hundreds of millions of content creators worldwide monetizing their work across YouTube, Instagram, TikTok, and countless other platforms, demand for professional-quality imaging tools has skyrocketed. These creators need equipment that delivers excellent results consistently, making cameras with reliable autofocus, good video capabilities, and creator-friendly features highly attractive.

Technological innovation continues at a rapid pace, with manufacturers regularly introducing meaningful improvements rather than incremental updates. Mirrorless cameras have revolutionized the market by offering DSLR-level performance in dramatically smaller, lighter packages. Features like in-body image stabilization, silent shooting, and advanced video capabilities give modern cameras versatility that previous generations lacked.

The professionalization of photography as both career and serious hobby drives premium segment growth. Online learning platforms, photo forums, and social media communities make photography education more accessible than ever, creating new generations of skilled photographers who invest in quality equipment as their abilities develop. This educational infrastructure creates a sustainable pipeline of customers progressing from entry-level to advanced equipment.

Media and entertainment industry growth creates substantial B2B demand. Film production, television broadcasting, streaming content creation, advertising, journalism, and corporate communications all require high-quality imaging equipment. As these industries expand—particularly in emerging markets—camera demand grows proportionally.

E-commerce and improved retail experiences make purchasing easier. Online retailers provide extensive product information, user reviews, comparison tools, and competitive pricing that help consumers make informed decisions. Simplified return policies reduce purchase risk, while financing options make premium equipment more accessible to budget-conscious buyers.

Market Restraints:

Despite strong growth drivers, the market faces meaningful challenges that temper expansion and create strategic complexities for manufacturers. Smartphone competition remains the elephant in the room. Modern smartphones feature increasingly capable cameras that satisfy casual photography needs for many consumers. For people who previously would have purchased entry-level point-and-shoot cameras, smartphones now provide adequate quality with unbeatable convenience. This has essentially eliminated the low-end camera market, forcing manufacturers to focus on more advanced segments where differentiation from smartphones is clearer.

High costs create barriers to entry, particularly for premium segments. Professional-grade camera bodies and lenses represent significant investments that many consumers cannot afford or justify. While financing options help, economic uncertainty or budget constraints can delay or prevent purchases. The used equipment market provides alternatives but also reduces new equipment sales.

Technical complexity can intimidate potential users. Despite improvements in user interfaces and automatic modes, advanced cameras still have learning curves that many casual users find daunting. The intimidation factor—fear of not being able to use expensive equipment effectively—prevents some potential customers from making purchases.

Market saturation in developed regions limits growth potential. Photography enthusiasts and professionals in North America, Europe, and Japan largely already own capable equipment. Upgrade cycles drive some replacement demand, but the "good enough" problem means users keep equipment longer when incremental improvements don't justify upgrade costs.

Economic sensitivity affects demand, particularly during recessions or periods of uncertainty. Cameras are discretionary purchases that consumers postpone when budgets tighten. Currency fluctuations in international markets can dramatically affect pricing and demand patterns.

Weight and bulk remain issues despite mirrorless advances. Many consumers value portability highly, and even compact camera systems cannot match smartphone convenience for casual shooting. Photographers often face trade-offs between image quality and carrying comfort, particularly when traveling.

Market Key Trends:

Several key trends are actively reshaping the digital camera landscape and creating new strategic imperatives for industry participants. Mirrorless dominance is perhaps the most significant shift. Mirrorless cameras are rapidly displacing DSLRs as the standard for serious photography, offering comparable or superior performance in smaller, lighter packages. Most major manufacturers have largely shifted product development focus to mirrorless systems, with DSLRs increasingly relegated to legacy product lines. This transition is reshaping the entire market structure.

AI integration is becoming standard rather than exceptional. Features that seemed futuristic just a few years ago—like eye autofocus that works on both humans and animals, or scene recognition that automatically optimizes settings—are now expected in mid-range and premium cameras. The competitive bar constantly rises as manufacturers introduce increasingly sophisticated AI capabilities.

Video capabilities are no longer optional extras but core features. The line between still cameras and video cameras has blurred dramatically, with many current models offering professional-grade video capabilities that would have required dedicated cinema cameras in the past. This hybrid capability expands addressable markets by appealing to content creators who need versatile tools for both photography and videography.

Connectivity and workflow integration continue improving. Modern cameras feature built-in Wi-Fi, Bluetooth, and sometimes cellular connectivity, enabling seamless image transfer to smartphones, tablets, and computers. Cloud integration allows automatic backup and multi-device access. These connectivity features dramatically improve the shooting-to-sharing workflow that's essential for content creators and professional photographers working on tight deadlines.

Sustainability and environmental consciousness are influencing purchasing decisions. Consumers increasingly consider product longevity, repairability, and manufacturers' environmental practices when making buying decisions. Companies responding with more durable products, better repair programs, and transparent sustainability initiatives are building stronger brand loyalty.

Niche specialization is creating market opportunities. Rather than trying to be everything to everyone, some manufacturers and products target specific use cases—whether wildlife photography, astrophotography, underwater shooting, or particular video production needs. This specialization allows for optimized features and creates passionate user communities around specialized equipment.

Subscription and service models are emerging alongside traditional equipment sales. Some manufacturers offer camera upgrade programs, extended warranties, or cloud storage services that create recurring revenue streams while providing customers with flexibility and peace of mind.

Leading Players of Digital Camera Market:

According to IMARC Group's latest analysis, prominent companies shaping the global digital camera landscape include:

- Canon Inc.

- Nikon Corporation

- Sony Corporation

- Panasonic Corporation

- Olympus Corporation

These industry leaders are driving innovation through substantial research and development investments focused on sensor technology, image processing, autofocus systems, and AI integration. Their competitive strategies emphasize technological leadership, with each company pushing boundaries in different areas—Sony in sensor innovation, Canon in color science and reliability, Nikon in optical excellence and ergonomics, Panasonic in video capabilities, and Olympus in compact system design.

Strategic partnerships and cross-industry collaborations are becoming increasingly important. Companies are working with software developers, content creators, and even competitors (as seen in the authentication technology initiative) to expand capabilities and address emerging market needs. Acquisitions also play a role, with Nikon's purchase of RED Digital Cinema representing a significant move into the professional cinema market.

Marketing strategies increasingly emphasize community building and education. Manufacturers sponsor photography workshops, maintain active social media presences, and create extensive educational content that helps users maximize their equipment's potential. This approach builds brand loyalty while expanding the overall market by making photography more accessible and less intimidating.

Product diversification across price points and use cases helps companies capture different market segments. Most major manufacturers now offer extensive product lines ranging from entry-level models for beginners to premium professional systems, with numerous specialized options addressing specific photography or videography needs.

Key Developments in Digital Camera Market:

- May 2025: Fujifilm released the GFX100RF, its first fixed-lens medium-format digital camera in the GFX series, featuring a 102MP CMOS II sensor, X-Processor 5 processor, AI-driven subject detection autofocus, and 4K/30P 10-bit video recording with F-Log2. The camera also features a newly created 35mm F4 lens, precision-machined aluminum body, and innovative Aspect Ratio Dial, making it a high-performance, compact option for professional creators seeking medium-format quality without lens-changing complexity.

- 2024: Canon, Sony, and Nikon joined forces to develop new camera technology featuring digital signatures that constitute proof that specific imagery is real and not AI-generated, with implementation planned for flagship mirrorless cameras including video capabilities. This unprecedented collaboration among competitors addresses critical concerns about image authenticity in an era where AI-generated content becomes increasingly difficult to distinguish from genuine photographs.

- 2024: Canon launched the EOS R5 Mark II, featuring a speedy 45MP stacked full-frame sensor and innovative in-camera editing capabilities including a 400% upscale function, demonstrating how AI-powered computational photography is enabling new creative possibilities and potentially ending the "megapixel race" by allowing lower-resolution captures to be intelligently enlarged.

- 2024: Major camera manufacturers have been expanding mirrorless system offerings across all price points, from budget-friendly entry-level models to premium professional bodies, reflecting the industry-wide shift away from DSLR technology toward more compact, feature-rich mirrorless systems that appeal to both amateur and professional users.

- 2024: Nikon's acquisition of RED Digital Cinema positions the company to combine RED's cinema camera expertise with Nikon's optical and sensor technologies, potentially creating hybrid cameras that blur lines between still photography and professional video production—a strategic move reflecting the convergence of photography and videography in modern content creation.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=877&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302