Cryptocurrency has evolved from a niche financial instrument to a transformative force reshaping global finance, commerce, and innovation. Over the past decade, blockchain-based digital currencies have created new paradigms of decentralized finance, paving the way for broader applications spanning payments, asset tokenization, decentralized apps, and more. As 2025 unfolds, the industry demonstrates tremendous growth, supported by technological advancements, regulatory developments, and growing mainstream adoption worldwide.

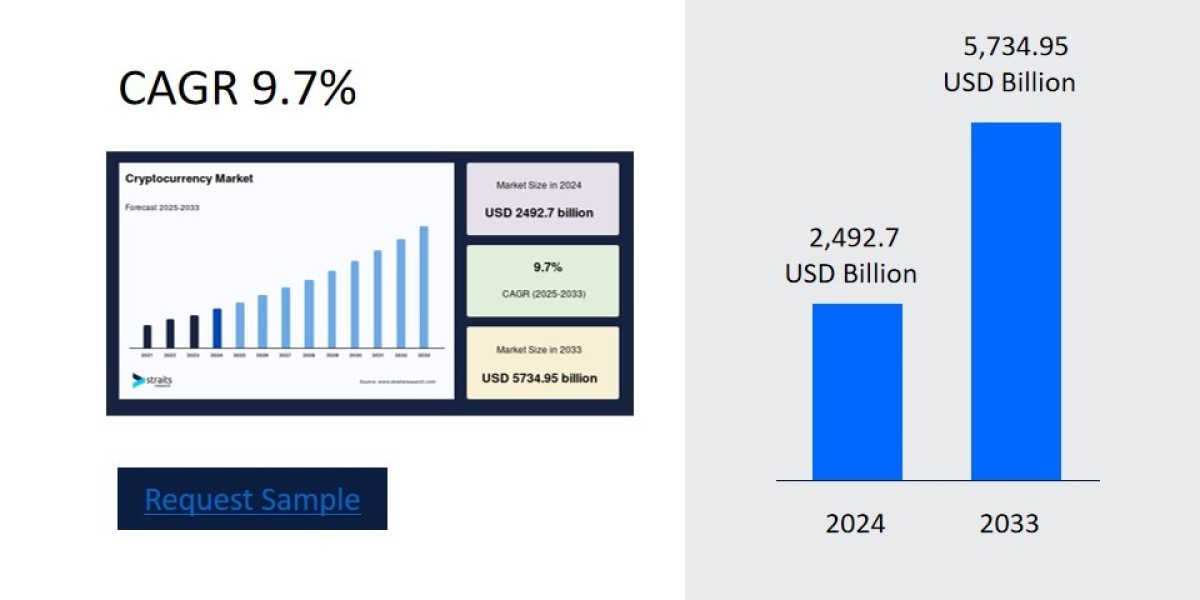

According to Straits Research, the global cryptocurrency sector was worth USD 2,492.7 billion in 2024 and is projected to reach USD 5,734.95 billion by 2033, growing at a CAGR of 9.7% during the forecast period from 2025 to 2033. This remarkable growth trajectory indicates increasing confidence from investors, enterprises, and governments eager to leverage the benefits of digital currencies and blockchain technologies.

Recent Updates and Innovations

Several seismic shifts are defining 2025 in cryptocurrency innovation:

Stablecoins and Central Bank Digital Currencies (CBDCs): Stablecoins like Tether (USDT) and USD Coin (USDC) facilitate more than 1 billion transactions annually and total over USD 8 trillion in transfer value according to Visa reports. Various countries, including Singapore, have begun testing CBDCs to integrate with global cross-border payments, raising acceptance and utility.

AI and Crypto Integration: Artificial intelligence is becoming intertwined with crypto, enhancing trading, decentralized finance (DeFi) protocols, and blockchain analytics. Projects like Render and mergers among SingularityNET, Fetch.ai, and Ocean Protocol exemplify the synergy between AI and crypto, boosting security, efficiency, and innovation.

Tokenization Revolution: Real-world asset tokenization is democratizing access to traditionally illiquid assets, such as real estate, fine art, and intellectual property. Large institutions like BlackRock are launching tokenized investment funds on blockchain networks, accelerating institutional adoption.

Regulatory Developments: The regulatory landscape is improving, particularly in the US and Europe. Following the 2024 elections, there is optimism about clearer, more favorable regulations that encourage innovation without compromising investor protection.

Massive Venture Capital Inflow: Crypto startups received $4.9 billion in venture funding in Q1 2025, with Binance alone securing the largest single investment of $2 billion, reinforcing the resilience and expansion of crypto ecosystems.

Key Players Shaping the Global Cryptocurrency Landscape

Binance (China/Malaysia): The world’s largest cryptocurrency exchange by trading volume and monthly visitors, Binance continues to lead in user acquisition, product innovation, and multi-chain adoption.

Coinbase (US): As a leading regulated exchange, Coinbase focuses on mainstream crypto adoption and compliance within the North American region.

Ethereum Foundation (Global): Ethereum remains the foremost platform for decentralized applications (dApps) and smart contracts, now thriving on proof-of-stake consensus and landmark upgrades.

Ripple Labs (US): Pioneers in blockchain-based cross-border payments, Ripple further expands partnerships with financial institutions globally.

Tether and Circle (US): Driving stablecoin issuance for transactional stability in the crypto ecosystem.

Kraken (US): Known for security and regulatory compliance, Kraken retains major presence across North America and Europe.

Chainalysis (US): The leading blockchain analytics firm, enabling compliance and security for crypto transactions worldwide.

Regional Overview and Growth Factors

North America: Robust adoption supported by investor enthusiasm, clearer regulations, and infrastructure development. CFOs surveyed in 2025 indicate accelerating crypto adoption in corporate treasuries, reflecting growing trust from institutional players.

Europe: Embraces digital assets with regulatory hygiene, open innovation hubs, and rising blockchain fintech startups. Countries like Germany, Switzerland, and the UK lead regulatory clarity and adoption.

Asia-Pacific: China leads blockchain innovation despite regulatory complexities, while Singapore, South Korea, Japan, and India emerge as hubs for stablecoins, DeFi, and blockchain integrations. Regional governments actively explore CBDC pilots and regulatory sandboxes.

Latin America and Africa: Crypto usage surges as a tool for financial inclusion, remittances, and banking alternatives in areas with limited traditional financial infrastructure.

Emerging Trends for 2025 and Beyond

Rise of Decentralized Finance (DeFi): DeFi projects are expanding beyond lending and exchanges, moving towards more sophisticated insurance, asset management, and decentralized autonomous organizations (DAOs).

Increased Security and Anti-Fraud Measures: With 48% of crypto users prioritizing policy improvements for security, platforms invest heavily in anti-fraud, KYC, and custody services.

Social Media and Meme Coins: Viral social media narratives and celebrity endorsements continue to propel memecoins, driving speculative interest and retail trading engagements.

Expanded Use of AI: Blockchain AI convergence ushers in predictive analytics, automated trading, decentralized AI marketplaces, and governance, fueling smarter and scalable crypto ecosystems.

Tokenization of Real-World Assets: Fractional ownership models enable broader participation in high-value assets, transforming investment paradigms and bringing mainstream investors into crypto.

Recent Headlines Shaping the Narrative

In 2025, the crypto space has been punctuated by high-profile mergers, significant investments, and regulatory breakthroughs. Binance’s major funding round demonstrates sustained confidence in crypto platforms, while AI-driven crypto protocols and tokenization initiatives gain momentum. Governments in Singapore and the US are launching pilot projects integrating crypto with traditional finance frameworks, aiming to balance innovation with oversight.

Looking Forward

Cryptocurrency as a technology and asset class continues maturing with increasing adoption, technical sophistication, and integration into traditional markets. Enhanced regulatory clarity paired with visionary leadership promises a future where digital currencies facilitate global trade, financial inclusion, and new digital economies.