IMARC Group, a leading market research company, has recently releases a report titled “Cervical Cancer Diagnostics Market Report by Test Type (Pap Testing, HPV Testing, Cervical Biopsies, Colposcopy, and Others), Age Group (20 to 35 Years, Above 35 Years), and Region 2025-2033.” The study provides a detailed analysis of the industry, including the global cervical cancer diagnostics market size, share, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Cervical Cancer Diagnostics Market Highlights:

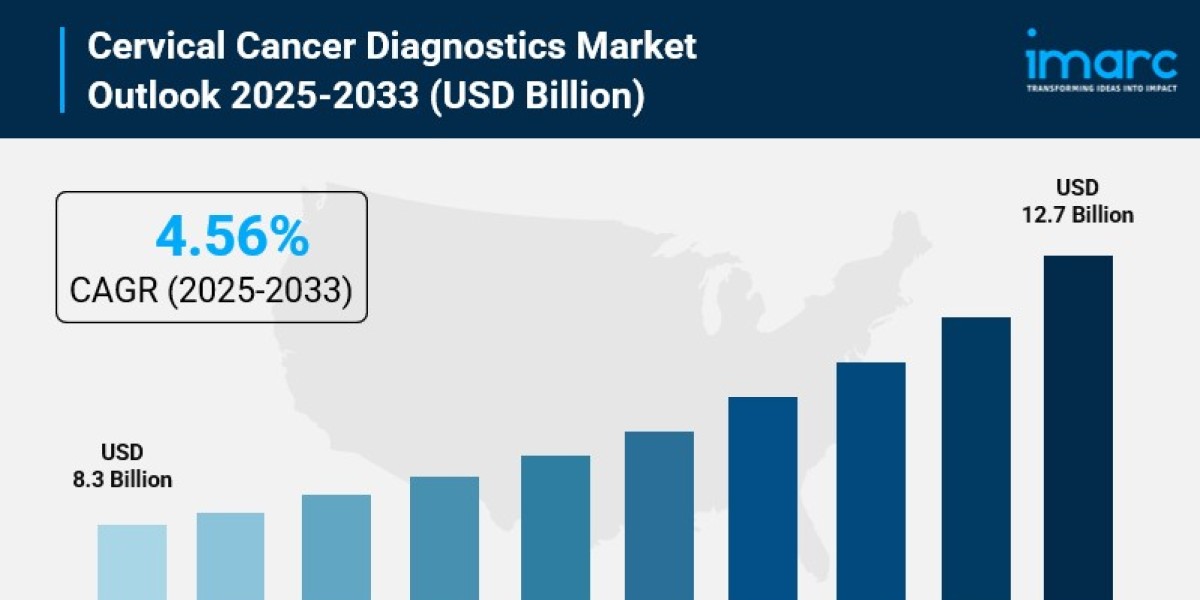

- Cervical Cancer Diagnostics Market Size: Valued at USD 8.3 Billion in 2024.

- Cervical Cancer Diagnostics Market Forecast: The market is expected to reach USD 12.7 billion by 2033, growing at an impressive rate of 4.56% annually.

- Market Growth: The cervical cancer diagnostics market is experiencing steady growth driven by expanding screening programs and rising awareness about early detection.

- Technology Integration: Advanced technologies like HPV self-collection solutions, dual-stain biomarker testing, and AI-powered diagnostic platforms are transforming cervical cancer screening processes.

- Regional Leadership: North America commands the largest market share, fueled by established healthcare infrastructure and comprehensive screening programs.

- Global Health Initiatives: The WHO's Cervical Cancer Elimination Initiative is driving unprecedented investment in screening and diagnostic capabilities worldwide.

- Key Players: Industry leaders include Abbott Laboratories, F. Hoffmann-La Roche AG, Hologic Inc., Becton Dickinson and Company, and Qiagen, which dominate the market with innovative diagnostic solutions.

- Market Challenges: Healthcare disparities in underserved regions and the need for affordable screening options remain ongoing challenges for global cervical cancer elimination efforts.

Request for a sample copy of the report: https://www.imarcgroup.com/cervical-cancer-diagnostics-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Global Push for Cervical Cancer Elimination:

The healthcare industry is witnessing an unprecedented global commitment to cervical cancer elimination. In March 2024, governments, donors, and multilateral institutions announced nearly USD 600 million in new funding specifically dedicated to eliminating cervical cancer. This massive financial commitment reflects the international community's determination to make history by eliminating a cancer for the first time. The WHO's initiative, launched in November 2020, aims to achieve cervical cancer elimination as a public health problem by 2100, with ambitious 90-70-90 targets for 2030. Countries around the world are developing their first-ever cervical cancer elimination strategies, with many nations approving comprehensive cancer policies and action plans that integrate screening into primary care. This wave of policy commitments and programmatic expansions is creating enormous opportunities for diagnostic solution providers as healthcare systems worldwide invest in building capacity for expanded vaccine coverage and strengthened screening programs.

- Revolutionary Self-Collection and Point-of-Care Testing:

The diagnostic landscape is being transformed by breakthrough innovations that are making screening more accessible and patient-friendly. In May 2024, the FDA approved one of the first HPV self-collection solutions in the United States, representing a game-changing moment for cervical cancer screening. This approval by Roche allows women to collect their own samples, dramatically expanding access for those who face barriers to traditional clinic-based screening. The shift toward self-collection is particularly significant because it addresses one of the biggest obstacles to screening – the discomfort and inconvenience of clinic visits. Healthcare providers are increasingly recognizing that self-collection options can reach underserved populations who might otherwise never receive screening. Additionally, the American Society of Colposcopy and Cervical Pathology updated their guidelines in 2024 to include dual-stain biomarker testing as an official screening tool, enabling clinicians to identify which HPV infections are transforming into pre-cancer with greater accuracy. These technological leaps represent a fundamental shift from traditional approaches, making screening faster, more comfortable, and more precise than ever before.

- Massive Expansion of National Screening Programs:

Countries across the globe are implementing ambitious national cervical cancer screening initiatives that are driving unprecedented demand for diagnostic solutions. China, which accounts for 23% of global cervical cancer cases, has launched comprehensive screening efforts aimed at meeting WHO's 90-70-90 targets by 2030. The Indo-Pacific region is seeing coordinated action, with the United States, Australia, India, and Japan rolling out a key initiative announced at the September 2024 Quad Leaders Summit to fight cervical cancer across multiple countries. In the Pacific Islands, nations have achieved over 80% HPV vaccination coverage among girls aged 10-18, supported by multilateral organizations. Governments are not only establishing policies but backing them with substantial resources – national cancer policies covering the period through 2029 are being approved with significant funding from international partners. The Pan American Health Organization has committed to supporting member states in equitably scaling up HPV vaccination coverage and introducing HPV testing across entire regions. This coordinated global expansion of screening programs is creating sustained demand for millions of diagnostic tests annually.

- Rising Prevalence of HPV and High-Risk Populations:

The growing burden of sexually transmitted infections worldwide is escalating the risk pool for cervical cancer and driving screening demand. HPV infection, which causes 99% of all cervical cancer cases, remains a persistent public health challenge despite increased awareness efforts. Healthcare systems are seeing considerable increases in individuals diagnosed with STIs including syphilis, chlamydia, gonorrhea, and HIV/AIDS – conditions that increase susceptibility to HPV and subsequent cervical cancer development. The rising number of smokers globally further compounds the risk, as smoking significantly increases the chances of developing cervical cancer when combined with HPV infection. This expanding at-risk population is prompting healthcare providers to prioritize preventive screening programs. Moreover, surveys commissioned by diagnostic companies reveal that HPV infection remains largely misunderstood by the general public, highlighting the critical need for both educational initiatives and accessible diagnostic solutions. As awareness campaigns reach more individuals, demand for screening services continues to climb, particularly for quick and accurate home testing options that provide privacy and convenience while delivering reliable results.

Cervical Cancer Diagnostics Market Report Segmentation:

Breakup by Test Type:

- Pap Testing

- HPV Testing

- Cervical Biopsies

- Colposcopy

- Others

Pap testing dominates the market, remaining the most widely utilized cervical cancer screening method due to its established track record and integration into routine gynecological care.

Breakup by Age Group:

- 25-40 Years

- 40-60 Years

- Above 60 Years

The 25-40 years age group leads the market, as this demographic represents the primary target for routine cervical cancer screening programs globally.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the global cervical cancer diagnostics market, supported by well-established healthcare infrastructure, comprehensive screening guidelines, and high awareness levels about preventive care.

Who are the key players operating in the industry?

The report covers the major market players including:

- Abbott Laboratories

- Arbor Vita Corporation

- Becton, Dickinson and Company

- Cooper Surgical Inc.

- F. Hoffmann-La Roche AG

- Guided Therapeutics Inc.

- Hologic Inc.

- Qiagen

- Quest Diagnostics Incorporated

- Siemens Healthcare GmbH

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=3175&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302