IMARC Group, a leading market research company, has recently releases a report titled “Hydrogen Energy Storage Market Size, Share, Trends and Forecast by Product Type, Technology, Application, End User, and Region, 2025-2033.” The study provides a detailed analysis of the industry, including the global hydrogen energy storage market share, size, growth, trends and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Hydrogen Energy Storage Market Highlights:

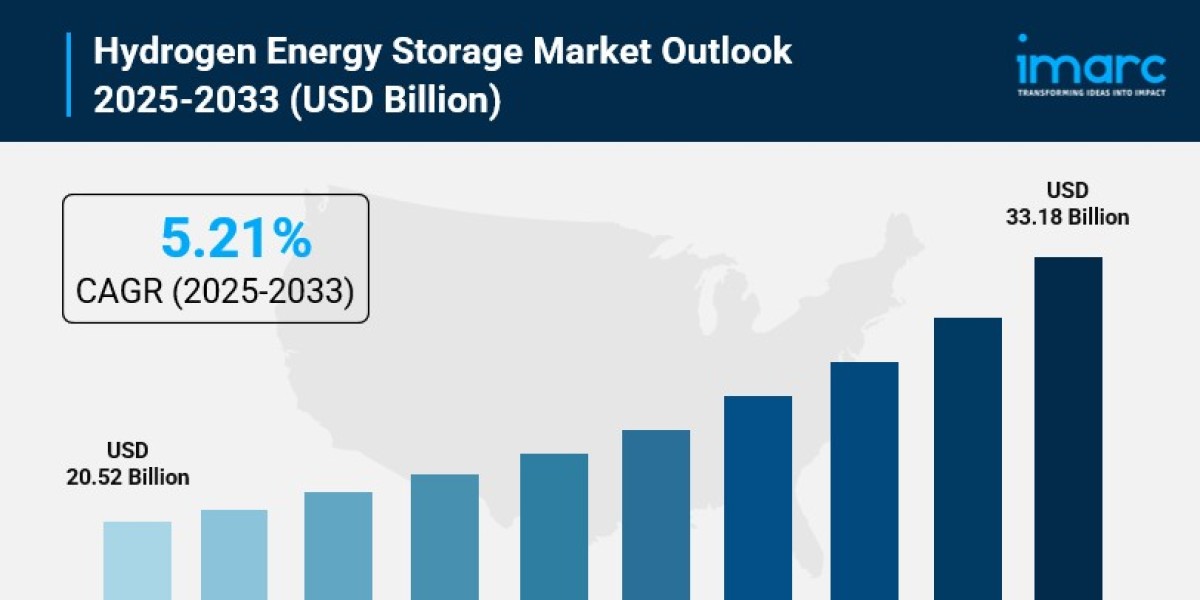

- Hydrogen Energy Storage Market Size: Valued at USD 20.5 Billion in 2024.

- Hydrogen Energy Storage Market Forecast: The market is expected to reach USD 33.18 Billion by 2033, growing at an impressive rate of 5.21% annually.

- Market Growth: The hydrogen energy storage market is experiencing robust growth driven by the global shift toward renewable energy integration and the critical need for large-scale, long-duration energy storage solutions.

- Technology Integration: Advanced technologies including compression systems, liquefaction processes, and material-based storage methods are transforming how hydrogen is stored and deployed across various applications.

- Regional Leadership: Asia-Pacific is emerging as a dominant force in the hydrogen energy storage landscape, supported by massive government investments and ambitious clean energy targets across major economies.

- Security Enhancement: The transition from fossil fuels to clean energy sources is accelerating demand for hydrogen storage systems that can provide reliable backup power and support grid stability.

- Key Players: Industry leaders include Air Liquide, Air Products and Chemicals, Inc., Chart Industries, Engie, Linde PLC, McPhy Energy S.A., and Plug Power Inc., which are driving innovation with cutting-edge storage solutions.

- Market Challenges: High infrastructure costs and the complexity of hydrogen handling require substantial investments in safety systems and specialized equipment.

Request for a sample copy of the report: https://www.imarcgroup.com/hydrogen-energy-storage-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Renewable Energy Integration:

The global energy landscape is undergoing a fundamental transformation as countries race to meet ambitious decarbonization targets. Hydrogen energy storage has emerged as a game-changing solution for addressing one of renewable energy's biggest challenges: intermittency. When solar panels and wind turbines generate excess electricity during periods of low demand, this surplus energy can be used to produce hydrogen through electrolysis. This hydrogen essentially acts as a battery, storing renewable energy that can later be converted back to electricity or used directly as fuel. The Biden-Harris Administration demonstrated strong commitment to this technology, announcing USD 750 million in funding to support 52 hydrogen projects across 24 states. These initiatives are specifically designed to advance electrolysis capabilities, improve manufacturing processes, and enhance recycling systems—all critical components for scaling up hydrogen storage infrastructure.

- Revolutionary Technology Integration:

The hydrogen storage industry is witnessing remarkable technological breakthroughs that are making storage systems more efficient and economically viable. Linde, a global leader in industrial gases, recently invested over USD 2 billion to build a world-scale integrated clean hydrogen facility in Alberta, Canada. This massive project showcases how advanced compression and liquefaction technologies are enabling large-scale hydrogen storage operations. The company operates what's recognized as the world's first high-purity hydrogen storage cavern and maintains an extensive pipeline network spanning approximately 1,000 kilometers. These technological advances aren't just improving storage capacity—they're fundamentally changing the economics of hydrogen energy. Liquid hydrogen storage, for instance, requires only one-seventh of the volume needed for gaseous hydrogen storage, dramatically reducing infrastructure footprint and costs.

- Massive Infrastructure Modernization Projects:

Governments worldwide are committing unprecedented resources to build hydrogen infrastructure from the ground up. The European Union has emerged as a particularly aggressive player in this space, approving funding for four waves of hydrogen-related projects totaling EUR 18.9 billion (USD 19.5 billion) in public investment, with an additional EUR 10 billion (USD 10.3 billion) expected from private sector partners. The Inflation Reduction Act in the United States has accelerated this momentum significantly, with over 80 solar, wind, and energy storage projects already taking advantage of the law's mix of direct payments and tax credits. This isn't just about building storage facilities—it's about creating complete hydrogen ecosystems that include production plants, distribution networks, refueling stations, and end-use applications. The University of Bath is leading efforts in the UK through the ZENITH project, working with GKN Aerospace to tackle hydrogen storage challenges specifically for aviation applications, demonstrating how storage solutions are being tailored for diverse industrial needs.

- Enhanced Security Through Energy Independence:

Energy security has become a paramount concern for nations seeking to reduce dependence on imported fossil fuels while ensuring stable power supply. Hydrogen energy storage offers strategic advantages that go beyond environmental benefits. Unlike battery storage systems that work well for short-duration needs, hydrogen can store massive amounts of energy for weeks or months, making it ideal for seasonal energy storage and emergency backup systems. The U.S. Department of Energy's Hydrogen and Fuel Cell Technologies Office is conducting extensive research across the entire hydrogen value chain—from production and delivery to storage and end-use applications. This comprehensive approach recognizes that effective hydrogen storage isn't just about tanks and containers; it requires integrated solutions that address safety protocols, delivery infrastructure, and compatibility with existing energy systems. Countries are increasingly viewing hydrogen storage as a critical component of national energy security, particularly as extreme weather events and geopolitical tensions highlight vulnerabilities in traditional energy supply chains.

Hydrogen Energy Storage Market Report Segmentation:

Breakup by Product Type:

- Liquid

- Solid

- Gas

Gas-based hydrogen storage currently dominates the market due to its established infrastructure and relatively lower costs for compression systems, though liquid hydrogen is gaining traction for applications requiring higher energy density.

Breakup by Technology:

- Compression

- Liquefaction

- Material Based

Compression technology leads the market as it represents the most mature and widely deployed approach for hydrogen storage, supported by decades of industrial experience and proven reliability.

Breakup by Application:

- Stationary Power

- Transportation

Stationary power applications command the larger market share, as hydrogen storage systems are increasingly deployed for grid balancing, backup power generation, and integration with renewable energy installations.

Breakup by End User:

- Industrial

- Commercial

Industrial end users dominate the hydrogen energy storage market, driven by demand from oil refineries, chemical plants, steel manufacturing, and power generation facilities that require large-scale, reliable hydrogen supply.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Air Liquide

- Air Products and Chemicals, Inc.

- Chart Industries

- Engie

- Gravitricity

- Hexagon Purus

- ITM Power plc

- Linde PLC

- McPhy Energy S.A.

- Plug Power Inc.

- Pragma Industries

- Steelhead Composites, Inc.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4932&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302