IMARC Group has recently released a new research study titled “Mexico Fintech Market Report by Deployment Mode (On-premises, Cloud-based), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), End User (Banking, Insurance, Securities, and Others), and Region 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Mexico Fintech Market Overview

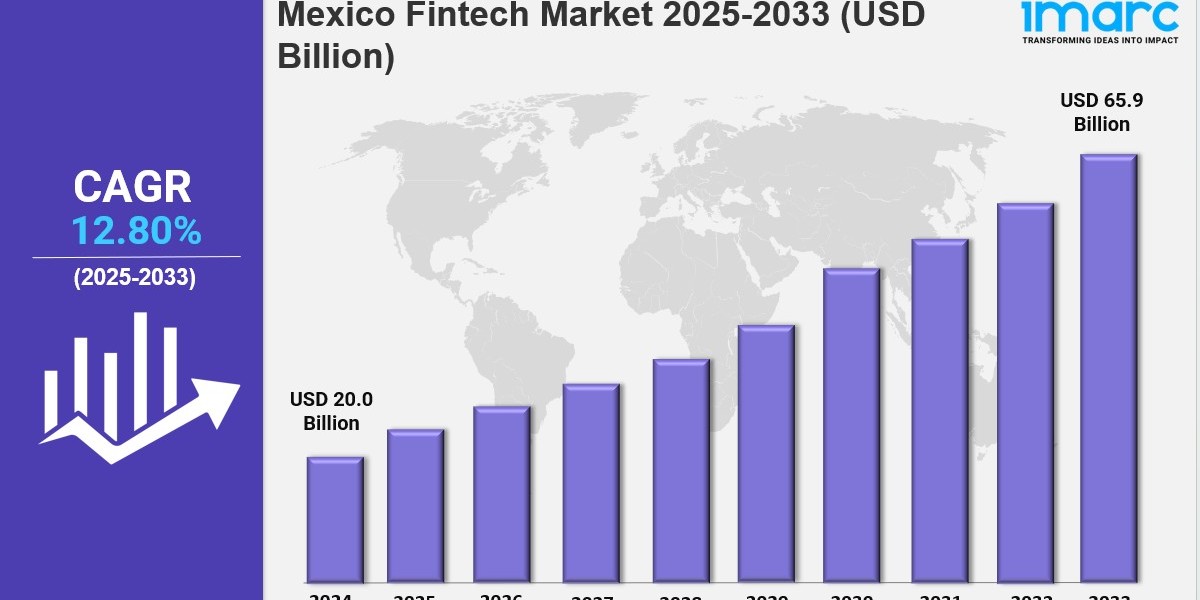

Mexico fintech market size reached USD 20.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 65.9 Billion by 2033, exhibiting a growth rate (CAGR) of 12.80% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 20.0 Billion

Market Forecast in 2033: USD 65.9 Billion

Market Growth Rate 2025-2033: 12.80%

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-fintech-market/requestsample

Key Market Highlights:

✔️ Strong expansion driven by digital transformation and financial inclusion

✔️ Growing usage of mobile wallets and online lending platforms

✔️ Increasing focus on AI, blockchain, and regulatory support for innovation

Mexico Fintech Market Trends

The Mexico fintech market is undergoing a rapid transformation, driven by rising smartphone usage, expanding internet access, and the growing demand for digital financial solutions. Once dominated by cash transactions, the Mexican economy is now shifting toward mobile wallets, online lending, and contactless payments. This change is not only reshaping consumer habits but also boosting financial inclusion across the country.

Mexico Fintech Market Share

Mexico has established itself as the second-largest fintech hub in Latin America, just behind Brazil. The country holds a significant share of the regional market, with digital payments, neobanks, and lending platforms leading the way. Mobile wallets and payment apps are widely used across urban centers, while adoption is also spreading into smaller towns and rural areas. The wide range of services offered—from digital wallets to peer-to-peer lending—demonstrates how fintechs are capturing customers who were underserved or excluded from traditional banking.

Mexico Fintech Market Growth

The Mexico fintech market growth has been fueled by consumer demand for faster, safer, and more convenient financial tools. Digital payments are the strongest driver of growth, embraced by e-commerce platforms, food delivery services, and even local businesses. Digital lending is another fast-expanding area, as fintech companies use alternative data and real-time analytics to extend credit to individuals and small businesses lacking formal credit histories.

In addition, partnerships between traditional banks and fintech startups are fostering innovation. Instead of competing head-to-head, financial institutions are increasingly working together to reach more customers and improve services. This collaborative model is accelerating market expansion and creating more opportunities within the sector.

Mexico Fintech Market Outlook

The Mexico fintech market outlook remains highly positive. Strong investor interest, supportive regulation, and consumer trust are expected to sustain rapid growth in the coming years. Mexico’s pioneering Fintech Law has already provided a solid regulatory framework, boosting confidence among users and investors.

Future trends point to greater adoption of technologies such as blockchain, biometric security, and open banking, which will enhance security and expand financial inclusion. With a young, tech-savvy population and a growing appetite for digital services, Mexico is positioned to become one of the leading fintech hubs in the region.

Conclusion

In summary, the Mexico fintech market is not only expanding in size but also reshaping the country’s financial landscape. With strong market share, accelerating growth, and a promising outlook, fintech in Mexico is set to play a vital role in the future of financial services across Latin America.

Mexico Fintech Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Deployment Mode:

- On-premises

- Cloud-based

Breakup by Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Breakup by Application:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Breakup by End User:

- Banking

- Insurance

- Securities

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=22146&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302