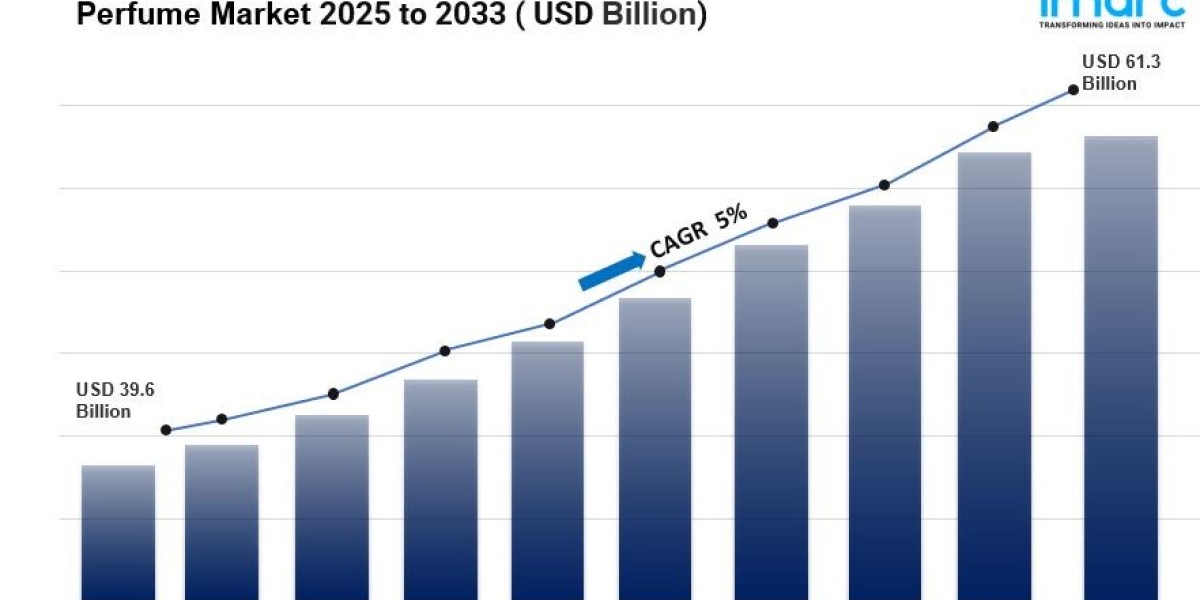

The global perfume market size was valued at USD 39.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 61.3 Billion by 2033, exhibiting a CAGR of 5% during 2025-2033. Brazil currently dominates the market, holding a significant market share in 2024. The market is experiencing steady growth driven by rising consumer demand for personal grooming and luxury products, growing disposable incomes particularly in emerging economies, rapid expansion of e-commerce and online retail channels, and increasing innovation in product development and marketing strategies.

Key Stats for Perfume Market:

- Perfume Market Value (2024): USD 39.6 Billion

- Perfume Market Value (2033): USD 61.3 Billion

- Perfume Market Forecast CAGR: 5%

- Leading Segment in Perfume Market in 2024: Premium Perfume Products

- Key Regions in Perfume Market: Brazil, United States, Germany, France, Russia

- Top companies in Perfume Market: Avon Products Inc., Natura Cosméticos SA, Chanel SA, Coty Inc., LVMH, L'Oréal SA, etc.

Why is the Perfume Market Growing?

The perfume market is witnessing robust expansion as consumers worldwide embrace fragrance as an essential part of their daily routine and personal identity. People are spending more on premium and luxury scents as their incomes rise, particularly in developing regions where the middle class is expanding rapidly. According to industry reports, both family spending and global disposable incomes rose 2.6% in 2022, while Saudi Arabia is projected to see income and spending grow around 16% annually.

The way people shop for perfumes has completely transformed. Online platforms now give consumers access to thousands of products from their homes, complete with detailed descriptions, customer reviews, and personalized recommendations. Industry projections show global retail e-commerce sales will surpass USD 4.1 Trillion in 2024, making luxury fragrances more accessible than ever before. Special online deals and discount offers are bringing high-end perfumes within reach of everyday consumers, significantly expanding the customer base.

What's really driving interest is how personalized the experience has become. People want unique scents that reflect who they are, not just what's popular. This has fueled explosive growth in niche and boutique perfume brands offering bespoke fragrances tailored to individual tastes. According to an industry survey, 43% of consumers worldwide are interested in aromas that help with relaxation, especially for home fragrances. They're selecting products that create a warm, welcoming atmosphere and boost their sense of well-being.

Celebrity endorsements and influencer marketing are also playing a huge role, especially with younger consumers who see fragrances as a way to express themselves. Social media has amplified brand awareness tremendously, making it easier for perfume companies to connect directly with their audience. Gender-neutral fragrances are gaining serious traction too, appealing to a broader demographic and opening up new market opportunities.

Sustainability is becoming non-negotiable. Consumers increasingly favor brands that use natural ingredients and eco-friendly practices. This shift is pushing perfume houses to innovate with sustainable extraction methods and recyclable packaging. Seasonal launches, festive collections, and aggressive marketing campaigns during holidays keep the momentum going throughout the year, with gifting culture contributing significantly to annual sales in many regions.

Request to Get the Sample Report: https://www.imarcgroup.com/perfume-manufacturing-plant/requestsample

AI Impact on the Perfume Market:

Artificial intelligence is reshaping how fragrances are created, marketed, and personalized for consumers. By 2023, perfumers at major scent companies began routinely using AI when developing formulas, and by the end of 2024, entrepreneurs could launch perfume brands with AI assistance in just two weeks. This represents a fundamental shift in an industry that traditionally relied on centuries of craftsmanship and intuition.

AI-powered platforms are analyzing vast databases of scent molecules to predict which combinations will resonate with specific consumer preferences. Companies like Givaudan have developed interactive systems where perfumers select raw materials on touchscreens, and specialized robots instantly produce real samples. This technology makes centuries of research accessible in seconds, dramatically speeding up the development process while expanding creative possibilities.

The technology goes beyond just formula creation. AI analyzes consumer data, purchase patterns, and social media trends to forecast which fragrances will succeed in the market. It's enabling hyper-personalization, where brands can create custom scents based on individual preferences, lifestyle choices, and even mood. Some platforms now offer virtual scent consultations powered by AI, guiding customers through thousands of options to find their perfect match.

Major luxury brands are embracing this shift. Prada proudly incorporated AI-generated jasmine accords in its 2024 launches, while Osmo launched Generation, billed as the world's first AI-powered fragrance house utilizing proprietary olfactory intelligence. In November 2024, Unilever announced a EUR 100 Million (approximately USD 104.91 Million) investment to develop digital skills for fragrance design and creation internally.

However, the rise of AI in perfumery isn't without controversy. Digital fragrance communities, which have become influential voices in the industry, have shown mixed reactions. Some embrace the innovation and efficiency, while others worry about losing the artisanal authenticity that makes perfumery special. The key insight is that AI isn't replacing master perfumers—it's augmenting their capabilities, handling data analysis and rapid prototyping so human experts can focus on the artistic and emotional aspects of scent creation.

Behind the scenes, AI is also streamlining supply chains, optimizing ingredient sourcing, and improving quality control. Predictive analytics help brands manage inventory more efficiently and reduce waste, which aligns with growing sustainability demands. This technological revolution is democratizing perfume creation while maintaining the premium appeal that drives the luxury fragrance market.

Segmental Analysis:

Analysis by Type:

- Premium Perfume Products

- Mass Perfume Products

Premium perfume products dominate the market, accounting for the largest segment. These high-end fragrances command consumer loyalty through superior quality, long-lasting formulas, and their association with luxury lifestyles. Growing disposable incomes have made people more willing to invest in premium personal grooming products that make them feel special. The segment benefits from strategic marketing campaigns featuring celebrity endorsements and aspirational branding that creates emotional connections with consumers.

E-commerce platforms have made premium perfumes more accessible, offering personalized recommendations and convenient shopping experiences. Expansion into emerging markets, where affluent middle-class populations are growing rapidly, continues fueling demand. Limited-edition releases and exclusive collections maintain excitement and encourage repeat purchases from dedicated customers who see premium fragrances as worth the investment.

Analysis by Category:

- Female Fragrances

- Male Fragrances

- Unisex Fragrances

Female fragrances lead the market, driven by the extensive variety of scents available ranging from floral and fruity to oriental and woody notes. These perfumes are typically marketed with strong emotional and aspirational appeals, creating deeper connections with consumers. Women's fragrance lines benefit from frequent seasonal collections and attractive gift sets, which drive substantial sales during festivals, holidays, and special occasions.

Celebrity-endorsed products specifically targeting women contribute significantly to segment growth through brand loyalty and repeat purchases. The market also benefits from continuous innovation in packaging design and customization options tailored to women's aesthetic preferences. Additionally, the broader acceptance of fragrance as part of daily grooming routines among women sustains consistent demand across all price points.

Analysis of Perfume Market by Regions

- Brazil

- United States

- Germany

- France

- Russia

Brazil leads the global perfume market, reflecting the country's strong cultural affinity for fragrance and personal grooming. Brazilians have integrated perfumes deeply into daily life, with industry reports showing adults are particularly interested in innovative formats—33% prefer in-shower perfumes, 14% favor fragrance sticks, and 13% choose solid fragrances. This diversity in product preferences keeps the market dynamic and continuously evolving.

The country's large and diverse population, combined with a booming middle class, creates robust demand across all price segments. Local brands dominate the landscape with tropical and floral scents that resonate with regional tastes. According to industry data, domestic powerhouses like Malbec from Grupo Boticário, Natura Ekos from Natura & Co., and Floratta from Grupo Boticário lead sales charts. E-commerce infrastructure has grown 20% annually, making perfumes increasingly accessible to younger consumers nationwide.

The United States represents one of the world's largest perfume markets, characterized by diverse consumer preferences spanning light florals to bold, musky fragrances. The competitive landscape includes numerous domestic and international brands distributed through department stores, specialty fragrance shops, and online retailers. American consumers increasingly prioritize sustainability and natural ingredients, pushing brands to adapt their product development strategies accordingly.

Demographic data reveals that consumers aged 35-54 purchase perfumes most frequently, as they typically have higher disposable incomes and stable employment. Market research indicates 18,784 firms operate in the United States online market for perfume and cosmetics sales, reflecting the industry's robust digital infrastructure. Celebrity fragrance lines continue expanding market reach, while influencer marketing and social media trends drive demand for new releases, particularly among younger demographics.

Germany's perfume market thrives on consumers' appreciation for high-quality fragrances and craftsmanship. Germans favor both traditional luxury brands and emerging niche perfumes, with over 65% of consumers expressing preference for vegan or natural formulations from companies offering cruelty-free, sustainable solutions. The country's strong economy and high purchasing power ensure steady sales across premium segments.

Germany emerged as the third-largest perfume exporter globally in 2022, shipping USD 1.67 Billion worth of fragrances internationally, according to the Observatory of Economic Complexity. Domestically, gifting culture accounts for 40% of annual perfume sales, especially during festive seasons. Rising e-commerce adoption has made high-end products more affordable and accessible, while urbanization and middle-class growth are driving demand for both affordable and luxury offerings.

France maintains its legendary position as the perfume capital of the world, hosting many of history's most renowned fragrance houses including Chanel, Dior, and Guerlain. Perfume is deeply embedded in French culture, with Paris featuring specialized perfume boutiques and museums that celebrate this heritage. French perfumes emphasize elegance, sophistication, and exceptional craftsmanship, commanding premium prices in global markets.

In 2022, France was the world's largest perfume exporter, shipping USD 7.24 Billion in fragrances globally, with perfumes ranking 16th among French export products. The United States recorded the highest growth in French perfume imports at USD 208 Million, followed by Spain at USD 151 Million and the United Kingdom at USD 120 Million. Domestically, sustainability trends are reshaping product development, with 40% of new launches featuring natural ingredients and recyclable packaging, maintaining France's position at the forefront of innovation.

Russia's perfume market demonstrates steady growth driven by improving economic conditions and an expanding middle class. Russian consumers prefer stronger, long-lasting fragrances suited to the country's colder climate, with nearly 50% viewing perfumes as status symbols. Luxury international brands like Dior and Gucci enjoy strong demand, while local producers gain popularity with reasonably priced products featuring potent, enduring scents.

Russia exported USD 30.9 Million worth of perfumes in 2022, according to the Observatory of Economic Complexity, with top destinations including Kazakhstan (USD 12.9 Million), Uzbekistan (USD 5.34 Million), and Azerbaijan (USD 2.47 Million). Gift culture during New Year celebrations and Women's Day contributes significantly to annual sales. Wealthy younger consumers increasingly seek limited-edition and custom fragrances that offer exclusivity and personal expression.

What are the Drivers, Restraints, and Key Trends of the Perfume Market?

Market Drivers:

The perfume market is propelled by widespread smartphone adoption and the integration of wearable technology that connects with fragrance apps for personalized recommendations. Rising health and wellness awareness extends beyond fitness to encompass holistic self-care, with fragrances playing a significant role in emotional well-being and stress management. Growing disposable incomes, particularly in emerging economies, enable more consumers to afford premium and luxury perfumes.

Busy lifestyles and hybrid work models have increased demand for versatile fragrances suitable for both professional and casual settings. The popularity of home fragrances has surged as people spend more time in personal spaces and prioritize creating comfortable environments. Integration of features like scent profiling, virtual try-ons, and subscription-based delivery models makes perfume shopping more convenient and appealing. Younger demographics' preference for digital shopping experiences and their willingness to experiment with new brands continue driving market expansion.

Market Restraints:

The market faces challenges around data privacy and security, as many fragrance apps and online platforms collect sensitive personal information about preferences and shopping behaviors. Limited internet access and lower smartphone penetration in developing regions restrict potential adoption of digital perfume shopping experiences. Intense competition between free sampling programs and paid premium offerings may affect profitability for smaller independent brands.

The inability to physically smell fragrances before online purchase remains a significant barrier, despite technological innovations like scent descriptions and recommendation algorithms. Concerns about ingredient authenticity and product quality when purchasing through third-party sellers create hesitation among some consumers. Additionally, market saturation in mature economies makes differentiation increasingly difficult for new entrants trying to establish brand recognition.

Market Key Trends:

Key trends reshaping the perfume market include the explosive growth of AI and machine learning for personalized scent recommendations and formula development. Integration with e-commerce platforms offering virtual consultations, sample programs, and subscription services is enhancing accessibility. Hybrid models combining online discovery with in-store experiences are gaining traction as brands recognize consumers want to engage through multiple touchpoints.

Gender-neutral and unisex fragrances are becoming mainstream as younger consumers reject traditional marketing categories. Sustainability and clean beauty movements are expanding beyond niche markets—consumers now expect transparent ingredient sourcing, eco-friendly packaging, and cruelty-free certifications from all brands, not just premium ones. Social commerce and influencer partnerships on platforms like Instagram and TikTok are becoming primary discovery channels, especially for independent and niche fragrance brands.

The rise of fragrance layering and customization services allows consumers to create signature scents by combining multiple products. Wellness-focused fragrances incorporating aromatherapy benefits and stress-relief properties are expanding the market beyond traditional perfumery. Furthermore, nostalgia-driven scents and retro packaging are resonating with consumers seeking emotional connections to past memories and experiences.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=631&flag=C

Leading Players of Perfume Market:

According to IMARC Group's latest analysis, prominent companies shaping the global perfume landscape include:

- Avon Products Inc.

- Natura Cosméticos SA

- Chanel SA

- Coty Inc.

- LVMH

- L'Oréal SA

These industry leaders are expanding their market presence through strategic partnerships, innovative product development, and advanced digital platforms. They're investing heavily in research and development to create unique fragrances that balance tradition with modern consumer preferences. Sustainability initiatives are becoming central to corporate strategies as these companies recognize environmental responsibility drives purchasing decisions.

Celebrity collaborations, designer partnerships, and influencer engagement remain key tactics for building brand awareness and reaching new demographics. These players maintain strong international footprints covering both mature and emerging markets, adapting their offerings to regional preferences while maintaining brand consistency. Marketing efforts emphasize the emotional and sensory aspects of perfumes, creating aspirational narratives that resonate with target audiences. Limited-edition collections and exclusive releases targeting various consumer segments keep brands relevant and exciting in a competitive marketplace.

Key Developments in Perfume Market:

The perfume industry has seen remarkable innovation and market expansion throughout 2024 and early 2025. Here are some notable developments shaping the market landscape:

In November 2024, Unilever announced a major commitment to digital transformation with a EUR 100 Million (approximately USD 104.91 Million) investment to develop internal capabilities for digital fragrance design and creation. This substantial investment signals the industry's recognition that technology and artificial intelligence are becoming essential tools for competitive advantage in modern perfumery.

Peloton made waves in December 2024 by launching its Strength+ app priced at just USD 1, marking the fitness brand's strategic entry into the strength training space. While primarily a fitness application, this move demonstrates how lifestyle brands are expanding into adjacent wellness categories, recognizing that modern consumers view fitness, wellness, and personal care as interconnected aspects of self-improvement.

The rise of AI-powered fragrance development platforms has accelerated dramatically. By 2024, entrepreneurs could launch complete perfume brands with AI assistance in approximately two weeks, compared to the months or years traditionally required. Companies like Osmo launched Generation, marketed as the world's first AI-powered fragrance house, utilizing proprietary olfactory intelligence to transform scent creation processes fundamentally.

Luxury brands are embracing technology while maintaining their heritage credentials. Prada's 2024 collections proudly featured AI-generated jasmine accords, demonstrating that even prestigious fashion houses recognize AI as a valuable creative partner rather than a threat to craftsmanship. This acceptance by luxury leaders has legitimized AI's role in perfumery among traditional fragrance communities.

The sustainability movement has gained serious momentum with 40% of new perfume launches in key markets now featuring natural ingredients and recyclable packaging. This isn't just marketing—it reflects fundamental changes in production methods and supply chain management as companies respond to consumer demands for environmental responsibility.

E-commerce infrastructure continues expanding rapidly, with Brazil's online fragrance retail growing 20% annually and making premium perfumes accessible to younger consumers across the country. Social commerce through platforms like Instagram and TikTok has become a primary discovery channel, with influencer partnerships driving awareness and sales, particularly for independent and niche fragrance brands.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302