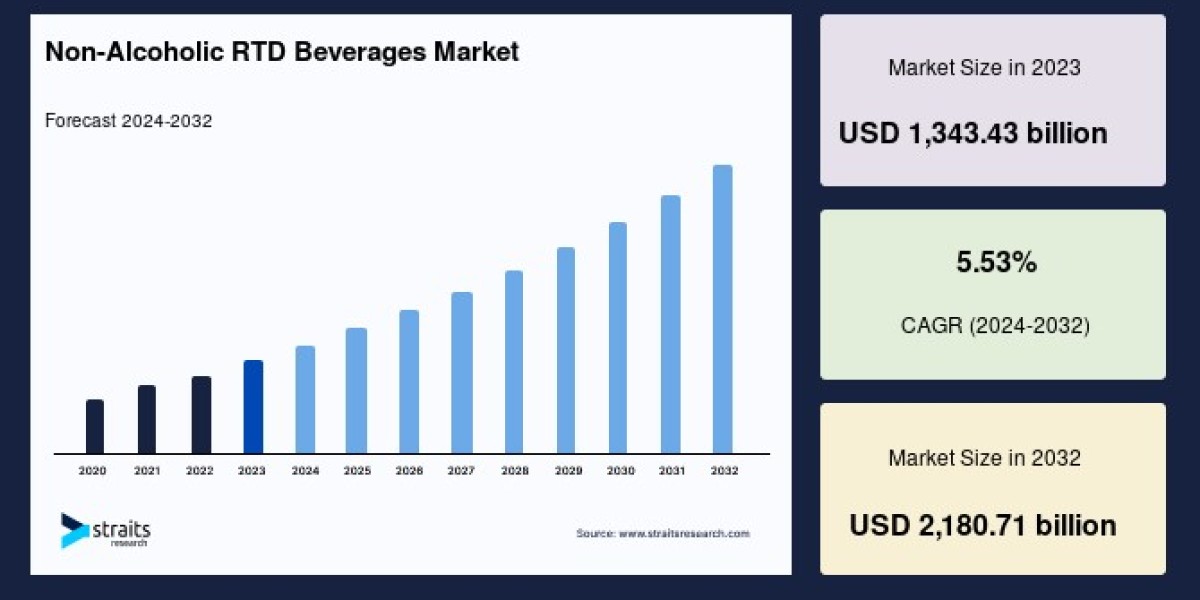

The global Non-Alcoholic RTD Beverages Market Size was valued at USD 1,343.43 billion in 2023. It is expected to reach USD 2,180.71 billion in 2032, growing at a CAGR of 5.53% over the forecast period (2024-32). Busy lifestyles and on-the-go consumption habits fuel the demand for convenient beverage options like non-alcoholic RTD beverages. Ready-to-drink formats eliminate the need for preparation or mixing, providing instant refreshment and portability for consumers.

Market Dynamics and Consumer Preferences

Non-alcoholic RTD beverages are diverse, including functional beverages, tea and coffee, carbonated soft drinks, fruit and vegetable juices, flavored and fortified water, and dairy-based drinks. The adaptation of multifunctional beverages enriched with minerals, vitamins, herbs, amino acids, and probiotics is enhancing the market's appeal. Such products promote health benefits like improved immunity, digestive health, hydration, and electrolyte replenishment post-exercise.

Consumers are increasingly switching to non-alcoholic drinks due to heightened health consciousness, concerns over obesity, diabetes, and cardiovascular diseases linked to unhealthy diets, and an awareness of the disadvantages of alcoholic beverages. This shift is particularly notable among millennials and health-driven youth, who favor innovative, low-sugar, and nutrient-rich options. The rise of premium soft drinks featuring complex flavors tailored for adults is also shaping the market landscape.

Regional Insights

Asia-Pacific holds the largest market share and is anticipated to maintain its dominance, growing at a CAGR of approximately 5.6%. The region's expanding middle class, urbanization, and increasing influence of Western dietary habits contribute significantly to market growth. Major countries driving revenue and growth in Asia-Pacific include China, India, and several Southeast Asian nations.

Europe is emerging as the fastest-growing market, with rising awareness of health and wellness leading to increased demand for RTD tea, coffee, and fruit/vegetable juices enriched with enhanced flavors and superior quality. Premiumization trends are prevalent here, with consumers opting for nutritionally rich and specialty RTD drinks over traditional sugary beverages.

North America remains a critical market, characterized by a decline in alcohol consumption and a surge in demand for functional and low-alcohol or alcohol-free RTD beverages. The presence of key global beverage companies such as Coca-Cola and PepsiCo further bolsters North America's market position. The U.S. consumer base shows a clear inclination toward healthier drink alternatives that align with lifestyle and wellness goals.

Other regions, including South America, the Middle East, and Africa, hold smaller market shares due to factors like limited consumer awareness, traditional beverage preferences, and lower purchasing power. However, countries such as Brazil and Peru in South America are witnessing growing demand for RTD tea and coffee, signaling potential growth areas.

Product Segmentation and Packaging Trends

Among product types, bottled water is the highest contributor to the market and is expected to continue growing at a CAGR of 5.72%. This growth is driven by the demand for flavored waters fortified with vitamins and minerals, offering a low-calorie healthy alternative to sugary drinks. Carbonated soft drinks also contribute significantly, with manufacturers introducing sugar-free options to counteract global health concerns related to sugary beverages.

Packaging preferences highlight bottles as the dominant choice, favored for their durability, ease of use, and aesthetic appeal. Bottle packaging benefits from its higher capacity, meeting consumer needs for larger servings. However, the use of cans in RTD beverages is rapidly rising due to their convenience for on-the-go consumption and increasing focus on sustainability, with many manufacturers adopting recycled aluminum cans.

Distribution Channels

Store-based channels, including supermarkets, hypermarkets, and convenience stores, dominate the distribution landscape, offering consumers a one-stop shopping experience for non-alcoholic RTD beverages. This segment is anticipated to see continued growth at a CAGR of 5.72%. Meanwhile, non-store-based channels, especially e-commerce, are gaining traction due to the convenience of online shopping and the expanding reach of manufacturers to diverse consumer bases across regions.

Regulatory Environment and Market Challenges

The non-alcoholic RTD beverage industry faces a complex regulatory environment, varying significantly across countries. In regions like the U.S., stringent regulations by authorities such as the FDA require thorough documentation and approval for products like probiotics, posing challenges for new product launches. Differing international regulations complicate operational procedures for global players, potentially limiting market expansion.

Future Outlook

The rising preference for organic and natural ingredients presents lucrative opportunities for market players. The demand for organic RTD beverages free from artificial chemicals is growing sharply in both developed and developing economies. Leading companies are responding by launching innovative products, such as organic coffee and tea sodas made with natural antioxidants and organic herbs.

Continued product innovation focused on health benefits, flavor diversity, and sustainable packaging will be vital in maintaining growth momentum. With increasing consumer awareness of healthy lifestyles and the convenience factor driving purchasing decisions, the non-alcoholic RTD beverages market is set for steady growth, reshaping the beverage industry globally.

In conclusion, the non-alcoholic RTD beverages market is poised for significant expansion driven by consumer trends favoring health, convenience, and innovation. Regional dynamics, product diversity, and evolving distribution channels will shape the competitive landscape in the coming decade, offering promising opportunities for manufacturers and investors alike.