Bike and scooter rental services have become a cornerstone of urban transport, offering convenient, eco-friendly alternatives to cars and taxis for everyday city dwellers and travelers alike. The rise of micromobility has been fueled by technology, app integration, and changing consumer attitudes, making rental services a key tool for last-mile connectivity and urban exploration in major cities worldwide.

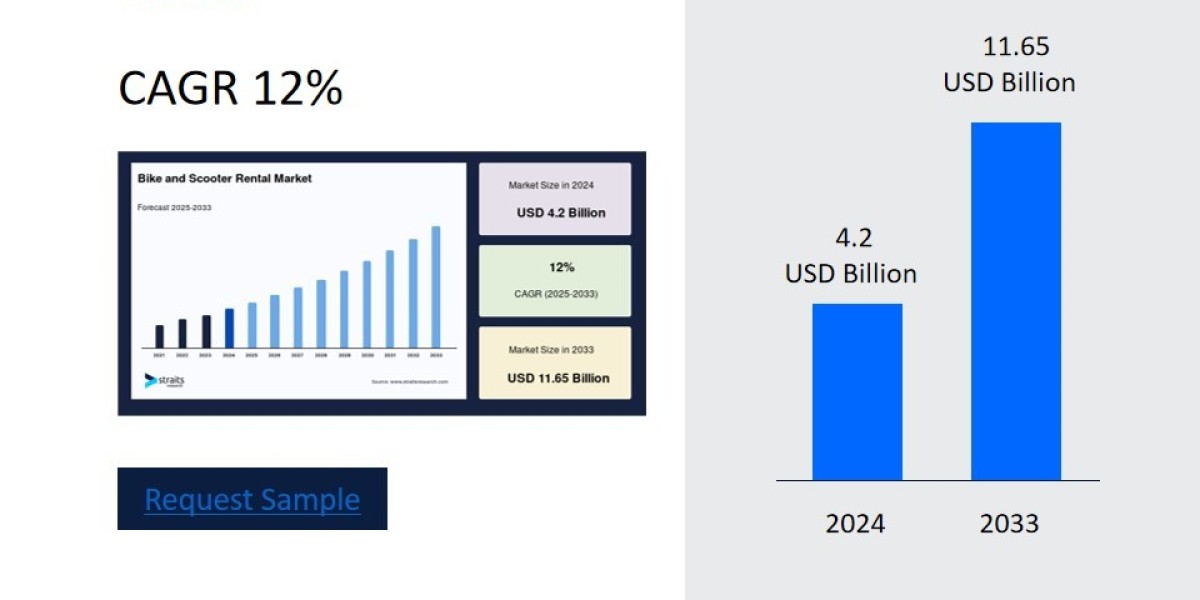

According to Straits Research, the global bike and scooter rental sector size was valued at USD 4.2 billion in 2024 and is expected to reach from USD 4.7 billion in 2025 to USD 11.65 billion in 2033, growing at a CAGR of 12% over the forecast period (2025-2033). This impressive growth underscores the shift towards shared mobility solutions, sustainability, and the expanding role of digital platforms in transportation.

Latest Updates and Innovations

Recent years have witnessed the expansion of fleets, technological sophistication, and enhanced service offerings. The introduction of electric scooters has revolutionized short-distance urban travel, allowing users easy rentals and returns through app-based stations and platforms such as Lime and Uber. GPS-enabled tracking, digital payment systems, and route optimization features are now standard, improving both user experience and operational efficiency.

Cities like San Francisco, New York, Berlin, Beijing, Delhi, and Jakarta have become testing grounds for these services, marked by rapid adoption and integration into public transport networks. Electric propulsion holds the largest share among rental options, driven by environmental awareness and advancements in battery efficiency.

Key Players and Country-Wise Analysis

Global expansion is spearheaded by a handful of dominant and emerging companies:

Lime (US): Leading the sector with extensive e-bike and scooter fleets, robust app ecosystems, and strategic partnerships across North America, Europe, and Asia-Pacific.

Bird (US): Renowned for pioneering urban micromobility, scalable fleet electrification, and advanced asset management, mainly operating in high-density urban centers.

Uber Technologies Inc. (US): Integrates bike and scooter rentals into its mobility platform, expanding seamlessly across global markets.

Lyft (US): Parallel to Uber, Lyft continues to fold rentals into its ride-hailing services and expand multi-modal offerings.

Spin (Ford, US): Offers app-driven scooter rentals emphasizing fleet optimization and urban mobility contracts.

TIER Mobility (Germany): Dominant European player leveraging multimodal integration and ESG-focused strategies.

Vogo, Bounce, Yulu (India): These companies focus on the Indian market, driving localized dockless, cost-sensitive services and partnering with smart city initiatives for scale.

Other notable names in Europe include Nextbike GmbH (Germany) and Cityscoot (France), while in Asia-Pacific, Hellobike, DiDi Bike (China), and Bluegogo are increasing their competitive edge through fleet expansion and service innovation.

Growth, Trends, and Regional Developments

Asia-Pacific: Leads globally due to sheer urban density, traffic congestion, and the rapid adoption of app-driven micromobility—especially in China, India, and Japan. Local government support and urbanization trends continue to drive adoption at scale.

North America: Strong municipal support for green transportation, developed cycling infrastructure, and favorable commuter attitudes feed steady sector growth. Dynamic pricing models are common in places like New York, Washington D.C., and San Francisco, reflecting demand and regulatory factors.

Europe: Fosters innovation with supportive policy frameworks, integrated public transit solutions, and leading companies like TIER Mobility and Nextbike. The UK, Germany, and France are especially active in rolling out new fleets and adopting advanced operational technologies.

Latin America, Middle East & Africa: Brazil, Mexico, UAE, and South Africa are rapidly embracing shared bikes and scooters amidst rising urbanization and focus on clean mobility solutions.

Recent News and Strategic Moves

Companies continue to expand fleets and app functionalities, making booking and tracking rides easier and more reliable.

Strategic partnerships with urban planners, municipal governments, and big tech are integrating bike and scooter rentals into existing transit ecosystems, supporting seamless multimodal mobility.

Advancements in artificial intelligence, IoT, and GPS technology are optimizing fleet management, route planning, and dynamic pricing to cater to commuter needs and regulatory requirements.

Regional startups are focusing on affordable solutions and personalized services, increasing competition and driving innovation for consumers.

The Road Ahead

Bike and scooter rental services are redefining urban transport by combining convenience, affordability, and sustainability. With technological innovation and policy support on the rise, key global and regional players are set to drive even more growth, giving commuters flexible and eco-friendly options for day-to-day travel.