Overview & Market Outlook

The Cysteamine Market is positioned for steady expansion, expected to grow at a 6.5% CAGR between 2025 and 2031, rising from its 2024 valuation to a significantly larger market by 2031. Although exact monetary values are redacted in the public summary, the trajectory indicates robust demand and investment potential.

Growth Drivers & Strategic Trends

Several pivotal factors are propelling the market:

- Therapeutic Advancements for Rare Diseases

Cysteamine has garnered attention as a critical treatment for rare genetic disorders such as cystinosis. As genetic research and personalized medicine evolve, the demand for cysteamine-based therapies is increasing. - Regulatory Approvals & Label Expansion

Ongoing approval pathways and label extensions—especially for emerging therapies such as cysteamine treatment for non-alcoholic fatty liver disease (NAFLD)—are expanding its therapeutic scope and driving broader uptake . - Innovative Formulations Enhancing Patient Compliance

New formulations, including delayed-release capsules and other oral and injectable systems, are improving treatment adherence, reducing adverse effects, optimizing dosage schedules, and expanding patient accessibility . - Combination Therapies & Personalized Medicine

Growing comorbidity rates (e.g., in multi-organ disorders) are resulting in cysteamine being used alongside other treatments for enhanced therapeutic outcomes. At the same time, personalized and targeted therapeutic approaches tailored to genetic patients are elevating efficacy and acceptance . - Strategic Collaborations & Advocacy

Partnerships with healthcare providers and patient advocacy groups, particularly those supporting cystinosis communities, are improving diagnosis rates, patient empowerment, awareness, and access to cysteamine treatments . - New Therapeutic Indications

Ongoing research into new indications for cysteamine—such as Alzheimer’s disease, liver fibrosis, and metabolic disorders—could open new market avenues, creating additional revenue streams for manufacturers . - Emerging Market Penetration

As healthcare infrastructure improves in emerging economies across Asia-Pacific and Latin America, expanded access to cysteamine therapies is expected to spur new demand and market growth.

Top Players in the Cysteamine Market

The market features several prominent companies, including:

- Lu An Pharmaceuticals Co., Ltd.

- Ningbo Haishuo Biotechnology

- Hefei TNJ Chemical Industry Co., Ltd.

- Hefei Jihen Pharmaceutical Co., Ltd.

- Wuxi Bikang

- Shine Star (often also referred to as “Bright Star” or “Starry Bright”)

- Wuxi Jinghai Amino Acid

- Dragon Biological Technology

- Hebei Huayang Amino Acids

These players represent a dense and competitive landscape, innovating across pharmaceutical production, formulation, and distribution to meet growing demand .

Market Segmentation

The cysteamine market can be analyzed across three key segmentation axes:

- By Type

- By Application

- Metal poisoning (e.g., certain heavy-metal toxicities)

- Radioactive disease (radiation-induced conditions)

- By End Use

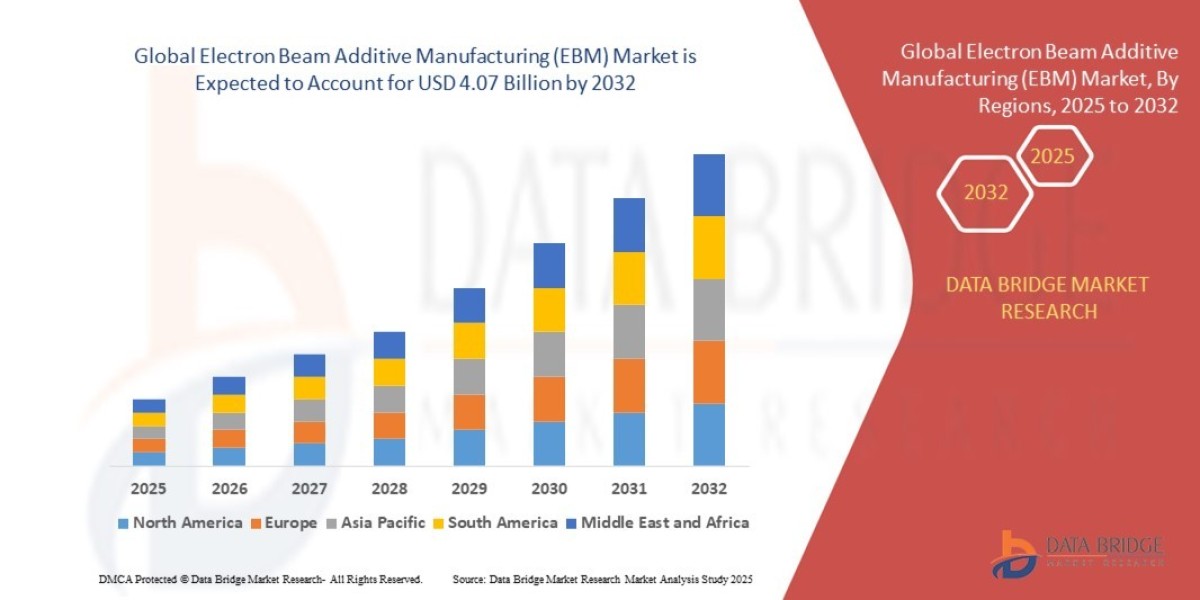

Additionally, the market's geographic span covers five broad regions:

- North America (US, Canada, Mexico)

- Europe (UK, Germany, France, Russia, Italy, Rest of Europe),

- Asia-Pacific (China, India, Japan, Australia, Rest),

- South & Central America (Brazil, Argentina, Rest),

- Middle East & Africa (South Africa, Saudi Arabia, UAE, Other) .

Recommended Growth Strategies

Here are several strategies that stakeholders—whether established players, startups, or investors—can pursue to cultivate growth:

- Prioritize R&D for New Indications

Advance clinical and translational studies of cysteamine in conditions like NAFLD, Alzheimer’s, liver fibrosis, and metabolic disorders. Securing regulatory approvals for these new therapeutic areas would broaden market reach and diversifies revenue. - Leverage Novel Formulation Technologies

Develop and commercialize sophisticated delivery systems—like delayed-release, sustained-release, liposomal, or PEGylated versions—to enhance patient compliance and reduce side effects. - Pursue Combination Therapy Approaches

Collaborate with other pharmaceutical innovators to co-develop or co-market combination regimens, particularly for multi-organ or systemic diseases where cysteamine could synergize with other modalities (e.g., antioxidants, anti-inflammatories, metabolic regulators). - Establish Collaborations with Advocacy and Health Organizations

Strengthen partnerships with patient groups, healthcare providers, and academic institutions to drive awareness campaigns, community engagement, and early diagnostics for conditions like cystinosis. - Expand Access in Emerging Markets

Build strategic alliances with regional healthcare systems in Asia-Pacific and Latin America to enhance distribution, navigate regulatory pathways, and tailor pricing models for access in less developed areas. - Differentiate via Personalized Therapeutic Solutions

Integrate genetic profiling and biomarker-based diagnostic tools to support precision medicine approaches—tailoring cysteamine therapy to an individual’s genetic signature and disease state. - Monitor Regulatory & Label Expansion Dynamics

Stay proactive in monitoring and responding to evolving regulatory landscapes—especially regarding orphan drug designations, pediatric extensions, or label expansions into the NAFLD and metabolic spaces.

Get Sample PDF- https://www.theinsightpartners.com/sample/TIPRE00022899/

Conclusion

In sum, the global cysteamine market is poised for meaningful growth, with a projected ~6.5% CAGR through 2031. Drivers include innovative formulations, expanding therapeutic indications, strategic collaborations, and increased penetration in emerging markets. A competitive but dynamic landscape—with key players such as Lu An Pharmaceuticals, Ningbo Haishuo, and others—sets the stage for continued product development and diversification.

By focusing on novel R&D, formulation improvements, personalized therapies, and geographic expansion, industry stakeholders can effectively position themselves at the forefront of the cysteamine space in the years ahead.