Once a fixture of science fiction, flying cars are becoming a game-changing reality in 2025, as visionary startups and established giants move from prototypes and pilot programs to actual manufacturing and commercialization. These innovative vehicles, generally built upon electric vertical takeoff and landing (eVTOL) platforms, hold promise for revolutionizing personal commuting, urban emergency response, and even luxury travel. Thanks to advancements in battery technology, autonomous navigation, and regulatory frameworks, countries and companies worldwide are making rapid progress toward integrating flying cars into daily life.

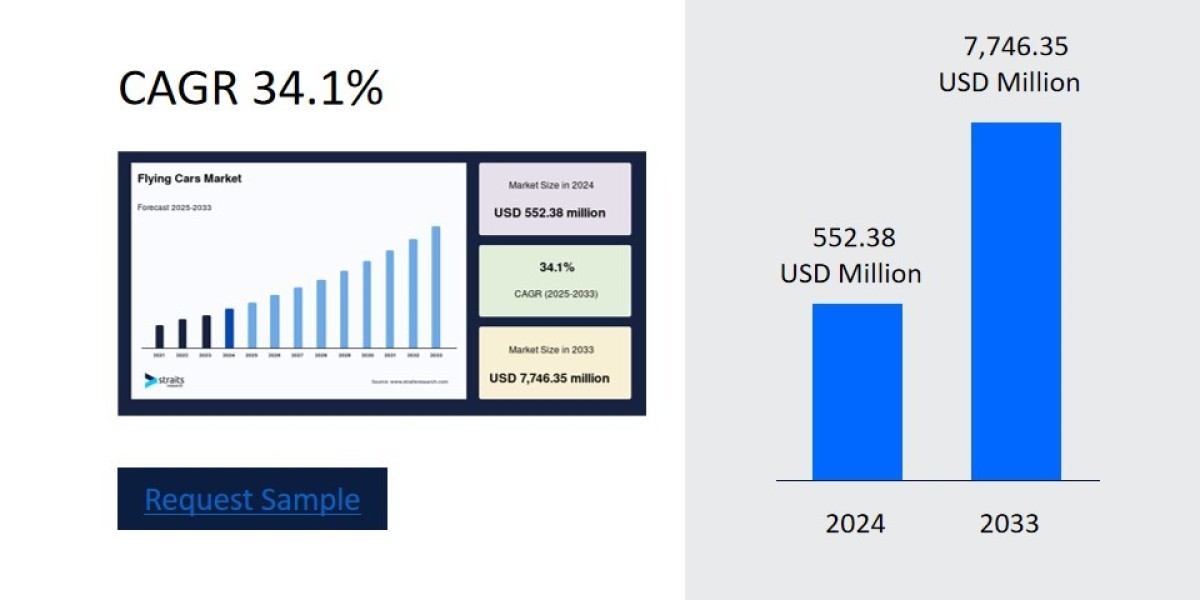

According to Straits Research, the global flying cars sector was worth USD 552.38 million in 2024 and is estimated to reach USD 740.74 million in 2025, soaring to USD 7,746.35 million by 2033 at a remarkable CAGR of 34.1% during the forecast period (2025–2033). Such explosive growth signals optimism from investors, manufacturers, and governments hungry for safer, greener, and more convenient urban mobility.

New Developments and Breakthroughs

2025 has been pivotal for flying cars, with several startups and manufacturers launching pre-production models, starting new manufacturing plants, and securing crucial regulatory approvals. Recent innovations focus on sustainability, safety, and integration with existing urban infrastructure:

Alef Aeronautics (USA): Alef revealed pre-production models of its fully electric Model A, sporting a 220-mile overall range. Alef boasts over 3,400 pre-orders and expects to commence customer deliveries by late 2025/early 2026. Its FAA certification and ability to pre-sell through an auto dealership set it apart from rivals.

XPeng Aeroht (China): XPeng began building a manufacturing plant in Guangzhou to produce 10,000 flying vehicles annually. Its Land Aircraft Carrier is a modular system where a ground vehicle carries a detachable flying component. The two-seater X2, capable of vertical takeoff and landing, demonstrates both manual and autonomous flight, with special safety features including multi-parachute rescue systems. XPeng has raised significant capital and expanded its test network across China.

Joby Aviation (USA): Joby’s S4 eVTOL craft, with six tilt-rotor propellers, near-silent operation, and a 150-mile range, has conducted successful test flights and is on track for FAA certification. Joby’s rapid progress positions the company as a leader in sustainable, high-performance aerial commuting.

Lilium (Germany): Lilium Jet leverages advanced ducted vectored thrust technology for vertical takeoff, zero emissions, and regional travel up to 300 km. Lilium is especially focused on quiet operations and European regulatory progress.

EHang (China): The EHang 184 is an autonomous flying vehicle using full-electric power. With successful test flights and deployments in Chinese cities, EHang is at the forefront of safe and affordable autonomous urban air mobility.

Volocopter (Germany): Volocopter integrates electric air taxis into cityscapes, balancing noise reduction with urban accessibility and has secured special airworthiness certifications.

ASKA (USA): The ASKA A5, previewed at CES 2023, marries advanced propulsion with vertical takeoff, a 250-mile range, and ongoing FAA approval processes.

Pal-V (Netherlands): Pal-V’s Liberty hybrid combines road driving with gyroplane flights, making it versatile for both air and ground travel. The Liberty is set for road-legal status soon, targeting consumers and professionals alike.

Global Key Players and Regional Highlights

United States: Dominates with Alef, Joby Aviation, Archer Aviation, and ASKA. The FAA fosters regulatory momentum and supports UAM pilot programs in major cities.

China: XPeng and EHang champion large-scale testing, manufacturing, and ecosystem-building for everyday and emergency uses.

Europe: Germany leads with Lilium and Volocopter, while Netherlands’ Pal-V pushes hybrid solutions for practical commutes. European Aviation Safety Agency (EASA) refines regulatory pathways for commercialization.

Japan: SkyDrive, a notable startup, conducts extensive tests and plans expanded deployments.

Other: BMW, Toyota, Boeing, and Hyundai are all investing in R&D, forming alliances, and racing to debut practical, safe flying vehicles for mass adoption.

Growth Trends and Industry News

Massive investment in eVTOL and battery technology is fueling expansion, with urban air mobility pilot programs underway in cities worldwide.

Strategic partnerships between manufacturers, battery suppliers, and city officials are building the infrastructure (vertiports, charging stations) essential for flying car adoption.

Regulations for certification and air traffic management are being clarified, especially in the US and EU, to enable safe commercial operations.

Public-private alliances drive consumer education and acceptance, with first manned flights drawing crowds at airshows globally, especially in China and the US.

Autonomy and collision avoidance systems are becoming priority features for upcoming models, minimizing risks in crowded urban environments.

The Road Ahead

Flying cars are moving from dreams to reality faster than many expected. The next decade will focus on scaling up production, building infrastructure, and refining regulations so that personal aerial transportation can become not just a novelty, but a viable solution to urban mobility challenges.