Market Overview

Green tires are engineered to reduce environmental impact through improved rolling resistance, sustainable material inputs (bio-based oils, silica-based compounds), and enhanced recyclability. The category spans original equipment (OEM) fitments, replacement tires and specialty segments such as low-rolling-resistance passenger tires and commercial vehicle offerings. Key demand vectors include regulatory fuel-efficiency targets, OEM lightweighting programs, and consumer preference for lower lifecycle emissions.

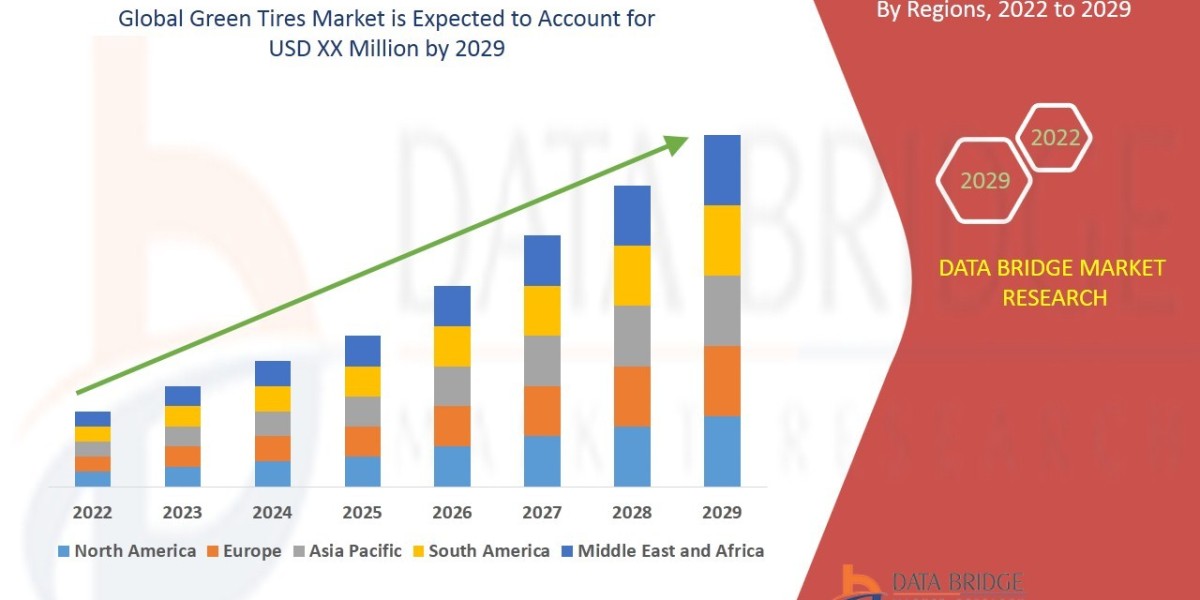

Data Bridge Market Research analyses that the green tires market will witness a CAGR of 16.22% for the forecast period of 2022-2029.

Market Size & Forecast

Baseline (2024 estimate): USD 30.4 Billion.

Forecast (2032 conservative synthesis): USD 45.7 Billion (2032).

Projected CAGR (2024–2032): 4.6%–5.0% (consensus range).

Commentary: market estimates vary by methodology — Databridge has published materially higher CAGR scenarios in some deliverables (e.g., a cited 16.22% CAGR for a near-term window), reflecting narrower definitions and higher growth assumptions tied to rapid materials adoption; other established providers model a lower, steady expansion driven by OEM fleet turnover and replacement cycles. We present a conservative revenue baseline and medium-growth forecast suitable for commercial planning while flagging upside scenarios where aggressive regulatory adoption and rapid ER&D (environmental rubber & design) deployment occur.

Market Segmentation

Segmentation identifies monetizable pockets and implementation levers for manufacturers, material suppliers and channel partners.

By Product Type

- Low Rolling Resistance Passenger Tires — primary volume driver for consumer vehicles.

- Commercial Vehicle Green Tires — fleet efficiency and total cost of ownership (TCO) focus.

- Electric Vehicle (EV) Optimized Tires — higher torque and lower rolling resistance demands; premium ASPs.

- Retread & Recycled Compound Tires — circular-economy plays with margin and regulatory benefits.

By Technology / Materials

- Silica & functional fillers — lower rolling resistance without traction trade-offs.

- Bio-based oils & sustainable elastomers — brand-differentiated sustainability claims.

- Advanced tread architectures — design-enabled efficiency gains.

- Reclaimed rubber & devulcanization processes — circularity and cost mitigation.

By Application

- OEM Fitments — strategic partnerships and long-term contracts with automakers.

- Replacement Market — retail channels, garages and e-commerce, driving recurring volumes.

- Commercial Fleets & Logistics — TCO-focused procurement and spec-buying.

- Specialty (Motorsport, Off-Road) — niche high-performance green solutions.

By Distribution Channel

- OEM Direct Sales & Tier-1 Supply

- Aftermarket Retail & E-commerce Platforms

- Fleet Management & B2B Contracting

- Tire Dealers & Service Chains

Regional Insights

Europe: Regulatory leadership (CO₂ and fuel-efficiency standards), high premium adoption and rapid OEM specification — historically largest regional contributor.

Asia-Pacific: Largest incremental volume opportunity; mix of local manufacturing scale, rising EV adoption and government incentives in China and Japan accelerate green tire penetration

North America: Rapid uptake driven by fleet electrification pilots and consumer demand for low-emission mobility; regulatory and incentive variability across states creates asymmetric adoption

Latin America & MEA: Nascent adoption with focused opportunity in commercial fleets and urbanization-driven replacement markets.

Competitive Landscape

The competitive set is led by large multinational tire manufacturers with integrated R&D in materials and scale manufacturing footprints. Key players driving product development, specification wins and channel penetration include:

- Pirelli & C. S.p.A.

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Michelin

- Continental AG

- Hankook Tire & Technology Co., Ltd.

- Yokohama Rubber Co., Ltd.

- Apollo Tyres Ltd. (regional scale plays)

These incumbents combine proprietary compounding, global distribution and OEM relationships; new entrants tend to focus on novel compound suppliers, devulcanization, or niche EV-optimized tread designs. For company-level profiles and the Databridge vendor analysis, see the links below.

Databridge report link: Global Green Tires Market — Databridge

Databridge company link: https://www.databridgemarketresearch.com/reports/global-green-tires-market/companies

Trends & Opportunities

- EV-driven tire segmentation: EV-specific compounds and architectures that deliver lower rolling resistance while handling higher torque loads present premium ASP opportunities.

- Material innovation: Silica-rich compounds, bio-based oils and reclaimed rubber reduce lifecycle emissions and appeal to OEM ESG procurement teams.

- Fleet telematics + tire-as-a-service: Integration of tire performance data into fleet management unlocks recurring revenue models (TaaS) and upsell for premium green compounds.

- Regulatory arbitrage: Early-certification and compliance in lead markets (EU, Japan) create export advantages into adjacent regions.

- Circularity & recycling: Scalable devulcanization partners and retread innovations reduce raw-material exposure and align with evolving producer responsibility schemes.

Challenges & Barriers

- Performance trade-offs: Balancing rolling resistance with wet-grip and longevity remains a product engineering constraint that can slow OEM specification.

- Raw-material cost volatility: Specialty fillers and bio-oils can create price pressure versus commodity rubber, impacting margin resilience.

- Certification cycles & testing: Automotive qualification and retread approvals introduce long lead times and capital requirements.

- Consumer education: Clear value communication (fuel savings, TCO, lifecycle footprint) is required to overcome premium resistance in replacement channels.

Conclusion

The Green Tires Market is a strategic growth corridor for tire OEMs, compound suppliers and circular-economy innovators. Conservative modeling indicates steady mid-single-digit CAGR for the broader market through 2032 with material upside in scenarios where EV adoption, regulatory tightening and circularity economics accelerate. Execution advantage accrues to players that combine compound IP, OEM specification capability and scalable recycling/retread operations. For the full Databridge dataset, methodology and company profiles, review the linked report.

Browse Trending Report:

Europe Text To Speech (TTS) Software Market

Asia-Pacific Unmanned Surface Vehicle (USV) Market

Global 3D Printing Powder Market

Global 4D Bioprinting for Tissue Engineering Market

Global A2 Yogurt Market

Global Abdominal Surgical Robots Market

Global ABS (Acrylonitrile Butadiene Styrene) Cement Market

Global Acid Lipase Deficiency Market

Global Acoustic Insulation Market

Global Activin A Market

Global Acute Respiratory Distress Syndrome (ARDS) Treatment Market

Global Adaptive Security Market

Global Adhesive Films Market

Global Aerosol Packaging Market

Global Aesthetic Services Market

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"