Market Overview 2025-2033

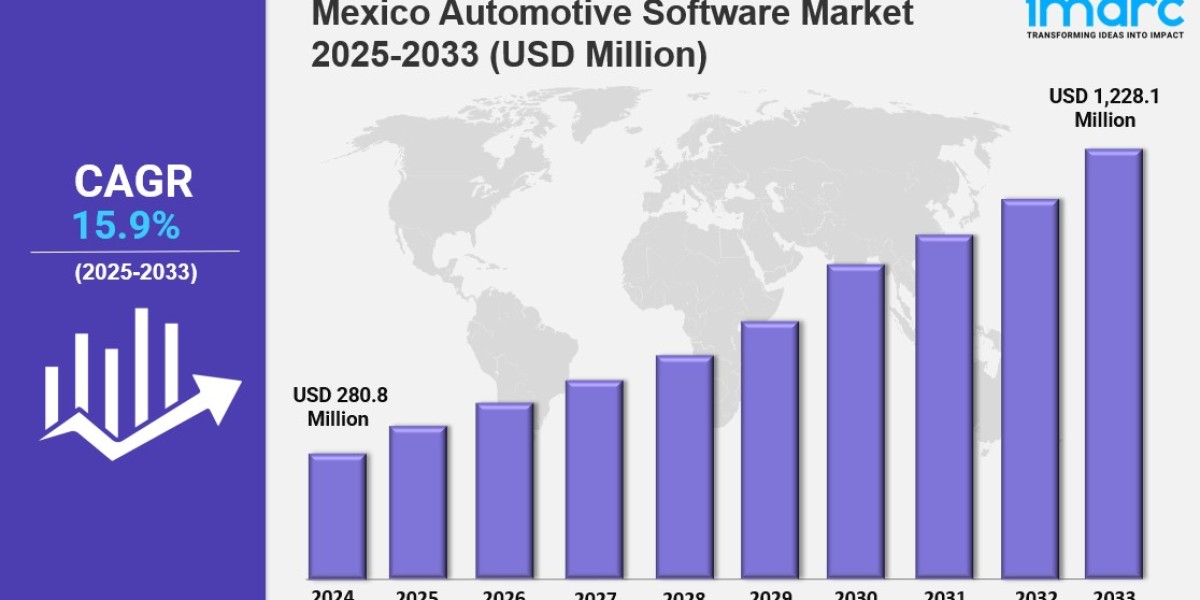

The Mexico automotive software market size reached USD 280.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,228.1 Million by 2033, exhibiting a growth rate (CAGR) of 15.9% during 2025-2033. The market is growing due to rapid EV adoption, rising demand for safety and infotainment systems, and urban mobility needs. Growth is driven by advanced ADAS software, OTA updates, and AI integration, making the industry more connected, innovative, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising demand for connected, autonomous, and electric vehicles

✔️ Increasing integration of software for vehicle diagnostics, infotainment, and ADAS functionalities

✔️ Expanding investments in R&D and collaborations to enhance automotive software innovation and cybersecurity

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-automotive-software-market/requestsample

Mexico Automotive Software Market Trends and Drivers:

The Mexico automotive software market is expanding rapidly as the nation accelerates its transition toward electric, connected, and autonomous vehicles. Leading automakers such as General Motors and Volkswagen are increasing their electric vehicle (EV) production capacity, with Mexico now contributing roughly 25% of total EV manufacturing in North America.

This transformation is fueling the Mexico automotive software market demand, particularly for intelligent systems focused on battery management, charging optimization, and vehicle performance enhancement. These developments are key factors behind sustained Mexico automotive software market growth, as highlighted in the latest Mexico automotive software market report.

Regulatory Landscape and Cross-Border Collaboration

Under the US-Mexico-Canada Agreement (USMCA), automotive software developed in Mexico must comply with rigorous cross-border regulations and data protection standards. To meet these requirements, local technology firms are partnering with global automotive players to build advanced solutions that enhance energy efficiency and enable real-time diagnostics.

By mid-2024, investment in EV software R&D exceeded $800 million, with startups like MexiSoft leading innovation in predictive maintenance and vehicle health monitoring. These collaborations are setting new benchmarks and defining emerging Mexico automotive software market trends.

Connectivity Transforming Fleet and Logistics Management

Connectivity is reshaping how logistics and fleet operations function. Major corporations such as FEMSA and Cemex are integrating automotive software that provides GPS tracking, driver performance analytics, and fuel monitoring. These tools are improving operational efficiency, reducing costs, and promoting safer driving practices.

In rural regions where internet access remains limited, developers are designing adaptive systems that can operate offline, expanding the Mexico automotive software market’s reach and accessibility.

Regulation, Cybersecurity, and Industry Transformation

Government regulations are further propelling digital transformation in Mexico’s automotive sector. The NOM-036 regulation mandates electronic monitoring of truck driver hours, spurring demand for compliance-focused applications.

Meanwhile, the rise in cybersecurity threats has encouraged adoption of technologies such as blockchain, along with secure cloud partnerships involving Telcel, to protect sensitive vehicle data. These developments have positioned Mexico as a key hub for automotive technology innovation in Latin America, as noted in the Mexico automotive software market report.

Advanced driver-assistance systems (ADAS) are rapidly becoming standard across Mexico’s automotive industry. By 2024, more than 70% of vehicles produced in the country were equipped with ADAS capabilities. Local engineers are designing software optimized for Mexico’s diverse driving environments—from urban congestion in Mexico City to mountainous terrain in central regions.

These innovations rely on a combination of camera, radar, and sensor data, improving safety and efficiency while reflecting key Mexico automotive software market trends.

To sustain this momentum, national initiatives and technical bootcamps are expanding to strengthen Mexico’s pool of AI and software engineering professionals. The goal is to triple the number of AI-trained engineers by 2026. Open-source projects such as “AutoMex” are helping budget carmakers integrate intelligent features at lower costs, supporting inclusive and scalable Mexico automotive software market growth.

Following several data breaches in early 2024, automakers and suppliers have adopted global standards like ISO/SAE 21434 for secure vehicle software development. Cloud providers such as AWS and Microsoft Azure are helping companies accelerate prototyping and reduce development costs by up to 30%, establishing a strong foundation for secure and efficient software production.

Shifting Consumer Preferences and Product Innovation

Consumer expectations are evolving quickly. Features like voice-activated controls, real-time navigation updates, and subscription-based infotainment systems are becoming standard in mid-range vehicles.

Luxury manufacturers are investing in augmented reality windshields, while affordable brands prioritize fuel-efficiency software—a crucial innovation for Mexico, where fuel quality varies by region. These shifting preferences continue to shape Mexico automotive software market demand across all segments.

Workforce Development and Domestic Innovation

While U.S.-based firms continue to recruit Mexican software talent, initiatives such as the Software Campus in Querétaro are helping retain skilled developers locally. These efforts aim to strengthen domestic innovation and ensure the country’s long-term competitiveness. With evolving USMCA regulations on emissions and data management, new opportunities are emerging to expand the Mexico automotive software market size and attract global investment.

Mexico Automotive Software Market Forecast: The Road Ahead

Looking forward, artificial intelligence (AI) will be a central driver of market evolution. In states like Jalisco, developers are already testing AI-driven predictive maintenance and driver-interaction features designed for next-generation vehicles.

Strong collaboration between the public and private sectors, ongoing R&D investment, and the rise of connected mobility ecosystems will continue to fuel expansion. According to the latest Mexico automotive software market forecast, the industry is expected to achieve steady double-digit growth through the next decade—solidifying Mexico’s role as a global hub for automotive software innovation

Mexico Automotive Software Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product:

- Application Software

- Middleware

- Operating System

Breakup by Vehicle Type:

- ICE Passenger Vehicle

- ICE Light Commercial Vehicle

- ICE Heavy Commercial Vehicle

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Autonomous Vehicles

Breakup by Application:

- Safety and Security

- Infotainment and Instrument Cluster

- Vehicle Connectivity

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302