Introduction

Snus, a smokeless tobacco product originating in early 18th-century Sweden, has emerged as a noteworthy alternative for those seeking less harmful tobacco options. Its unique placement under the upper lip and steam-pasteurized manufacturing differentiate it from other smokeless tobaccos, while its growing popularity among younger consumers points towards shifts in global nicotine habits. As the tobacco landscape changes, the snus market is positioned for significant growth, marked by evolving regulations, changing social attitudes, and technological advancements in product development.

Market Overview and Forecast

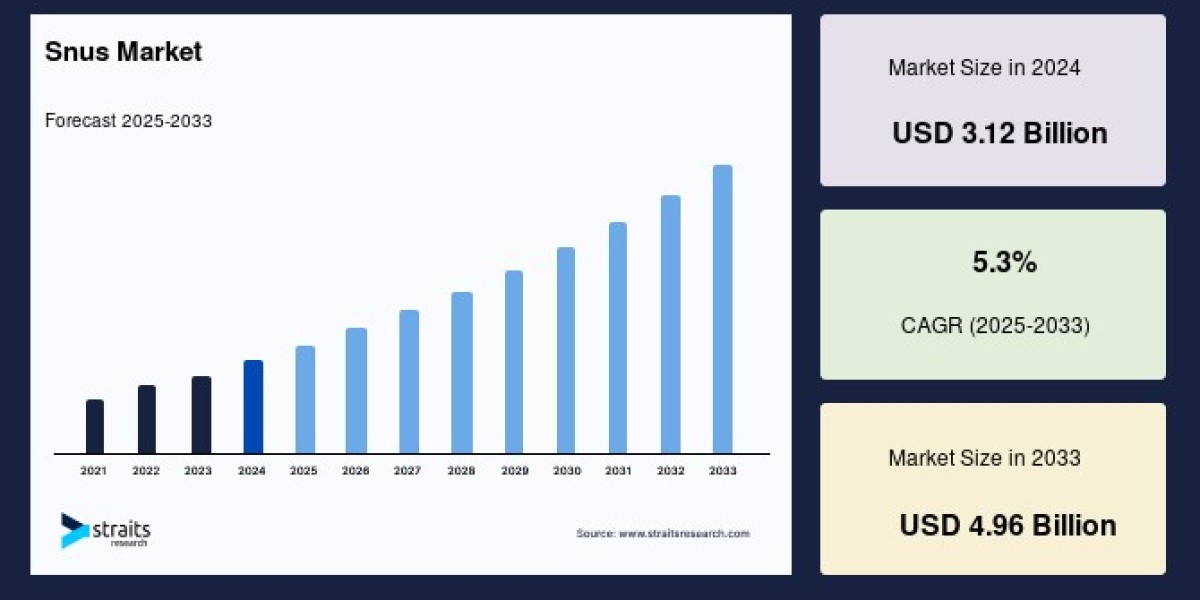

The global snus market size was valued at USD 3.12 billion in 2024. It is estimated to reach from USD 3.28 billion in 2025 to USD 4.96 billion by 2033, growing at a CAGR of 5.3% during the forecast period (2025–2033).

A multitude of factors contribute to this growth, including increasing health consciousness, the search for reduced-risk nicotine products, and favorable regulatory environments in select regions. Snus is perceived by many as a healthier alternative compared to smoking or vaping, and its adoption among young adults and women especially in Europe and the United States has intensified market demand.

Evolving Product Landscape

Manufacturers in the snus market have responded to shifting preferences by diversifying their offerings. Modern snus products come in an array of portion sizes, flavors, and nicotine strengths, appealing to both traditional users and newcomers seeking novelty. Popular flavors range from mint, eucalyptus, and berries to whiskey, spices, and various citrus blends, reflecting the broadening consumer base.

Portion snus has become the market’s largest segment, credited to its convenience and discreet use. Available in mini, large, and maxi sachets, these products cater to the demands of millennials and busy professionals alike. In addition, high-intensity varieties with elevated nicotine content have been released, meeting the needs of those seeking a stronger experience.

Regulatory and Societal Dynamics

Global regulatory frameworks have played a decisive role in shaping the snus market. While European Union directives generally ban snus in most member states, exemptions in Sweden, Finland, and Austria sustain a vibrant market in those countries. The EU’s stance is based on public health concerns; however, Sweden’s experience demonstrates how snus can serve as an alternative for smokers seeking less harmful choices. This Swedish model is often highlighted for its impactful reduction in smoking rates among men, with snus considered central to these outcomes.

In North America, the Food and Drug Administration (FDA) has issued regulations acknowledging snus as less harmful than smoked tobacco. This recognition has enabled major brands to legally market snus products under modified risk status, spurring industry growth. E-commerce platforms have further boosted market access in the U.S. and Canada, enabling consumers in major cities to purchase a wide variety of snus brands and flavors online.

Regions like Mexico and Venezuela exemplify markets with minimal regulatory constraints, promoting easier adoption and marketing of snus. In these countries, taxation levels are lower, warning label requirements are less stringent, and advertising restrictions are limited, presenting advantageous operating conditions for manufacturers.

Regional Market Highlights

Europe remains the largest market for snus, primarily due to its historic roots and cultural acceptance in Sweden, where regulations classify snus as a food product. Snus also enjoys considerable popularity in Norway, where indoor smoking bans have led to increased consumption. Scandinavian countries have seen steady proliferation of flavors and product formats over the years.

North America is expected to be the fastest-growing market, led by increasing consumer acceptance, government endorsement of harm reduction strategies, and the rapid expansion of online retail channels. From Canada to the U.S., opportunities abound for foreign and domestic manufacturers to introduce snus products in an environment welcoming alternatives to traditional cigarettes.

Asia-Pacific is another region witnessing accelerated snus adoption, especially as manufacturers devise innovative marketing campaigns to promote their products within strict anti-smoking law frameworks. As health and wellness concerns gain prominence, snus is promoted not only for its convenience but also as a method for smokers to curb or eliminate their cigarette use.

Central and South America’s market dynamic is influenced by growing awareness around the health differences between nicotine and tobacco smoke. The emergence of snus as a respectable, less dangerous substitute has fueled acceptance among consumers, while the lack of gateway effects to smoking further supports regional growth.

Africa and the Middle East represent promising frontiers, with the product’s affordability relative to other reduced-risk tobacco alternatives spurring expansion. In Africa, no national bans on snus products and an increasing interest in strategies to combat cigarette-related health issues have contributed to rising demand.

Segmental Insights

Portion snus products dominate the current market landscape, attributed to their ease of use and modern packaging. Available in original, white, and other innovative forms, each segment addresses unique preferences for moisture content, flavor release, and product longevity.

Nicotine strength is a critical differentiator, with most varieties offering 8 milligrams per gram of tobacco. Strong and extra-strong snus products with up to 22 milligrams of nicotine per gram have been developed for consumers seeking higher potency.

Meanwhile, loose snus, the market’s earliest form, continues to attract users who prefer traditional smoky flavors and a handcrafted experience. Regional preferences influence flavor options, with Scandinavian countries favoring classic blends and newer markets embracing diverse, innovative profiles.

Industry Challenges and Opportunities

Despite robust expansion, the snus market contends with challenges including restrictive regulations, rising public health awareness, competitive substitutes, and economic uncertainties. Both European and North American authorities have tightened rules around tobacco advertising, promotion, and distribution, impacting growth rates. Manufacturers are meeting these challenges with continuous R&D efforts, developing improved product formulations, innovative packaging, and targeted marketing initiatives.

Opportunities lie in premiumization, expanded online sales, and the introduction of new flavors and product formats that cater to evolving consumer behaviors. Education around harm reduction and product safety remains essential for sustaining long-term growth.

Conclusion

The global snus market is set for dynamic evolution by 2033, marked by diversified product offerings, technological innovation, and steadily expanding regional footprints. While regulatory scrutiny and public health imperatives will continue to steer market development, rising consumer adoption of reduced-risk tobacco products and manufacturers’ commitment to innovation suggest ongoing robust growth. Snus is poised to play an increasingly central role in the changing landscape of global tobacco consumption.