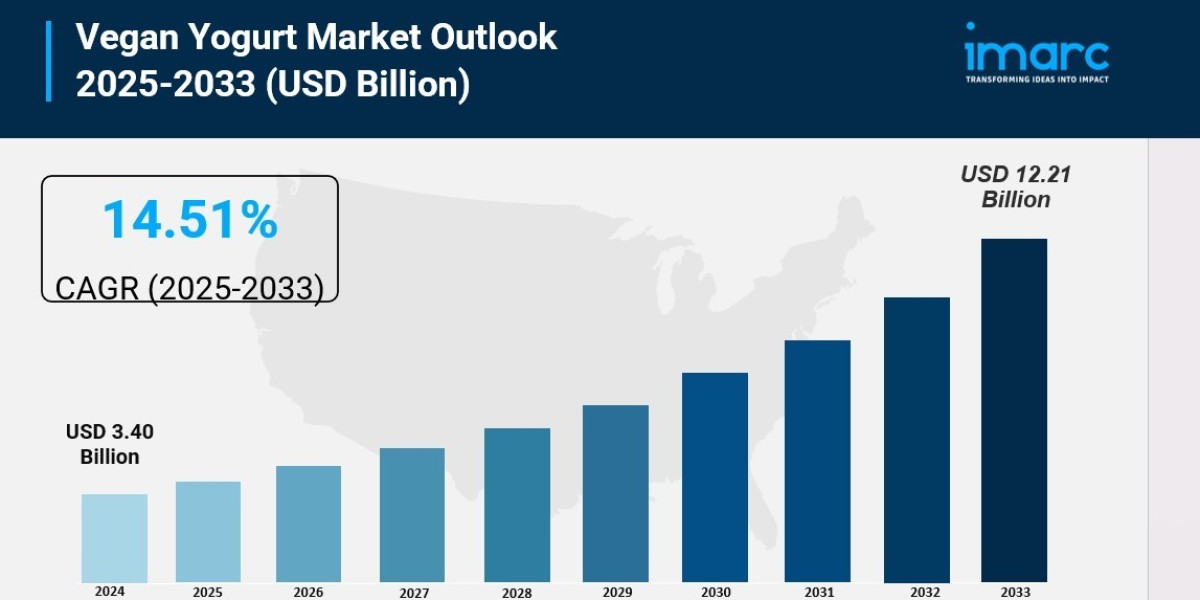

The global vegan yogurt market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.2 Billion by 2033, exhibiting a CAGR of 14.51% during 2025-2033. North America currently dominates the Vegan Yogurt Market Share, holding a significant portion driven by high consumer awareness about health and environmental sustainability, strong retail infrastructure for plant-based products, and widespread adoption of lactose-free alternatives. The market is experiencing explosive growth driven by rising lactose intolerance cases, increasing environmental consciousness among consumers, and expanding product innovations across multiple plant-based platforms.

Key Stats for Vegan Yogurt Market:

- Vegan Yogurt Market Value (2024): USD 3.4 Billion

- Vegan Yogurt Market Value (2033): USD 12.2 Billion

- Vegan Yogurt Market Forecast CAGR: 14.51%

- Leading Segment in Vegan Yogurt Market in 2024: Soy-Based Yogurt (46.9%)

- Key Regions in Vegan Yogurt Market: North America, Europe, Asia Pacific, Latin America, Middle East and Africa

- Top companies in Vegan Yogurt Market: Danone S.A., General Mills Inc., Oatly Group AB, Chobani LLC, Kite Hill, Califia Farms LLC, The Hain Celestial Group Inc., Silk (Danone North America), Forager Project, Coyo Pty Ltd., Blue Diamond Growers, Vitasoy

Why is the Vegan Yogurt Market Growing?

The vegan yogurt market is experiencing phenomenal growth as consumers increasingly embrace plant-based alternatives for health, environmental, and ethical reasons. The surge in lactose intolerance awareness has created a massive consumer base seeking dairy-free options, with studies indicating that approximately 65% of adults worldwide have some degree of lactose malabsorption. This health-driven demand has transformed vegan yogurt from a niche product into a mainstream category available in major retail chains globally.

Environmental sustainability concerns are driving significant consumer behavior changes, particularly among younger demographics who prioritize eco-friendly food choices. Plant-based yogurt production requires substantially less water and generates fewer greenhouse gas emissions compared to traditional dairy farming, appealing to environmentally conscious consumers willing to pay premium prices for sustainable products.

The wellness trend has elevated protein-rich, probiotic-enhanced vegan yogurt as a functional food that supports digestive health and immune function. Modern formulations now match or exceed the nutritional profiles of dairy yogurt while offering unique benefits like additional fiber and plant-based nutrients. Major food manufacturers are investing heavily in research and development to create products that deliver authentic taste and texture experiences that rival conventional dairy options.

Retail expansion has made vegan yogurt more accessible than ever before, with products now available in mainstream supermarkets, convenience stores, and online platforms. The category has evolved beyond basic vanilla and strawberry flavors to include sophisticated offerings like Greek-style coconut yogurt, oat-based parfaits, and protein-enhanced almond varieties that cater to diverse consumer preferences.

Request For A Sample Copy Of This Report: https://www.imarcgroup.com/vegan-yogurt-market/requestsample

AI Impact on the Vegan Yogurt Market:

Artificial intelligence is revolutionizing vegan yogurt development through advanced flavor profiling and texture optimization that creates products virtually indistinguishable from dairy alternatives. Machine learning algorithms analyze consumer taste preferences and sensory data to predict successful flavor combinations and identify optimal ingredient ratios for specific plant-based platforms.

Smart manufacturing systems powered by AI are optimizing fermentation processes for different plant milks, ensuring consistent probiotic cultures and achieving desired texture profiles across various production batches. These intelligent systems monitor temperature, pH levels, and microbial activity in real-time, automatically adjusting parameters to maintain product quality and extend shelf life.

Predictive analytics are transforming supply chain management by analyzing seasonal demand patterns, regional preferences, and emerging flavor trends to optimize inventory levels and reduce food waste. AI systems can predict which products will perform best in specific markets, enabling manufacturers to customize production schedules and distribution strategies accordingly.

Consumer insights platforms powered by artificial intelligence are analyzing social media sentiment, purchase patterns, and demographic data to identify emerging market opportunities and guide new product development. These systems can detect rising interest in specific ingredients like oats or pea protein months before traditional market research would identify these trends.

Segmental Analysis:

Analysis by Source:

- Soy-Based Yogurt

- Coconut-Based Yogurt

- Almond-Based Yogurt

- Oat-Based Yogurt

- Others (Pea, Cashew, Rice)

Soy-based yogurt leads the market with a 46.9% share, valued for its high protein content and established consumer acceptance. Soy yogurt provides complete amino acid profiles comparable to dairy while offering excellent texture and taste characteristics that appeal to mainstream consumers.

Analysis by Flavor:

- Plain/Vanilla

- Fruit Flavored

- Chocolate

- Others

Plain and vanilla varieties dominate sales as they serve as versatile bases for breakfast bowls, smoothies, and cooking applications. However, fruit-flavored options are experiencing rapid growth as manufacturers develop more sophisticated flavor profiles.

Analysis by Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Health Food Stores

- Others

Supermarkets and hypermarkets represent the largest distribution channel as vegan yogurt transitions from specialty product to mainstream grocery staple. Online retail is experiencing explosive growth, particularly for premium and artisanal brands.

Analysis by Packaging:

- Cups

- Bottles

- Pouches

- Others

Cup packaging dominates the market due to consumer familiarity and portion control convenience, though innovative packaging solutions like resealable pouches are gaining traction for on-the-go consumption.

Analysis of Vegan Yogurt Market by Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America leads the global vegan yogurt market, driven by high consumer awareness of plant-based nutrition, strong retail infrastructure for alternative products, and significant investment in product innovation by major food manufacturers. The region benefits from established health and wellness trends that support premium positioning for vegan yogurt products.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=2289&flag=C

What are the Drivers, Restraints, and Key Trends of the Vegan Yogurt Market?

Market Drivers:

The vegan yogurt market is propelled by rapidly increasing lactose intolerance awareness, with approximately 65% of adults worldwide experiencing some degree of lactose sensitivity that drives demand for plant-based alternatives. Health-conscious consumers are actively seeking products that support digestive wellness while providing essential nutrients without dairy-related side effects.

Environmental sustainability concerns are creating powerful consumer motivation as plant-based yogurt production requires significantly less water and generates fewer carbon emissions compared to conventional dairy farming. Younger consumers particularly prioritize eco-friendly products and are willing to pay premium prices for brands that align with their environmental values.

The fitness and wellness trend has elevated vegan yogurt as a functional food that provides plant-based protein, probiotics, and essential nutrients for active lifestyles. Professional athletes and fitness influencers are endorsing plant-based options, creating aspirational appeal that drives mainstream adoption.

Product innovation and improved taste profiles have eliminated traditional barriers to vegan yogurt adoption, with modern formulations delivering creamy textures and authentic flavors that satisfy conventional dairy consumers while offering unique nutritional benefits.

Market Restraints:

The market faces challenges from higher production costs compared to conventional dairy yogurt, which can limit adoption among price-sensitive consumers and restrict market penetration in developing regions where affordability is a primary concern.

Taste and texture preferences remain barriers for some consumers who find vegan alternatives don't match their expectations based on dairy yogurt experiences. Overcoming these sensory challenges requires continuous product development investments that can strain smaller manufacturers.

Limited shelf life and specialized storage requirements can create distribution challenges, particularly in regions with inadequate cold chain infrastructure. Some vegan yogurt products require more careful handling than conventional dairy options.

Regulatory complexity around health claims and nutritional labeling can slow product development and market entry, while varying regulations across different markets create compliance challenges for global brands seeking consistent positioning.

Market Key Trends:

Key trends shaping the vegan yogurt market include the rise of high-protein formulations that appeal to fitness-oriented consumers seeking plant-based alternatives to Greek yogurt. Manufacturers are developing innovative protein blends using pea, hemp, and other plant sources to create nutritionally superior products.

Probiotic enhancement is becoming standard as consumers recognize digestive health benefits, with brands incorporating multiple bacterial strains and prebiotic fibers to support gut microbiome health. These functional benefits differentiate vegan yogurt from simple dairy alternatives.

Premium and artisanal positioning is growing as consumers embrace craft food experiences, with small-batch producers offering unique flavors, locally-sourced ingredients, and sustainable packaging that commands higher price points.

Furthermore, hybrid plant-based formulations combining multiple sources like oat-coconut or almond-cashew are creating unique taste and texture profiles that offer advantages over single-ingredient products while appealing to adventurous consumers seeking novel experiences.

Leading Players of Vegan Yogurt Market:

According to IMARC Group's latest analysis, prominent companies shaping the global Vegan Yogurt landscape include:

- Danone S.A.

- General Mills Inc.

- Oatly Group AB

- Chobani LLC

- Kite Hill

- Califia Farms LLC

- The Hain Celestial Group Inc.

- Silk (Danone North America)

- Forager Project

- Coyo Pty Ltd.

- Blue Diamond Growers

- Vitasoy International Holdings Ltd.

These leading providers are expanding their footprint through strategic product innovations, retail partnerships, and targeted marketing campaigns to meet growing demand across health-conscious, environmentally aware, and lactose-intolerant consumer segments. Market strategies focus on taste optimization, nutritional enhancement, and sustainable packaging with emphasis on protein content, probiotic benefits, and premium positioning.

Key Developments in Vegan Yogurt Market:

- January 2025: Major vegan yogurt brands reported record sales growth during Veganuary, with several companies experiencing 200% increases in new customer acquisition. This annual plant-based challenge has become a significant driver of trial and conversion for vegan yogurt products globally.

- December 2024: Leading manufacturers launched high-protein vegan yogurt lines featuring 15-20 grams of plant-based protein per serving, directly competing with traditional Greek yogurt protein levels. These innovations target fitness enthusiasts and health-conscious consumers seeking dairy-free protein sources.

- November 2024: Retail partnerships expanded significantly with major supermarket chains dedicating entire refrigerated sections to plant-based yogurt alternatives. Walmart, Target, and Kroger reported 150% increases in vegan yogurt shelf space allocation to meet growing consumer demand.

- October 2024: Sustainability initiatives gained momentum with several brands launching carbon-neutral production processes and compostable packaging solutions. Oatly and Califia Farms announced commitments to achieve net-zero emissions across their entire supply chains by 2030.

- September 2024: Probiotic enhancement reached new levels of sophistication with companies introducing multi-strain formulations specifically designed for plant-based matrices. These innovations provide digestive health benefits comparable to traditional dairy yogurt while offering unique plant-based nutritional advantages.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302