Overview of Rubber Processing Chemicals Market

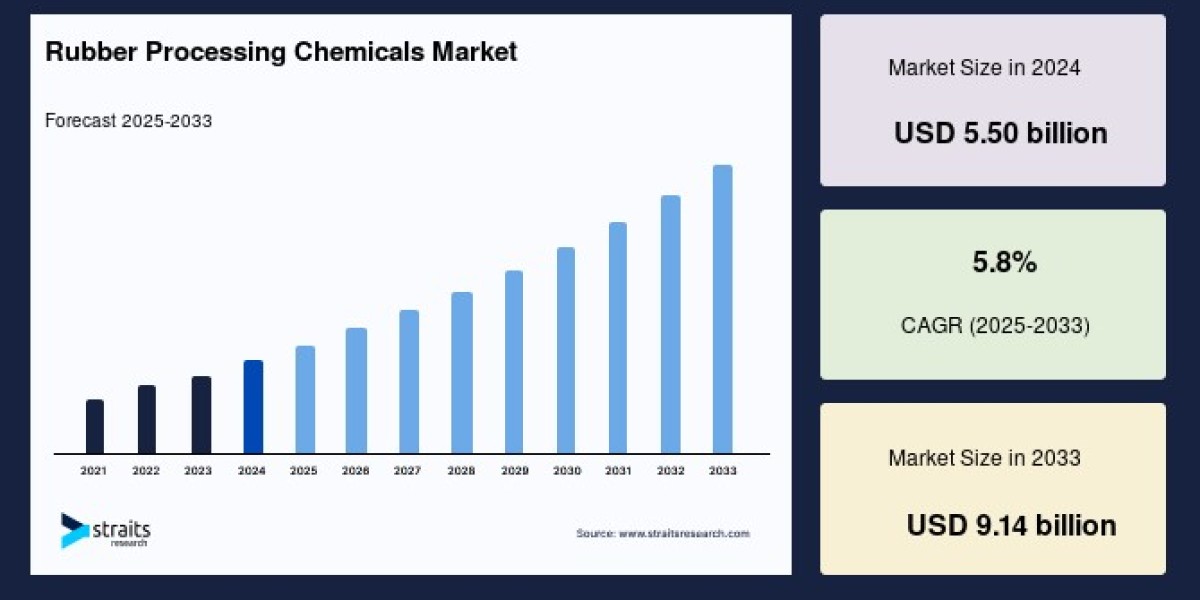

The global rubber processing chemicals market size was valued at USD 5.50 billion in 2024 and is projected to grow from USD 5.82 billion in 2025 to USD 9.14 billion by 2033, exhibiting a CAGR of 5.8% during the forecast period (2025-2033).

Rubber processing chemicals encompass a range of additives such as accelerators, activators, anti-degradants, flame retardants, and processing aids. These chemicals are essential for manufacturing a wide variety of rubber-based products like tires, seals, gaskets, hoses, and industrial components. The rising demand for high-performance tires, expanding automotive production, and increasing infrastructure development are primary growth catalysts fueling the market's expansion globally.

Market Drivers and Trends

Key drivers behind the rapid market growth include the automotive industry's expansion and construction sector developments, especially in emerging economies across Asia-Pacific, and growing environmental awareness prompting demand for greener solutions. The shift towards electric vehicles (EVs) has increased the need for specialized rubber compounds that support energy efficiency, thermal management, and durability in high-torque applications.

Sustainability is a critical influencing factor, with regulatory frameworks like REACH in Europe and stringent environmental controls in North America pushing manufacturers to adopt bio-based, low volatile organic compound (VOC) rubber processing chemicals. These eco-friendly alternatives help reduce harmful emissions, improve workplace safety, and address customer demand for green products, thereby giving companies a competitive edge.

Technological innovations also propel the market forward. Advances such as integrating nanotechnology with rubber compounds utilizing nanoparticles like carbon nanotubes, graphene, and nanosilica significantly enhance tensile strength, thermal stability, flexibility, and abrasion resistance. Breakthroughs in green chemistry and precision compounding techniques improve additive dispersion, reduce material waste, and enable the production of sustainable, high-performance rubber.

Regional Insights

Asia-Pacific holds the largest share of the global rubber processing chemicals market, accounting for over 60% of demand. This region's dominance is supported by rapid industrialization, urbanization, and the presence of major automotive manufacturers in China, India, Japan, and South Korea. Large infrastructure projects and government initiatives, such as China’s Belt and Road Initiative and India’s Smart Cities Mission, heavily contribute to rubber chemicals demand for durable construction materials like gaskets, seals, vibration dampeners, and waterproofing systems.

China stands out as a key market due to its expansive automotive sector, which drives massive consumption of high-performance rubber additives. Additionally, China’s increasing environmental regulations motivate manufacturers to innovate with sustainable chemical formulations.

North America is identified as the fastest-growing regional market, led primarily by the United States. The U.S. automotive industry's shift to electric vehicles, along with strong aerospace and industrial manufacturing sectors, drive demand for advanced rubber chemicals. Stringent environmental standards enforced by agencies like the EPA encourage the adoption of eco-friendly processing additives, further encouraging market growth.

Europe’s market growth is shaped by strict regulations promoting green alternatives and bio-based chemicals. Countries such as Germany and France are central to this transition, investing heavily in research and development to advance sustainable rubber formulations that comply with evolving safety and emission standards.

Market Challenges

Volatility in raw material prices remains one of the main challenges for rubber processing chemical manufacturers. These chemicals largely depend on petrochemical derivatives, making them vulnerable to global crude oil price fluctuations, which impact production costs and profit margins. Additionally, stringent environmental regulations increase the cost and complexity of sourcing compliant raw materials, limiting supply stability.

The competition is intense with several large multinational companies focusing on innovation, sustainability, and regional expansion to build market share. The urgent demand for low-toxicity and environmentally compliant additives demands continuous investment in R&D and strategic adaptations to changing regulations.

Product Segmentation and Key Applications

Among product categories, anti-degradants dominate the market due to their crucial role in protecting rubber products from heat, ozone, UV radiation, and oxygen exposure. These additives extend the lifespan of automotive tires, conveyor belts, hoses, seals, and other industrial rubber goods by preventing cracking and degradation under harsh conditions.

Tires represent the largest application segment, driven by global vehicle production growth and increasing consumer demand for high-performance, energy-efficient, and noise-reducing tires. The rise of electric vehicles further fuels the demand for specialized rubber additives aimed at meeting new performance standards, such as improved rolling resistance and higher torque tolerance.

The construction sector is another vital end-use segment, with rubber chemicals enhancing the durability and weather resistance of seals, gaskets, vibration isolators, and waterproofing components used in buildings, railways, roads, and infrastructure projects.

Future Outlook

Looking ahead, the rubber processing chemicals market is poised for sustained growth fueled by expanding automotive production, infrastructure development, and regulatory pressure for greener products. The integration of advanced technologies like nanomaterials and industry 4.0 digitalization in rubber compounding will unlock higher performance and sustainability, supporting the evolving demands of end-users.

Emerging markets, particularly in Asia and parts of Latin America and the Middle East, are expected to contribute significantly to demand growth, driven by industrialization, urbanization, and rising consumer safety standards. Leading market players continue to invest in innovation, sustainable product lines, and regional footprint expansion to capitalize on growth opportunities.

In summary, the global rubber processing chemicals market is shaping up as a dynamic sector marked by rapid innovation, sustainability challenges, and growing application breadth across automotive, construction, and industrial domains. With advancing regulations and technology catalyzing change, the industry’s future will revolve around developing high-performance, environmentally responsible chemicals essential for durable and efficient rubber products worldwide.