IMARC Group has recently released a new research study titled “United States Agricultural Films Market Report by Type (Low-Density Polyethylene, Linear Low-Density Polyethylene, High-Density Polyethylene, Ethylene Vinyl Acetate, and Others), Application (Greenhouse, Silage, Mulching, and Others), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

United States Agricultural Films Market Overview

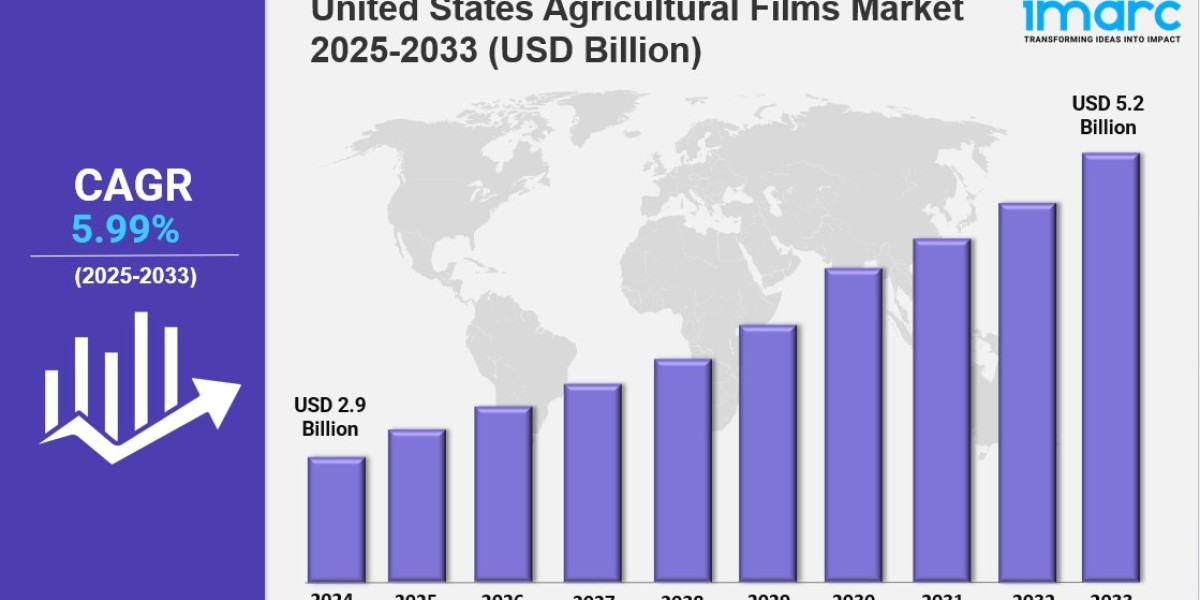

United States agricultural films market size reached USD 2.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.99% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 2.9 Billion

Market Forecast in 2033: USD 5.2 Billion

Market Growth Rate 2025-2033: 5.99%

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-agricultural-films-market/requestsample

Key Market Highlights:

✔️ Increasing adoption of modern farming techniques driving demand for protective agricultural films

✔️ Growing awareness about crop yield enhancement and soil moisture conservation

✔️ Rising use of biodegradable and UV-resistant films in sustainable agriculture practices

United States Agricultural Films Market Trends

The United States Agricultural Films Market is undergoing major transformation as stricter environmental regulations, climate challenges, and new farming technologies reshape demand. In 2025, the EPA introduced the Farm Film Sustainability Mandate, requiring most polyethylene film producers to include biodegradable additives. Early trials showed promising results, with microplastic pollution reduced by nearly 73% in targeted regions.

Manufacturers have responded quickly. Berry Global, in partnership with Novamont, developed Mater-Bi® mulch films that naturally break down within 90 days after harvest, capturing 42% of the California strawberry market. At the same time, the USDA’s Climate-Smart Commodities Program provided more than $680 million in subsidies to support companies bringing innovative films to market. Examples include Dow Chemical’s nitrogen-retaining barrier films for cornfields and Trioplast’s ammonia-absorbing silage films with fermentation sensors, both helping to reduce emissions while improving yields.

Meeting Climate Challenges with Adaptive Films

Climate extremes—drought in the Midwest, flooding in the Southeast, and hailstorms in the Rockies—are fueling demand for advanced, adaptive films. Ginegar Plastic Products delivered over 18,000 tons of UV- and IR-resistant films to help stabilize crop yields in difficult conditions. BASF has developed self-repairing greenhouse films that reduce storm damage costs, particularly in hail-prone states like Colorado.

Precision agriculture is also driving innovation. John Deere and AEP Industries partnered to create row covers designed for autonomous tractors, boosting soybean yields by nearly 30%. In Arizona, water-harvesting films from Netafim and Al-Pack Enterprises are helping cotton growers capture more than 8 liters of water per square meter daily, offering a practical solution for drought-stricken regions.

Sustainability and Recycling at the Core

Sustainability remains central to the United States Agricultural Films Market Outlook. Under the Extended Producer Responsibility (EPR) Act, at least 65% of agricultural films must now be recycled. Manufacturers are investing in advanced collection systems and recycling technologies to meet these targets.

Revolution Plastics launched a blockchain-enabled recycling program in Arkansas to track recovery, while TOMRA and BP introduced new sorting technology to purify contaminated polyethylene. Eastman Chemical has expanded chemical recycling capacity with a Texas facility capable of processing 120,000 tons of used greenhouse films annually. Farmers are also engaged—programs like AgriRecycle in Wisconsin have already pushed silage film recycling rates above 70%.

Interestingly, recycled films are now finding value beyond agriculture. Saint-Gobain is repurposing recovered materials into radiation-resistant panels for vertical farms located near nuclear power facilities, highlighting new opportunities for circular economy applications.

Market Leaders Driving Growth

Several key players are shaping the competitive landscape, including:

- Berry Global Inc.

- Dow Chemical Company

- BASF SE

- Trioplast Industries AB

- Ginegar Plastic Products Ltd.

- Revolution Plastics

- Eastman Chemical Company

- Saint-Gobain

- Plastika Kritis S.A.

- Novamont S.p.A.

These companies are expanding investments in biodegradable materials, recycling systems, and smart coatings, accelerating United States Agricultural Films Market Growth.

United States Agricultural Films Market Forecast

Looking ahead, the United States Agricultural Films Market Size is projected to reach $4.9 billion by 2033. Growth will be supported by innovations such as Mitsubishi Chemical’s self-diagnostic films that monitor soil pH—already adopted by more than 90% of California almond growers—and ExxonMobil’s bio-based feedstock sourcing under the USMCA Bio-Based Materials Protocol.

Next-generation farmers are also shaping demand. A Farm Bureau survey revealed that nearly 70% of younger farmers prefer multifunctional films, such as Innovia Films’ products combining weed-blocking, insect-repelling, and neem oil-based natural protection. Emerging technologies include carbon-sequestering biodegradable films that generate credits per acre, quantum dot films designed to enhance cannabis yields, and edible coatings that extend the shelf life of fresh produce.

With advancements in nano-layering reducing film thickness to just 12 microns, the industry is moving toward lighter, stronger, and more sustainable products. From California strawberry farms to Arizona cotton fields, the United States Agricultural Films Market Outlook points to continued innovation, sustainable practices, and strong growth across all regions.

United States Agricultural Films Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Type:

- Low-Density Polyethylene

- Linear Low-Density Polyethylene

- High-Density Polyethylene

- Ethylene Vinyl Acetate

- Others

Breakup by Application:

- Greenhouse

- Silage

- Mulching

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=20534&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302