Energy Storage As-a-Service (ESaaS): power-on-demand without the sticker shock

The electricity system is changing fast — more solar and wind on the grid, more behind-the-meter load from data centers and EVs, and more sensitivity to outages. Energy Storage-as-a-Service (ESaaS) answers a practical question: what if businesses, utilities and local grids could access battery capacity and services without owning, operating or financing the batteries themselves? ESaaS packages the hardware, software and operations into a commercial contract — customers pay for outcomes (backup power, peak shaving, resilience, arbitrage) while providers own and optimize the batteries.

Why ESaaS matters now

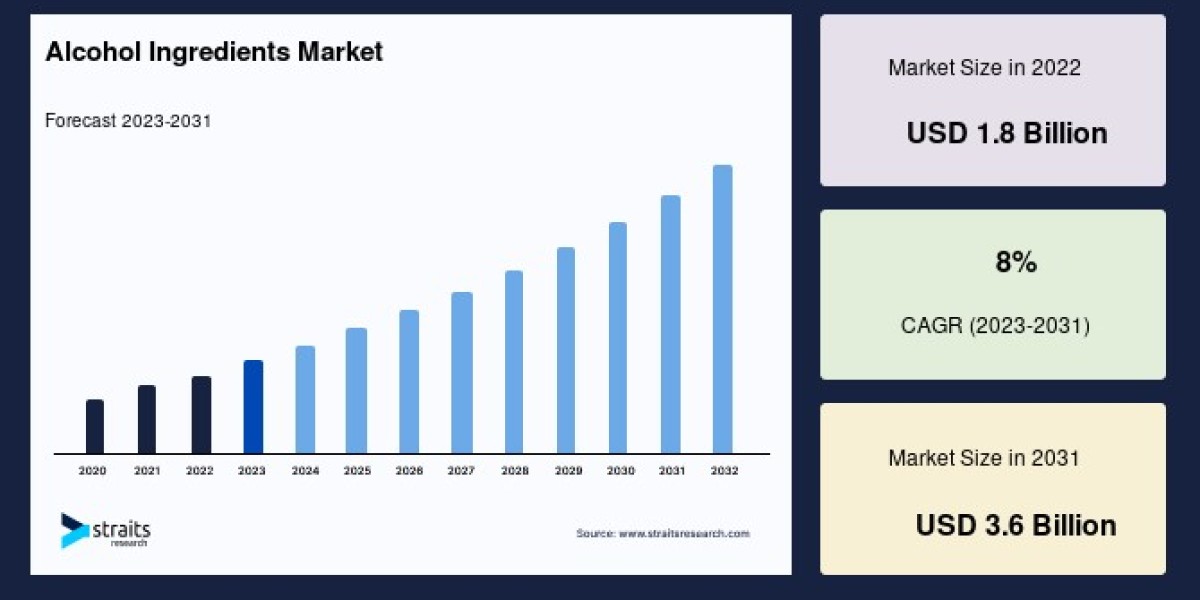

Market research groups place ESaaS as one of the fastest-growing segments inside the broader energy-storage market. Multiple estimates put the global ESaaS market in the low-to-few billion USD range today with double-digit CAGRs through the 2020s, driven by falling battery costs, increasing renewables, and demand for resilience and flexibility. Grand View Research+1

How the model works (quick primer)

An ESaaS provider designs and installs an energy storage system (often lithium-ion today, but longer-duration chemistries are emerging), finances the project, and runs the asset under a performance contract. The customer signs an agreement that usually guarantees a service level — e.g., X kW of backup for Y hours, or a target reduction in demand charges — and pays either a subscription fee, a usage fee, or shares revenues from market participation. The provider monetizes the battery by stacking value streams: behind-the-meter bill savings, grid services and wholesale market participation.

Key drivers

Renewable integration: Storage smooths variable solar and wind output and shifts energy to peak demand times, increasing renewable value. Grand View Research

Cost reduction: Battery pack costs have fallen dramatically, making third-party financing and aggregation models viable. Research Nester

Commercial & industrial (C&I) demand: Businesses with high demand charges or critical loads find ESaaS attractive because it avoids large upfront capex.

Grid services revenue: Aggregated ESaaS fleets can offer frequency response, capacity and ancillary services — turning distributed assets into virtual power plants.

Policy & auctions: Governments are creating revenue-stability mechanisms and auctions that de-risk storage projects and attract investment. Reuters

Market landscape and players

The ESaaS space is populated by a mix of incumbents and newcomers: battery makers and integrators (Tesla, Fluence, Sungrow and others), energy incumbents and utilities (Enel X, EDF, AES), software/aggregation platforms, and specialist financiers. At the component level, Chinese battery firms (notably CATL and BYD) have grown rapidly and now supply a large share of stationary storage cells — a factor shaping global costs and supply chains. Reuters+1

Common use cases

C&I peak shaving: Reduce demand charges and lower monthly bills.

Backup & resilience: Guaranteed power during outages for hospitals, data centers and manufacturing.

Renewable firming: Pair storage with on-site solar to increase self-consumption and reduce grid draw.

Grid services & arbitrage: Providers bid aggregated capacity into wholesale markets for additional revenue.

Microgrids & remote power: ESaaS accelerates deployments where grid extension is costly.

Challenges to scale

Regulatory complexity: Market rules for storage participation vary widely by region and can limit stacking of revenue streams.

Safety and recycling: Batteries introduce thermal-runaway risk and end-of-life handling obligations; both require standards and recycling infrastructure.

Contract complexity: Structuring long-term ESaaS contracts that fairly allocate risk (performance, degradation, market price volatility) is nontrivial.

Supply chain concentration: Heavy reliance on a few cell manufacturers creates geopolitical and tariff risks. Reuters

What’s next — trends to watch

Long-duration storage & chemicals diversification: Beyond lithium-ion, flow batteries and other technologies will expand the types of services ESaaS can offer.

Software & AI optimization: Better forecasting, real-time market bidding and predictive maintenance will lift utilization and margins.

Virtual Power Plants (VPPs): Aggregated ESaaS portfolios will increasingly act as dispatchable resources for grid operators.

Specialized financing & contracts: New risk-sharing models (performance guarantees, outcome-based pricing) will broaden customer segments.

Energy Storage As-a-Service (ESaaS): power-on-demand without the sticker shock

The electricity system is changing fast — more solar and wind on the grid, more behind-the-meter load from data centers and EVs, and more sensitivity to outages. Energy Storage-as-a-Service (ESaaS) answers a practical question: what if businesses, utilities and local grids could access battery capacity and services without owning, operating or financing the batteries themselves? ESaaS packages the hardware, software and operations into a commercial contract — customers pay for outcomes (backup power, peak shaving, resilience, arbitrage) while providers own and optimize the batteries.

GET REPORT LINK:https://m2squareconsultancy.com/reports/energy-storage-as-a-service-market

Energy Storage As-a-Service Market Overview

The energy storage as a service (ESaaS) market is anticipated to experience robust growth from 2025 to 2033, with increasing adoption of renewable energy sources and the integration of distributed energy systems serving as key drivers for market expansion. With an estimated valuation of approximately USD 1.39 billion in 2025, the market is expected to reach USD 4.2 billion by 2033, registering a strong compound annual growth rate (CAGR) of 13.6% over the forecast period. This upward trajectory is further propelled by advancements in battery technologies, favorable regulatory policies, and growing emphasis on sustainable energy solutions to support the global energy transition.

An ESaaS provider designs and installs an energy storage system (often lithium-ion today, but longer-duration chemistries are emerging), finances the project, and runs the asset under a performance contract. The customer signs an agreement that usually guarantees a service level — e.g., X kW of backup for Y hours, or a target reduction in demand charges — and pays either a subscription fee, a usage fee, or shares revenues from market participation. The provider monetizes the battery by stacking value streams: behind-the-meter bill savings, grid services and wholesale market participation.

Key drivers

Renewable integration: Storage smooths variable solar and wind output and shifts energy to peak demand times, increasing renewable value.

Cost reduction: Battery pack costs have fallen dramatically, making third-party financing and aggregation models viable.

Commercial & industrial (C&I) demand: Businesses with high demand charges or critical loads find ESaaS attractive because it avoids large upfront capex.

Grid services revenue: Aggregated ESaaS fleets can offer frequency response, capacity and ancillary services — turning distributed assets into virtual power plants.

Policy & auctions: Governments are creating revenue-stability mechanisms and auctions that de-risk storage projects and attract investment.

Market landscape and players

The ESaaS space is populated by a mix of incumbents and newcomers: battery makers and integrators (Tesla, Fluence, Sungrow and others), energy incumbents and utilities (Enel X, EDF, AES), software/aggregation platforms, and specialist financiers. At the component level, Chinese battery firms (notably CATL and BYD) have grown rapidly and now supply a large share of stationary storage cells — a factor shaping global costs and supply chains.

REPORT SAMPLE LINK:https://m2squareconsultancy.com/request-sample/energy-storage-as-a-service-market

BUY NOW:https://m2squareconsultancy.com/purchase/147

Common use cases

C&I peak shaving: Reduce demand charges and lower monthly bills.

Backup & resilience: Guaranteed power during outages for hospitals, data centers and manufacturing.

Renewable firming: Pair storage with on-site solar to increase self-consumption and reduce grid draw.

Grid services & arbitrage: Providers bid aggregated capacity into wholesale markets for additional revenue.

Microgrids & remote power: ESaaS accelerates deployments where grid extension is costly.

Challenges to scale

Regulatory complexity: Market rules for storage participation vary widely by region and can limit stacking of revenue streams.

Safety and recycling: Batteries introduce thermal-runaway risk and end-of-life handling obligations; both require standards and recycling infrastructure.

Contract complexity: Structuring long-term ESaaS contracts that fairly allocate risk (performance, degradation, market price volatility) is nontrivial.

Supply chain concentration: Heavy reliance on a few cell manufacturers creates geopolitical and tariff risks.

TRENDING REPORTS:

https://m2squareconsultancy.com/reports/wearable-medical-devices-market

https://m2squareconsultancy.com/reports/global-energy-drinks-market

https://m2squareconsultancy.com/reports/std-diagnostics-market

https://m2squareconsultancy.com/reports/oncology-drugs-market

https://m2squareconsultancy.com/reports/ultomiris-drug-market

https://m2squareconsultancy.com/reports/sustainable-pharmaceutical-packaging-market

https://m2squareconsultancy.com/reports/syringe-infusion-pumps-market

https://m2squareconsultancy.com/reports/local-anesthesia-drugs-market

https://m2squareconsultancy.com/reports/hospital-acquired-infections-diagnostics-market

https://m2squareconsultancy.com/reports/biopolymers-and-bioplastics-market

https://m2squareconsultancy.com/reports/solar-panel-operation-and-maintenance-market

https://m2squareconsultancy.com/reports/fruit-and-vegetable-pulp-market

https://m2squareconsultancy.com/reports/spiritual-and-wellness-products-market

https://m2squareconsultancy.com/reports/portable-ultrasound-devices-market

https://m2squareconsultancy.com/reports/fecal-immunochemical-diagnostic-test-market

https://m2squareconsultancy.com/reports/next-generation-sequencing-market

https://m2squareconsultancy.com/reports/surgical-operating-tables-market

https://m2squareconsultancy.com/reports/floor-cleaner-market

What’s next — trends to watch

Long-duration storage & chemicals diversification: Beyond lithium-ion, flow batteries and other technologies will expand the types of services ESaaS can offer.

Software & AI optimization: Better forecasting, real-time market bidding and predictive maintenance will lift utilization and margins.

Virtual Power Plants (VPPs): Aggregated ESaaS portfolios will increasingly act as dispatchable resources for grid operators.

Specialized financing & contracts: New risk-sharing models (performance guarantees, outcome-based pricing) will broaden customer segments.

Conclusion

The Energy Storage-as-a-Service (ESaaS) market represents a transformative shift in how businesses and utilities approach energy management. By converting energy storage from a capital-intensive asset into a flexible, pay-as-you-use service, ESaaS democratizes access to advanced storage technologies and grid services. This model enables organizations to achieve energy resilience, cost savings, and sustainability targets without bearing the burden of high upfront investments or technical complexity.

As renewable integration accelerates and global electricity demand rises, ESaaS is positioned to play a crucial role in stabilizing grids and supporting the clean energy transition. With rapid advancements in battery technology, digital control systems, and smart financing models, the ESaaS market is poised for sustained expansion over the next decade. Companies that embrace this innovative service model today will not only optimize operational efficiency but also future-proof their energy strategy in a rapidly evolving energy landscape.

About m2squareconsultancy :

We are a purpose-driven market research and consulting company passionate about turning data into direction. Founded in 2023, we bring together researchers, strategists, and data scientists who believe that intelligence isn’t just about numbers, it’s about insight that sparks progress.

We cater to a wide range of industries by delivering customized solutions, strategic insights, and innovative support that help organizations grow, adapt, and lead in their respective sectors. Here’s a brief overview of key industries we work with.

Contact Us:

Email: sales@m2squareconsultancy.com

Phone (IN): +91 80978 74280

Phone (US): +1 929 447 0100

More Report:

https://m2squareconsultancy.com/reports/organic-personal-care-products-market

https://m2squareconsultancy.com/reports/portable-power-station-market

https://m2squareconsultancy.com/reports/power-transformer-market

https://m2squareconsultancy.com/reports/renewable-energy-market

https://m2squareconsultancy.com/reports/artificial-sweeteners-market

https://m2squareconsultancy.com/reports/blister-packaging-market

https://m2squareconsultancy.com/reports/digital-therapeutics-market

https://m2squareconsultancy.com/reports/drug-discovery-outsourcing-market

https://m2squareconsultancy.com/reports/e-pharmacy-market

https://m2squareconsultancy.com/reports/hospital-acquired-infections-diagnostics-market

https://m2squareconsultancy.com/reports/edible-oil-market

https://m2squareconsultancy.com/reports/solar-panel-operation-and-maintenance-market

https://m2squareconsultancy.com/reports/premium-chocolate-and-confectionery-market

https://m2squareconsultancy.com/reports/health-and-wellness-snacks-market

https://m2squareconsultancy.com/reports/fruit-and-vegetable-pulp-market

https://m2squareconsultancy.com/reports/dehydrated-vegetables-market

https://m2squareconsultancy.com/reports/spiritual-and-wellness-products-market

https://m2squareconsultancy.com/reports/portable-ultrasound-devices-market

https://m2squareconsultancy.com/reports/ophthalmic-lenses-market

https://m2squareconsultancy.com/reports/fecal-immunochemical-diagnostic-test-market

https://m2squareconsultancy.com/reports/sports-medicine-market

https://m2squareconsultancy.com/reports/military-drone-market

https://m2squareconsultancy.com/reports/almond-milk-market

https://m2squareconsultancy.com/reports/smart-shopping-cart-market

https://m2squareconsultancy.com/reports/drone-delivery-services-market

https://m2squareconsultancy.com/reports/smart-vehicle-market

https://m2squareconsultancy.com/reports/global-biopesticides-market

https://m2squareconsultancy.com/reports/financial-app-market

https://m2squareconsultancy.com/reports/cellular-iot-market

https://m2squareconsultancy.com/reports/supply-chain-security-market

https://m2squareconsultancy.com/reports/comic-book-market

https://m2squareconsultancy.com/reports/online-gambling-market

https://m2squareconsultancy.com/reports/beauty-tech-market

https://m2squareconsultancy.com/reports/global-exoskeleton-market