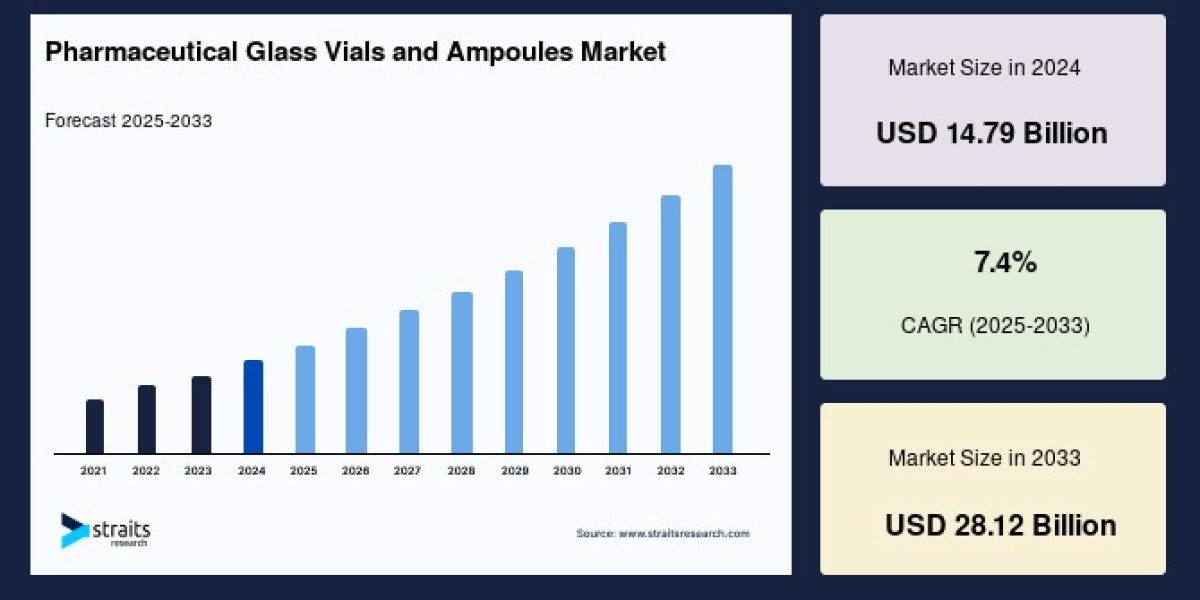

The global pharmaceutical glass vials and ampoules market size was valued at USD 14.79 billion in 2024. It is projected to reach from USD 15.89 billion in 2025 to USD 28.12 billion by 2033, growing at a CAGR of 7.40% during the forecast period (2025-2033).

Characteristics and Importance of Glass Vials and Ampoules

Glass has long been the preferred material for pharmaceutical packaging due to its chemical inertness, durability, and transparency. Vials are small, cylindrical containers with rubber stoppers or screw caps used primarily for injectable drugs, while ampoules are sealed glass containers that provide a single dose of sterile medication. The use of borosilicate glass a composition containing silicon dioxide, boron oxide, sodium oxide, and aluminum oxide ensures chemical stability, resistance to thermal shock, and minimal interaction with drug formulations.

These containers protect medications from contamination, air, and moisture while allowing easy visual inspection of contents. Furthermore, glass packaging is recyclable and environmentally friendly, which aligns with growing sustainability concerns in the pharmaceutical industry.

Market Drivers and Growth Factors

The market expansion is driven by several key factors:

Increasing Prevalence of Chronic Diseases and Demand for Injectable Therapies: The rise in chronic illnesses and complex biopharmaceuticals requires more advanced packaging solutions. Injectable drugs and vaccines, including those for COVID-19, have surged demand for high-quality glass vials and ampoules.

Growing Pharmaceutical Manufacturing and R&D Spending: Emerging economies such as India and China have ramped up pharmaceutical production and research investments. India, notably, contributes about 33% of its pharmaceutical output from Gujarat, fueling regional demand.

Advancements in Medical Technology: Innovations in aseptic filling, smart packaging, and coatings have improved the manufacturing efficiency and product safety of glass vials and ampoules.

Sustainability Initiatives: The move towards recyclable materials and energy-efficient manufacturing is influencing packaging choices, making glass an attractive option over plastics for many applications.

Regional Market Insights

Europe currently holds the largest market share due to its strong pharmaceutical manufacturing base and established companies specializing in glass packaging. The region grows at a CAGR of approximately 6.4%, driven by investments in capacity expansion and stringent quality standards.

North America is the fastest-growing market with a CAGR of 6.6%, largely attributed to the United States' dominance in pharmaceutical innovation and packaging quality requirements. Major global players like Schott AG, Gerresheimer, Corning, and Stevanato maintain significant manufacturing presence. Regulatory approvals such as FDA increases in vaccine vial doses also support market growth.

The Asia-Pacific region, led by China and India, exhibits dynamic growth prospects. China is the largest market in the region, supported by a vast pharmaceutical manufacturing industry and domestic demand. India is the fastest-growing market driven by enhanced manufacturing capabilities, government incentives, and expanding export opportunities. The region's response to the COVID-19 vaccination drive pushed manufacturers to increase capacity significantly. Several new facilities and joint ventures have been established to meet the rising demand for vaccine vials and injectable drug packaging.

Applications and Industry Trends

Vaccines represent the largest segment in this market, growing at a CAGR of 10.3%, reflecting the critical role of glass vials and ampoules in global immunization programs. Besides vaccines, applications include packaging for gene therapy, insulin storage, active pharmaceutical ingredients (APIs), and anti-rheumatic medications.

Pharmaceutical companies collaborate with equipment suppliers to optimize filling and packaging processes, ensuring sterile conditions and high throughput for mass production. The increasing complexity of drug formulations and the trend toward personalized medicine underscore the need for advanced primary packaging that guarantees drug safety and efficacy.

Challenges and Opportunities

While the market is expanding, challenges exist such as high production and operational costs associated with raw materials, manufacturing processes, and quality controls. The risk of breakage during transport and handling also poses operational difficulties.

However, technological advancements in manufacturing automation, sterilization, and smart packaging provide significant opportunities for improving product quality and reducing costs. Furthermore, increasing focus on sustainable manufacturing practices and recyclable packaging materials strengthens glass vial and ampoule adoption.

Leading Industry Players and Market Outlook

Key companies such as Schott AG, Gerresheimer AG, Stevanato Group, and Piramida are at the forefront of innovation and capacity expansion in pharmaceutical glass packaging. These manufacturers emphasize quality assurance, regulatory compliance, and sustainability to support the growing global demand.

The pharmaceutical glass vials and ampoules market is poised for sustained growth as pharmaceutical industries worldwide continue to innovate, expand, and respond to public health needs. Driven by rising demand for injectable drugs and vaccines, along with advances in packaging technology and environmental consciousness, this market segment will remain an integral component of pharmaceutical manufacturing and healthcare delivery.

In conclusion, robust growth in pharmaceutical production, increasing biologics and injectable therapies, and critical demand for durable, transparent, and sustainable packaging solutions underpin the positive outlook for the pharmaceutical glass vials and ampoules market over the next decade.