In an era where businesses are under constant pressure to reduce costs, improve efficiency, and maintain financial transparency, manual accounts payable (AP) processes are proving to be a bottleneck. Across the USA, UK, and India, organizations are embracing accounts payable automation to transform their finance functions. This article explores the power of AP automation, its benefits, and how IBN Technologies is enabling enterprises to achieve digital-first finance operations.

What Is Accounts Payable Automation?

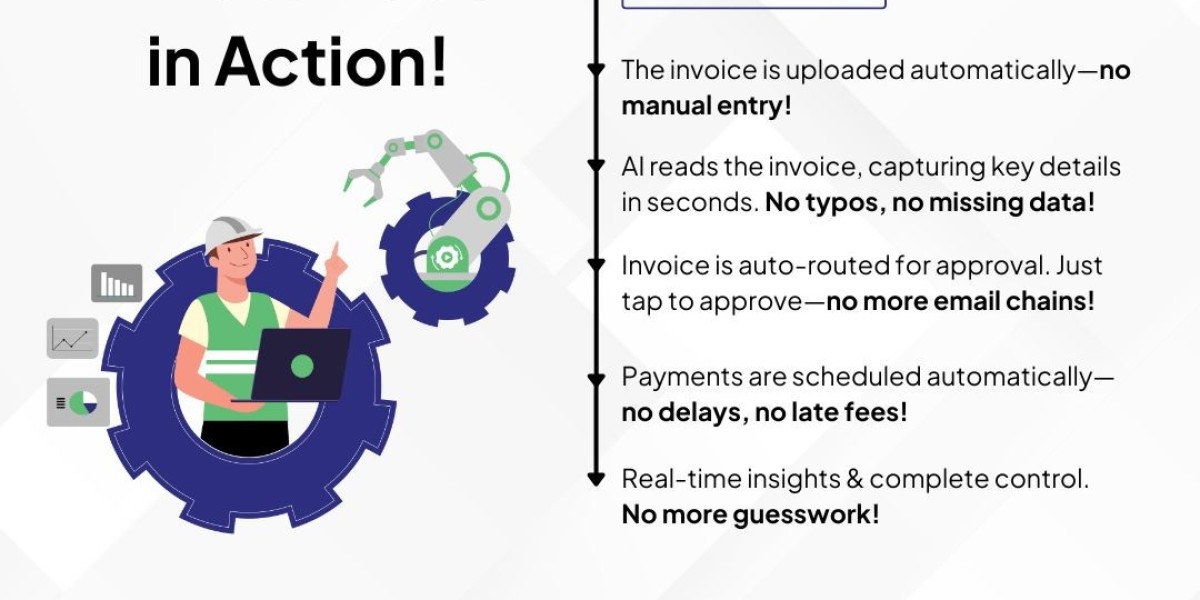

Accounts payable automation uses technology AI, machine learning, robotic process automation (RPA), and workflow tools to streamline invoice processing and payment cycles. Instead of relying on paper invoices, manual approvals, and human data entry, businesses automate the entire process from invoice receipt to vendor payment.

Core features include:

Automated invoice capture and data extraction

PO and invoice matching (2-way / 3-way)

Rule-based approval workflows

Fraud detection and error elimination

Vendor portals and self-service tools

Integration with ERP systems

Real-time financial reporting

Why Businesses in USA, UK, and India Need AP Automation

1. United States (USA)

In the USA, businesses deal with high transaction volumes and strict compliance regulations. AP automation helps reduce costs per invoice, speeds up cycle times, and ensures adherence to regulatory requirements like SOX and IRS reporting.

2. United Kingdom (UK)

UK companies face pressure from Making Tax Digital (MTD) and other government-led initiatives demanding transparency and digital-first processes. AP automation enhances compliance, boosts efficiency, and improves supplier relationships in highly competitive markets.

3. India

In India, digital transformation is accelerating with initiatives like Digital India and GST compliance. AP automation eliminates manual paperwork, reduces dependency on manpower, and supports scalability for fast-growing enterprises.

Benefits of Accounts Payable Automation

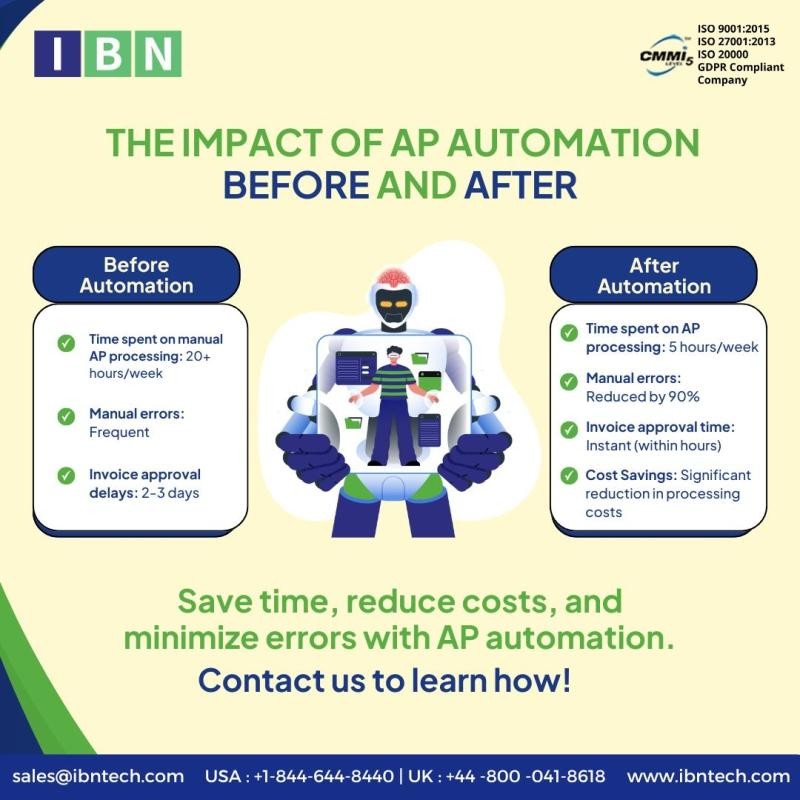

Reduced Processing Costs – Automated workflows significantly cut down labor expenses.

Faster Approvals & Payments – No delays in invoice routing or approvals.

Improved Accuracy – AI eliminates data entry errors and duplicate invoices.

Compliance & Fraud Prevention – Built-in controls safeguard transactions.

Cash Flow Visibility – Real-time dashboards give CFOs and finance teams full visibility into liabilities.

Scalability – Easily supports growing invoice volumes without increasing headcount.

IBN Technologies: Driving AP Automation Excellence

When it comes to implementing accounts payable automation, choosing the right partner is critical. IBN Technologies is a trusted global provider helping businesses in the USA, UK, and India streamline their AP and AR processes.

With deep expertise in AI-driven invoice processing, ERP integration, and end-to-end AP automation, IBN enables finance teams to:

Process invoices faster and at lower costs

Ensure compliance with regional regulations

Enhance vendor relationships with timely payments

Unlock valuable insights through analytics and reporting

Their tailored approach ensures that each solution aligns with a company’s unique workflows, compliance needs, and growth strategy.

Conclusion

The shift towards accounts payable automation is no longer optional it is a strategic move for organizations looking to thrive in competitive markets like the USA, UK, and India. By partnering with experts such as IBN Technologies, businesses can transform their finance operations, reduce costs, and build a future-ready digital ecosystem.